- Gold is rallying on fear and safe-haven demand, while Bitcoin is moving independently.

- Bitcoin is increasingly driven by liquidity, ETFs, and institutional flows.

- The decoupling signals maturity, not weakness, in Bitcoin’s market role.

Gold is doing what gold does best right now. Prices have surged past $4,600 per ounce, driven by geopolitical risk, easing real yields, and heavy inflows into gold ETFs. For traditional investors, this is classic behavior. When uncertainty rises and confidence in paper assets wobbles, capital runs straight to the oldest safe haven in the book. Silver joining the rally only reinforces that fear-driven trade is firmly back in play.

Bitcoin Is Taking a Different Route

Bitcoin, however, is not tagging along. It isn’t collapsing, but it also isn’t sprinting higher with gold. Instead, BTC is behaving more like an institutional, liquidity-sensitive asset than a panic hedge. Analysts have pointed out that Bitcoin’s correlation with gold has weakened, while its sensitivity to ETF flows, regulatory clarity, and broader risk appetite has increased. The drop in the BTC–gold ratio looks less like a failure and more like evidence that markets are pricing Bitcoin on different terms.

Digital Gold Was Always an Oversimplification

For years, Bitcoin’s “digital gold” narrative relied on moments when both assets moved together during macro stress. That framework is breaking down. Gold and Bitcoin are now reacting to separate forces. Gold is responding to fear, geopolitical tension, and collapsing real yields. Bitcoin is responding to liquidity conditions, institutional positioning, and policy signals. The divergence feels uncomfortable only if you expect them to behave the same way forever.

Different Hedges for Different Risks

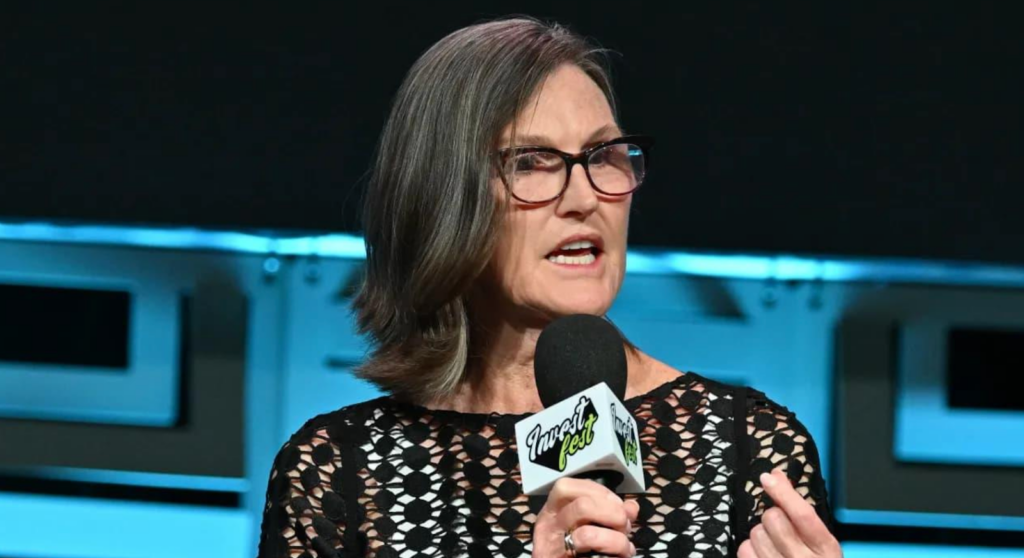

Some respected voices, including Cathie Wood, argue that Bitcoin lagging gold right now doesn’t damage its long-term thesis. Gold’s explosive rally reflects short-term defensive behavior. Bitcoin, by contrast, is increasingly viewed as a long-term diversification tool rather than an emergency shelter. It performs best when liquidity expands, regulation becomes clearer, and institutions allocate strategically, not when fear spikes overnight.

What This Shift Really Means

The idea that Bitcoin and gold must move in tandem was always too neat. Markets are now treating them as distinct tools. Gold remains the immediate refuge when uncertainty hits. Bitcoin is evolving into a strategic hedge tied to institutional flows and financial system dynamics. That decoupling isn’t a breakdown of Bitcoin’s role. It’s a sign that the asset is maturing into something markets understand differently.