- Over $300B returned to crypto today as institutional access opened sharply.

- Vanguard and Bank of America fueled the rally with major crypto-friendly policy shifts.

- Options flow shows big money betting the correction has already bottomed.

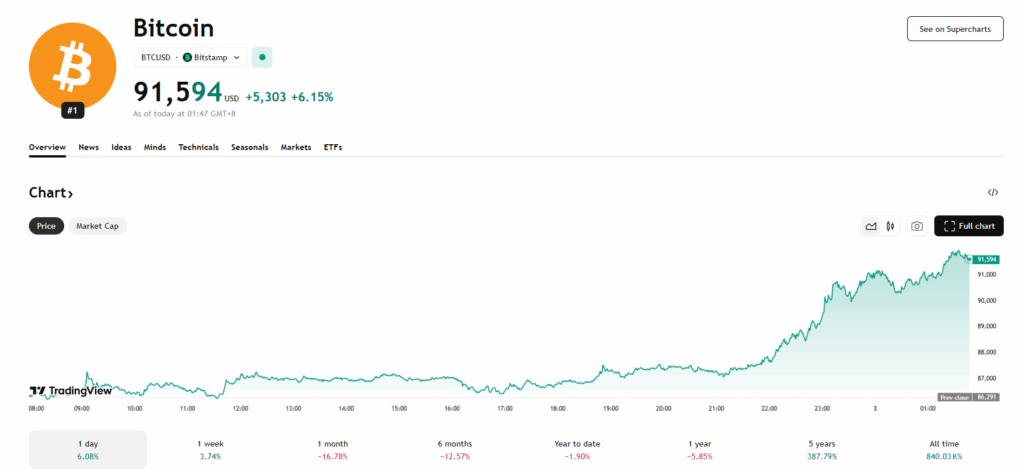

Crypto did not creep higher today — it exploded. More than $300 billion flooded back into digital assets in a single session as investors rushed into risk-on mode. Bitcoin blasted above $91,000, Ethereum reclaimed the $3,000 level, and large caps across the board delivered clean 8%–15% intraday gains. The mood flipped in a matter of hours, not days, and the spark wasn’t subtle.

Institutions Reopen the Gates

The switch flipped when two heavyweight institutions changed course at once. Vanguard — long one of crypto’s most stubborn skeptics — officially opened access to digital-asset ETFs for its enormous brokerage base. At the same time, Bank of America gave its advisers the green light to recommend up to a 4% bitcoin allocation. For legacy finance, this was the loudest cross-signal imaginable: the institutional door isn’t just open — it’s wide open.

Combine that with Bitcoin holding the key $80,000–$85,000 support zone during the recent pullback, and sidelined capital suddenly found the confidence it needed to rush back in.

Derivatives Market Shows Big Money Leaning Bullish

Under the surface, traders were already positioning for upside. Options markets saw a spike in demand for higher-strike calls while downside protection clustered tightly near the previous lows. That imbalance says something very simple: professional money is betting the worst of the correction is behind us. When higher-timeframe players lean bullish and liquidity returns, moves like today happen fast.

Not Just a Bounce — A Sentiment Reset

Today’s rally wasn’t just a relief bounce. It was a sentiment reset. Institutional willingness to re-engage, combined with strong technical resilience, ignited one of the sharpest inflow days of the year. With more than $300 billion rotating back into crypto, the market sent a clear and loud message: confidence wasn’t dead — it was waiting for permission to come back.