- The $2,000 tariff dividend remains unimplemented and unfunded.

- Revenue math and legal challenges undermine feasibility.

- Any future payments would likely be smaller and delayed.

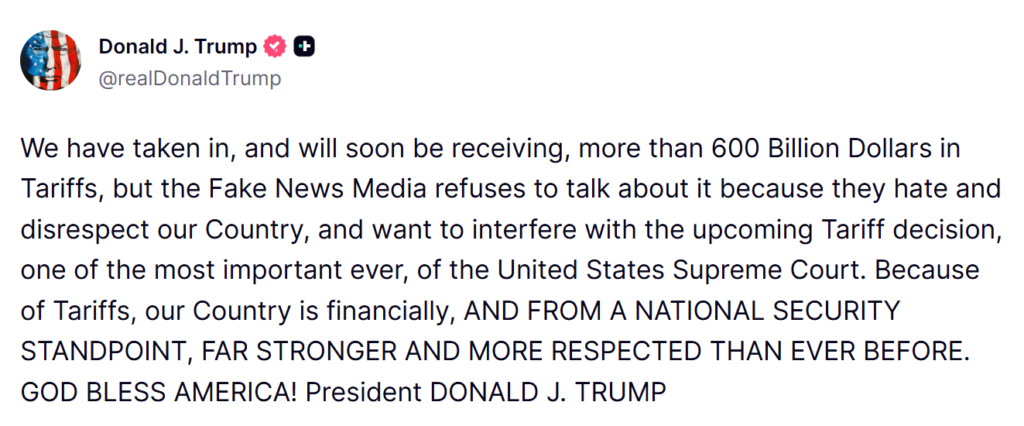

For a moment, the idea sounded almost inevitable. Tariffs would pour in revenue, and Americans would get a $2,000 “tariff dividend” check as a direct payoff. The promise was loud, repeated often, and framed as simple. Fast forward, and the checks are still theoretical. President Trump has continued to reference them, even floating 2026 as a possible window, but there’s still no approved plan, no legislation, and no real mechanism to send money out. In a recent Oval Office exchange, he even had to be reminded of the pledge before suggesting distribution might happen “toward the end of the year.”

Why the Plan Keeps Stalling

The biggest obstacle is math. Even under optimistic assumptions, tariff revenue doesn’t come close to funding universal $2,000 checks. Analysts estimate such a program would cost roughly $600 billion, while expected tariff revenue sits closer to $200 billion. That gap doesn’t disappear with optimism. It either creates massive deficits or forces a smaller, more limited payout, neither of which matches the original pitch.

There’s also legal friction. The tariffs themselves are tied up in ongoing court challenges, including a Supreme Court case that could scale them back or invalidate parts of the program. When the revenue source isn’t settled, building a rebate system on top of it becomes risky, if not impossible.

Politics and Law Add Another Layer

Even if the numbers worked, checks don’t go out by executive suggestion alone. Congress would need to pass new legislation authorizing payments, and the appetite for a hundreds-of-billion-dollar program is thin. Budget pressures, election-year priorities, and partisan gridlock all slow things down. Meanwhile, unresolved legal questions around tariff authority hang over the entire idea.

What This Really Means

The tariff dividend hasn’t been formally canceled. It’s just been boxed in by reality. The promise still resurfaces because it plays well politically, but the path from talking point to bank deposit is long and messy. If payments ever materialize, they’re unlikely to resemble the clean, universal $2,000 checks that were originally advertised.

Conclusion

For now, the tariff dividend is more significant than policy. The headlines linger, but the infrastructure to deliver real money does not. Any movement will depend on court rulings and legislative deals that could take months, if not longer. Until then, Americans are left with talk, not checks.