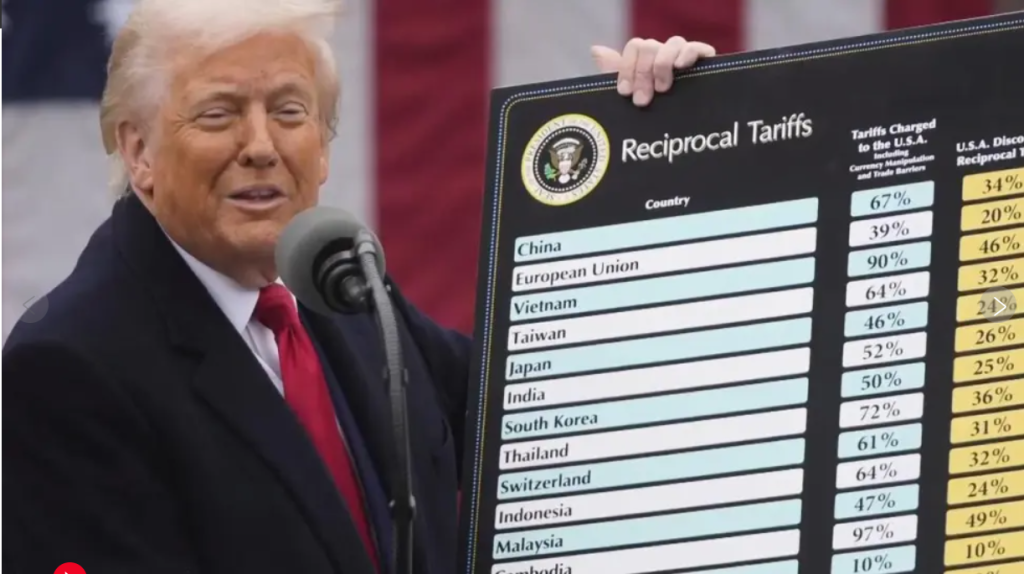

- The Supreme Court ruled Trump’s sweeping tariffs illegal in a 6–3 decision

- Up to $150B+ in tariff refunds could ease macro pressure across markets

- Crypto benefits as one major risk-off narrative fades

Late Friday, the U.S. Supreme Court delivered a decision that quietly rewired the macro backdrop. In a 6–3 ruling, the court found that former President Trump overstepped his authority by imposing broad tariffs under emergency powers that were never meant for that purpose. Both conservative and liberal justices agreed that trade policy of this scale belongs to Congress, not the executive branch.

For markets, this isn’t just a legal footnote. It removes a lingering source of uncertainty that has weighed on global trade, inflation expectations, and investor confidence for more than a year.

Refunds Mean Liquidity, Not Just Headlines

The most underappreciated part of the ruling is what comes next. Analysts estimate that more than $150 billion, and possibly closer to $175 billion, in tariff revenues could now be subject to refunds. That’s real money flowing back to businesses, supply chains, and balance sheets.

This kind of cash release doesn’t guarantee growth, but it reduces stress. Less strain on margins, fewer pricing distortions, and slightly looser financial conditions all matter when liquidity is already tight.

Why Crypto Felt the Tariff Weight

Crypto markets don’t live in isolation, even if they like to pretend otherwise. Over the past year, tariff headlines consistently lined up with risk-off behavior. Bitcoin and altcoins tended to weaken as trade tensions fueled fears of slower growth, higher rates, and tighter capital.

Tariffs became part of the macro fear stack. Inflation pressure, policy uncertainty, and geopolitical noise all fed into the same narrative, and crypto paid the price as traders reduced exposure.

One Less Reason to De-Risk

This ruling doesn’t magically flip crypto bullish. Inflation data still matters. Rate policy still matters. Regulation still matters. But one large, unpredictable wildcard just got taken off the table.

Removing tariff fear helps markets recalibrate risk without pricing in another sudden macro shock. For Bitcoin and digital assets, that means fewer forced narratives pushing investors toward the exits.

Final Take

The Supreme Court didn’t change Bitcoin’s fundamentals. It didn’t rewrite crypto’s long-term story. But it did eliminate a meaningful source of uncertainty that has quietly pressured risk assets.

Crypto still lives downstream from macro conditions, but for the first time in a while, one heavy weight just got lifted. That alone doesn’t spark a rally, but it does give markets room to breathe again.