- Whales bought 230 million DOGE in 24 hours, signaling potential positioning for a major market move.

- Buying patterns suggest dip accumulation and preparation for possible catalysts like an ETF or X payments integration.

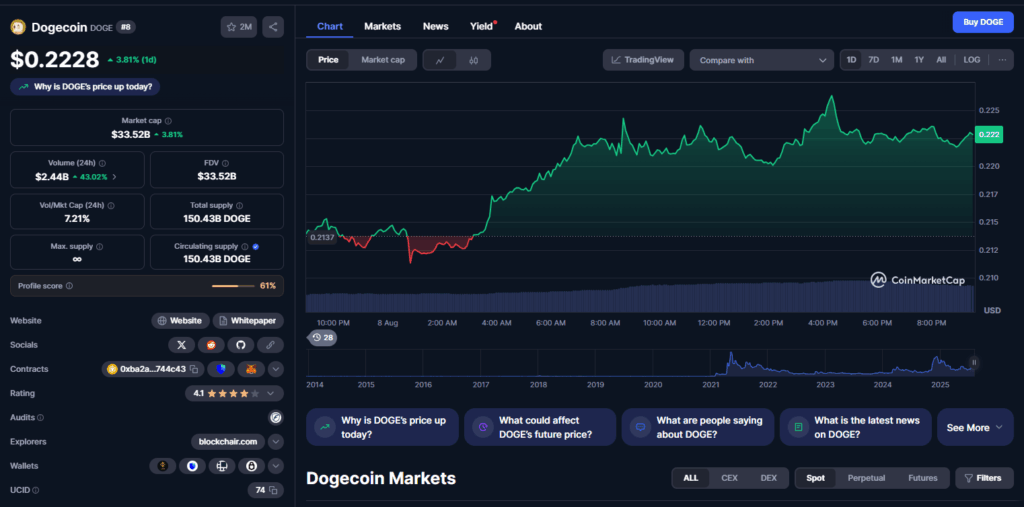

- Long-term forecasts see DOGE reaching $0.58 by 2030, with current sentiment leaning bullish.

Dogecoin has caught the attention of large-scale investors, with whales accumulating nearly 230 million DOGE in just 24 hours. This surge in whale activity is notable given the token’s recent stagnant price action, sparking speculation that big players might be positioning for an upcoming catalyst. While the price remains relatively dormant, such concentrated buying often hints at strategic moves based on anticipated developments or market signals.

Buying the Dip and Strategic Positioning

One possible explanation for this activity is classic dip accumulation. Whales often seize opportunities when assets trade at lower prices, aiming to maximize future gains. With Dogecoin trading in a subdued range, these purchases could represent calculated bets on a rebound. Historically, such buying patterns from whales precede upward momentum, especially when supported by a broader bullish sentiment in the crypto market.

Speculation Around Future Integrations and ETFs

Dogecoin’s long-standing association with payments on X (formerly Twitter) continues to fuel speculation. The possibility of DOGE integration into X’s payment ecosystem, alongside growing chatter about a potential Dogecoin ETF, offers tangible bullish narratives. Both developments could significantly increase the token’s utility and investor exposure, providing a logical basis for whales to accumulate heavily now in anticipation of future demand.

Long-Term Price Prospects

According to CoinCodex data, Dogecoin is projected to see gradual but meaningful price growth in the coming years, potentially reaching $0.50 by 2028 and $0.58 by 2030. Current market indicators reflect a bullish sentiment, with the Fear & Greed Index at 62 (greed) and DOGE showing more than half of the past 30 days in the green. For whales, this long-term bullish outlook could justify aggressive accumulation despite short-term volatility.