- Google searches for “crypto” fell to near yearly lows by late December 2025.

- Weak search interest reflects retail fatigue and lingering caution.

- Low attention can precede recoveries, but it’s not a standalone signal.

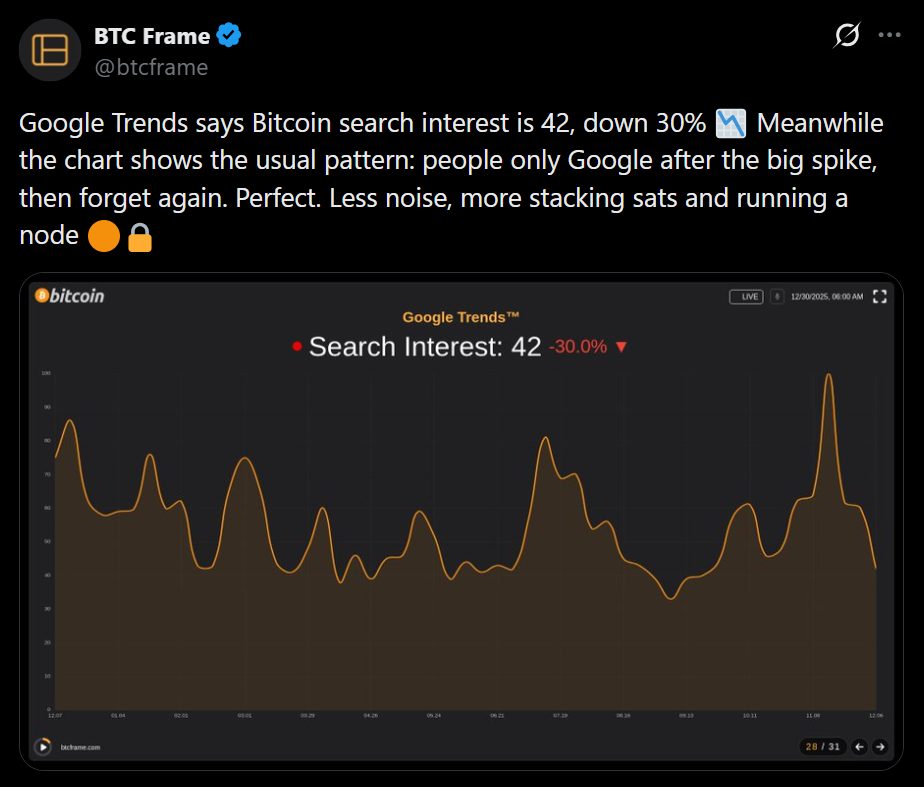

By late December 2025, Google search interest for the term “crypto” had slipped to around 26 on the 0–100 Trends scale, barely hovering above the lowest levels seen all year. That drop marks a sharp contrast to earlier periods when retail excitement surged alongside rallies, ETF headlines, and viral narratives. In the United States, the decline was even more striking, with search activity falling to levels not seen at any other point in 2025.

What the Drop in Searches Says About Retail Mood

This isn’t just a data quirk. Search trends often reflect how casual investors feel, and right now, interest looks drained. Many of the people who once checked Google daily for “crypto” or “Bitcoin” updates simply aren’t doing so anymore. A mix of factors likely contributed to the fatigue, including sharp market drawdowns earlier in the year, unexpected policy shifts, and repeated memecoin blowups that eroded confidence. Fear indicators remain elevated, lining up closely with the lack of retail curiosity.

Is Low Attention a Bottom Signal?

That leads to the bigger question traders are debating. Some view low public interest as a contrarian signal, arguing that markets often bottom when nobody cares anymore. In past cycles, periods of extreme apathy sometimes came just before recoveries began. Others are more cautious, pointing out that search interest reflects sentiment, not price direction, and that markets can stay quiet longer than expected without immediately turning higher.

What It Means Right Now

Search trends alone won’t tell you when to buy or sell, but they do offer a window into crowd psychology. The sharp drop in interest suggests most retail participants are cautious, burned out, or simply focused elsewhere. Whether that silence marks the edge of fear or just a pause in attention remains unclear. For now, it’s a reminder that crypto is moving forward without the hype it once relied on.