- Political pressure on monetary institutions is undermining confidence in fiat currencies.

- Investors are rotating into gold and digital assets as perceived safe havens.

- The shift reflects structural concerns, not just short-term market fear.

Markets don’t like ambiguity, especially when it touches institutions meant to stay neutral. A criminal investigation involving the US Federal Reserve Chair, tied to testimony around a building renovation, has done exactly that — rattled confidence in central bank independence. The fallout was immediate. The dollar softened, gold surged to new record highs, and traders began questioning whether monetary policy decisions are drifting closer to political influence than economic data.

A Market-Wide Flight Toward Safety

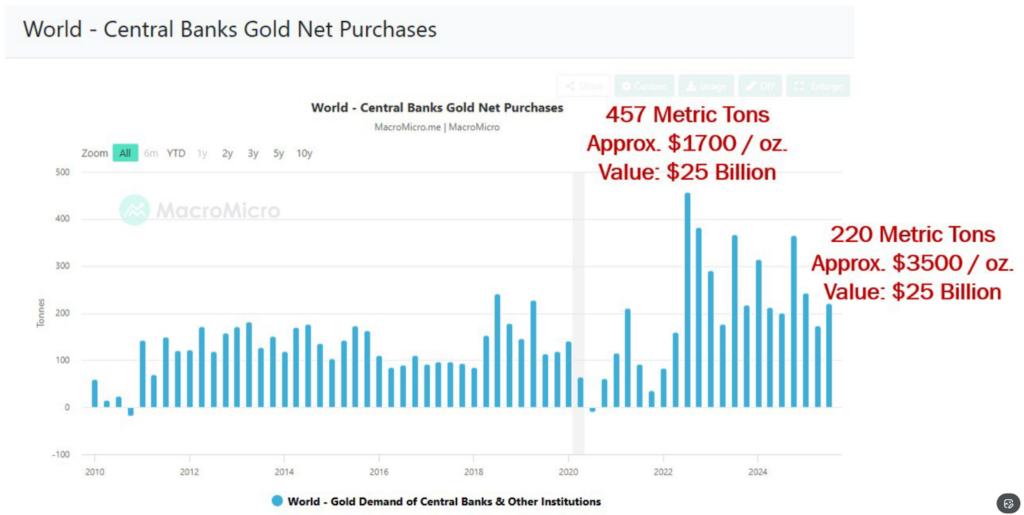

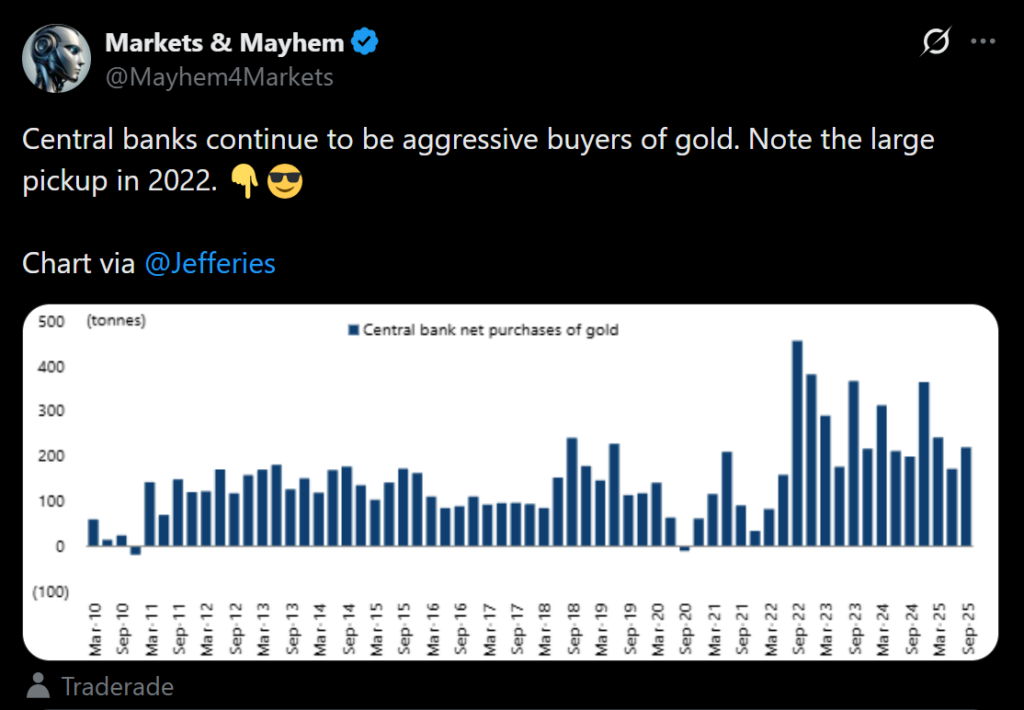

As confidence in fiat currencies wavers, capital tends to move fast. Gold climbing past $4,600 per ounce isn’t just a technical breakout; it’s a message. Investors are seeking protection from uncertainty, and even traditionally dominant reserve assets like the US dollar are starting to show cracks. Fiscal stress, political interference, and policy unpredictability are eroding the sense of stability that fiat systems rely on.

Why Alternatives Are Gaining Ground

This shift isn’t happening in a vacuum. Growing political skepticism is increasingly shaping how investors think about long-term allocation. Research continues to show a correlation between distrust in centralized monetary systems and rising interest in decentralized alternatives. Cryptocurrencies, in particular, are being reframed not just as speculative instruments, but as hedges against fiat erosion and policy manipulation. For some, blockchain-based money represents a system where rules are enforced by code, not political pressure.

A Structural Warning, Not a Panic Reaction

What’s unfolding feels deeper than a temporary fear trade. When political agendas start pulling on the levers of monetary power, faith in fiat currencies weakens by default. The resulting flow into gold and digital assets is less about chasing returns and more about preserving trust. If governments continue to blur the line between fiscal influence and monetary independence, markets will keep responding the same way — by voting with their capital.