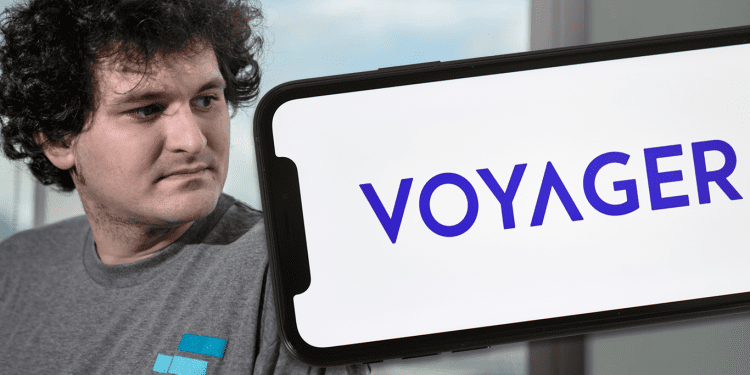

Crypto-lending company Voyager Digital was in hot water these days after they filed bankruptcy last month. Recently, AlamedaFTX offered a buyout. However, Voyager refused the offer due to “higher” acquisition proposals.

FTX proposed that it would buy all of the Voyager assets and pending loans. When the assets liquidate, they convert into USD using the FTX exchange.

Voyager said they don’t want FTX’s offer because it does not “maximize the value” for the customers. While it may be questioned why the firm declined a reasonable offer, it claims that over 88 parties were interested in bailing Voyager Digital out.

How are the Offers Better?

In a recent New York hearing, the judge that oversaw the bankruptcy proceedings cleared Voyager Digital to refund $270 million to the Metropolitan Commercial Bank. Right now, the firm said that out of the 88 parties, 20 are “actively discussing” with the superiors.

The initial Alameda x FTX buyout proposal happened last July 2022, indicating that they will do all they can to help compensate for the affected persons.

Voyager also clarified that it had already received better proposals before the AlamedaFTX deal. The firm also sent a cease and desist letter to AlamedaFTX for the “incorrect” information they said to the public.

Voyager’s Bankruptcy in a Nutshell

On July 5, 2022, Voyager Digital officially filed for bankruptcy. The company still had funds in the bank account, but these were blocked after the proceedings started. According to the trial, Voyager owes almost $10 billion to no more than 100,000 creditors.

However, while the numbers are significant, this is not the first crypto-based brokerage that has struggled with its users. Among these are BlockFi, Three Arrows Capital, and Celsius.

Stephen Ehrlich, CEO of Voyager Digital, created a plan to refund customer funds from the Metropolitan Commercial Bank as soon as the “fraud prevention process” concluded. Based on the reports, he requested the MCB to release the funds on July 15.