• Bitcoin slides back toward $100K as U.S. trading-hour weakness persists.

• Crypto-linked stocks suffer deeper losses, with major miners dropping 10%–19%.

• Fed uncertainty and fading rate-cut bets weigh heavily on the entire sector.

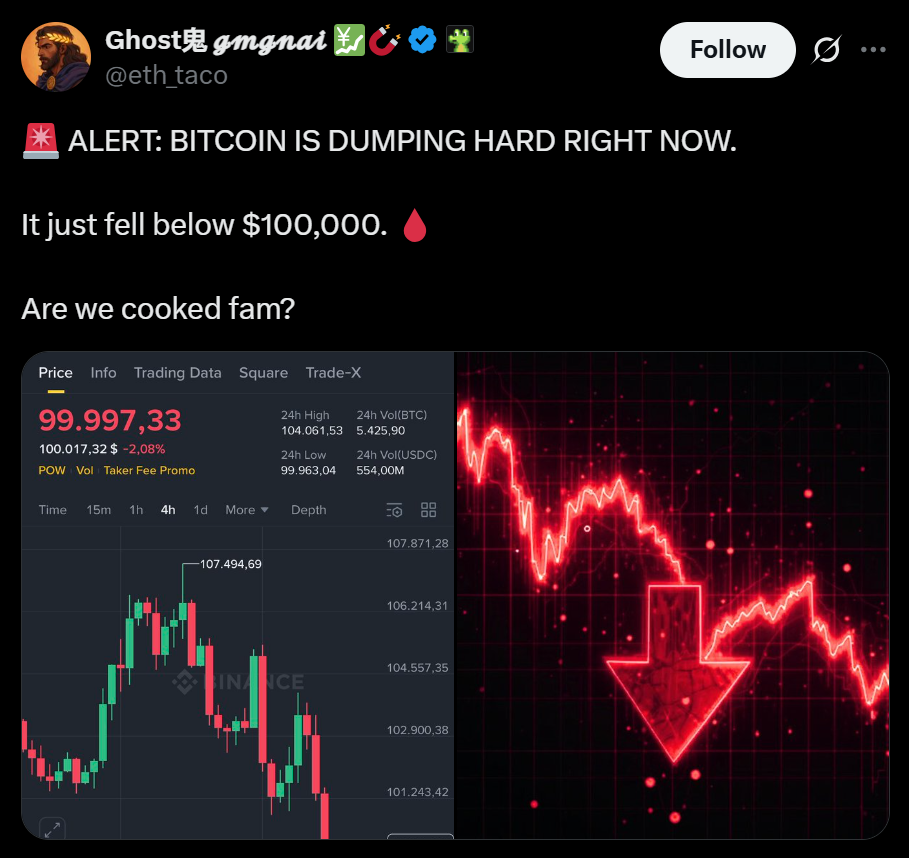

Bitcoin slipped toward the $100,000 mark on Thursday, extending a trend of sharp weakness during U.S. trading hours. After rebounding to $104,000 overnight, BTC flipped lower early in the New York session and hovered barely above $100K by midday. Futures activity also slowed, reflecting a broader risk-off tone that’s building across global markets as rate-cut expectations fade.

Crypto Stocks Face Steeper Losses

While Bitcoin drifted lower, crypto-linked equities absorbed dramatically heavier damage. Miners with AI-heavy infrastructure exposure — Bitdeer, Bitfarms, Cipher Mining and IREN — saw double-digit losses. Other major names, including Galaxy, Bullish, Gemini and Robinhood, fell between 7% and 8% as liquidity thinned across the sector. The sell-off mirrored a wider slump in equities: the Nasdaq fell around 2% and the S&P 500 slid 1.3%.

Market Confidence Wavers as Fed Cuts Look Less Likely

The driver behind the downturn is increasingly clear: investors are losing confidence in a December rate cut from the Federal Reserve. Markets now price the odds at roughly 50/50 — far below the near-certain expectations from several weeks ago. According to Wincent’s senior strategist Paul Howard, BTC’s strong correlation with macro conditions means a muted finish to the year is more likely than another leg up. With just weeks left in 2025, Howard believes the cycle’s peak may already be behind us.

What Comes Next for Bitcoin?

For now, the crypto market appears stuck between liquidity pressures and shifting macro expectations. Bitcoin continues to show resilience around the $100K level, but without renewed momentum, analysts warn it could remain trapped in a tight range into year-end. The next phase, Howard suggests, may be a steadier, slower climb through 2026 — with volatility far from gone, but the year’s euphoria unlikely to repeat in the short term.