- Bitcoin dipped to $120K, triggering $120M in liquidations, mostly from long positions.

- BTC, ETH, and SOL led the on-chain wipeouts as leverage reset across exchanges.

- Analysts see the move as a healthy correction that could fuel the next leg higher.

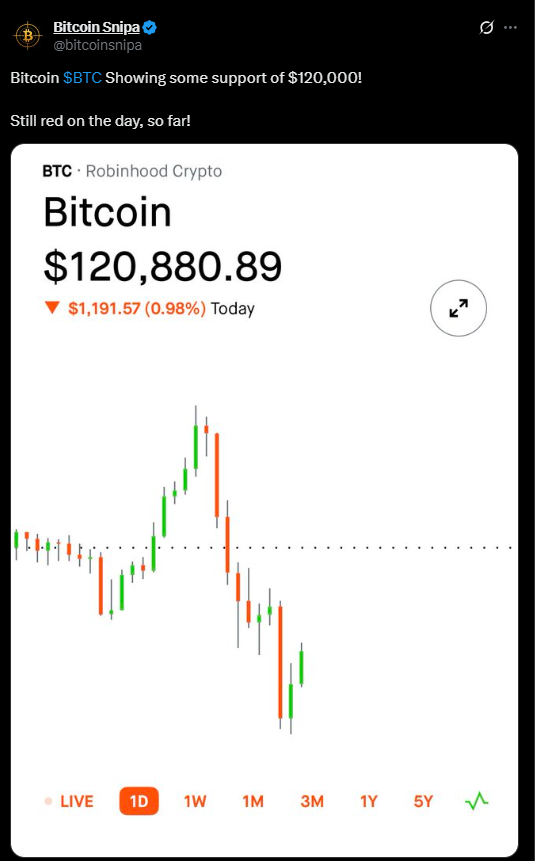

Bitcoin briefly dropped to the $120,000 level, triggering over $120 million in liquidations across the crypto market in just one hour. The move came after BTC’s latest run to new all-time highs above $126,000 earlier this week, leaving overleveraged traders exposed to a quick reset.

According to data from Coinglass, roughly $100 million came from long positions, while $20 million stemmed from short squeezes caught in the rebound. Bitcoin accounted for the bulk of the wipeouts at $67 million, followed by Ethereum ($19 million) and Solana ($14 million). Despite the cascade, prices stabilized quickly, with BTC recovering above $120K soon after the drop.

Analysts Call It a Healthy Reset

Market analysts have largely dismissed the correction as panic-worthy. Instead, they describe it as a “healthy cooldown” following Bitcoin’s aggressive surge past $120K last week. Rapid rallies tend to inflate open interest and leverage across exchanges, setting up volatility traps that reset positions when funding rates spike.

“The market was overheated after the parabolic move,” one trader noted. “These liquidation events often clear excess leverage before the next leg higher.” The sentiment remains broadly bullish, with traders expecting consolidation between $118K and $122K before Bitcoin attempts another breakout.

Ethereum and Solana Follow the Shakeout

Ethereum and Solana mirrored Bitcoin’s correction, both seeing double-digit millions in liquidations as traders scrambled to de-risk. ETH briefly touched $4,450, while SOL slid to $218 before rebounding. The broader altcoin market experienced mild contagion, though many assets remain significantly up from last month’s levels.

This synchronized pullback highlights how Bitcoin’s volatility still dictates short-term market rhythm, even as altcoins and DeFi tokens gain traction amid rotation flows.

What Comes Next for BTC

Despite the flush, market structure remains bullish. Funding rates have cooled, open interest has normalized, and spot demand continues to show strength across major exchanges. Analysts say this positioning reset could pave the way for a more sustainable push toward $130K in the coming weeks.

If Bitcoin holds above $120K with strong spot inflows, the next phase of the rally may unfold with lower leverage risk — giving bulls room to run without immediate liquidation pressure.