- WLFI is the top daily gainer among the top 100 cryptocurrencies by market cap

- The rally is likely tied to USD1 stablecoin reaching a $3 billion market cap

- Sustainability remains uncertain amid a weak crypto market and rising risk aversion

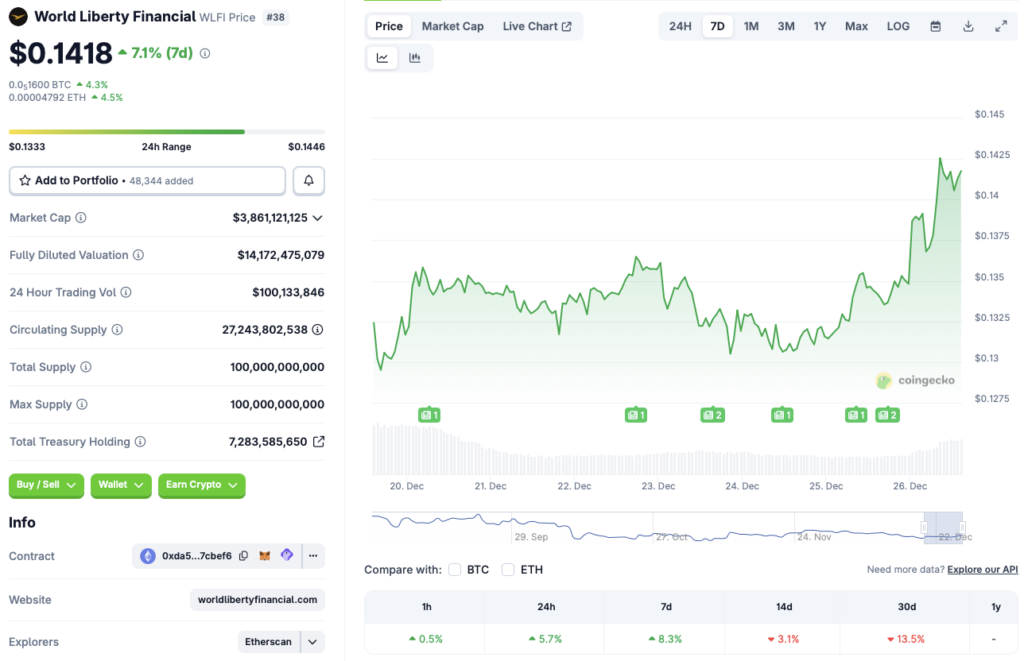

World Liberty Financial (WLFI) has emerged as the best-performing cryptocurrency among the top 100 projects by market capitalization over the last 24 hours. According to CoinGecko data, WLFI is up 5.7% on the day and 8.3% over the past week, standing out while the broader crypto market remains under heavy pressure. Despite the short-term bounce, the token is still down 3.1% over the last 14 days and 13.5% over the past month, raising questions about whether this rally has real staying power.

USD1 Stablecoin Growth Sparks Fresh Interest

The primary catalyst behind WLFI’s sudden strength appears to be the rapid expansion of its USD1 stablecoin. USD1 recently crossed the $3 billion market capitalization milestone, a notable achievement at a time when stablecoins continue to gain importance across both CeFi and DeFi ecosystems. Stablecoins have become one of the most resilient segments of the crypto market, even during broader downturns, and USD1’s growth has likely boosted confidence in the World Liberty Financial ecosystem.

Sentiment may have been further lifted by Binance’s USD1 Boost Program, which aims to increase engagement by offering additional rewards to USD1 holders. Programs like this often attract short-term capital and renewed attention, especially during periods when traders are searching for assets showing relative strength.

Can WLFI’s Rally Hold in a Weak Market?

While WLFI’s price action is impressive, sustainability remains uncertain. The broader crypto market is still in a fragile consolidation phase, with Bitcoin struggling to hold above the $89,000 level. Historically, isolated rallies during weak market conditions often fade once profit-taking sets in, particularly if BTC resumes its downward trend.

Given the risk-off environment, some investors may choose to lock in short-term gains from WLFI and rotate capital into safer assets. This cautious behavior is reinforced by the continued surge in gold and silver prices, which suggests that many market participants are prioritizing stability over speculative exposure.

Risk Aversion Remains a Key Headwind

The ongoing strength in precious metals signals that capital is still flowing toward traditional safe havens. If this trend continues, WLFI could face renewed selling pressure despite its strong daily performance. Without broader market support or continued positive developments around USD1 adoption, the current rally may struggle to extend much further.

For now, WLFI stands out as a rare bright spot in a difficult market, but its next move will likely depend on whether stablecoin-driven optimism can outweigh broader macro and crypto-specific headwinds.