- Price Drop: BONK fell 14%, trading at $0.00001875, with resistance at $0.00002039 and support at $0.00001572.

- Data Insights: On-chain volume drops; $251K in long liquidations suggest traders stay bullish.

- Partnership Boost: New deal with Nasdaq-listed DeFi Development Corp could lift market sentiment.

Bonk (BONK), a Solana-based meme coin with a market cap exceeding $1.436 billion, faced a rough patch last week as its price dipped by 14%. Despite broader market trends favoring smaller cryptos and Solana-based memes, BONK lagged behind, while blue-chip DeFi tokens like Dogwifhat (WIF) led in gains.

Mixed Technical Signals for BONK

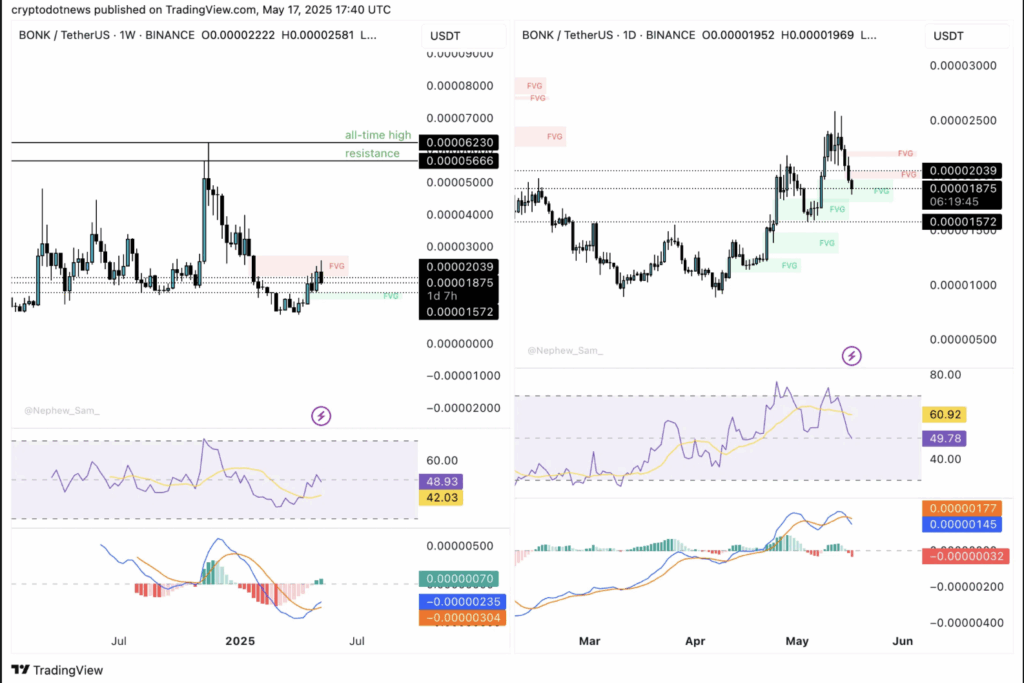

The daily and weekly charts paint a mixed picture for BONK. On the weekly timeframe, technical indicators like MACD hint at underlying bullish momentum, flashing green bars that suggest potential upside. The RSI reads 48, hovering near neutral territory.

Currently trading at $0.00001875, BONK faces its nearest resistance at $0.00002039, marking the lower boundary of a Fair Value Gap (FVG) on the weekly chart. On the downside, the closest support level lies at $0.00001572 — the lower boundary of a bullish imbalance zone.

On the daily chart, the outlook appears more bearish. The MACD has flipped negative, displaying red histogram bars, and the RSI sits at 49, also near neutral. While BONK is in an upward trend, it has slipped into the imbalance zone, a signal that further correction could be on the horizon. However, should BONK gather liquidity and rebound, targets at $0.00002039 and $0.00002581 come into focus, both marked by lower FVG boundaries on the daily timeframe.

On-Chain Data Reflects Market Fatigue

On-chain data from Santiment shows a decline in transaction volume and social dominance for BONK over the past week. Lower transaction volume suggests reduced trading activity, while decreased social dominance indicates waning interest from retail traders and influencers.

Interestingly, despite the dip, Santiment data doesn’t indicate a significant uptick in selling pressure. This could mean that while interest in BONK has faded somewhat, there hasn’t been a notable increase in bearish sentiment.

Derivatives Data: Long Liquidations Pile Up

Data from Coinglass reveals a surge in long liquidations over the last 24 hours, with over $251,000 in longs liquidated compared to just $2,670 in shorts. The long/short ratio on OKX reads 1.81, suggesting that despite the price dip, derivatives traders remain bullish on a potential BONK recovery.

New Partnership Could Be a Game Changer

Beyond price action, BONK announced a noteworthy partnership with DeFi Development Corp, a Nasdaq-listed firm, for the launch of its meme coin validator. The development is pivotal as it marks the first collaboration between a Solana-based meme token and a publicly listed company.

According to the BONK team, the partnership will expand validator coverage, bolster BONKSOL, the community-run Liquid Staking Token, and further decentralize Solana’s network infrastructure. As BONK pilots this initiative, it could set a precedent for future collaborations between meme tokens and established firms, potentially influencing market sentiment and price action in the weeks ahead.