- Volcon stock soared 135% after announcing a $500M private placement, with 95% of the funds going toward building a Bitcoin treasury.

- The deal is backed by major firms like Empery, Pantera, and FalconX, signaling growing institutional confidence in BTC as a treasury asset.

- Despite a $45M loss in 2024, Volcon is shifting focus from electric off-road vehicles to digital asset accumulation, following the playbook of companies like Strategy Inc.

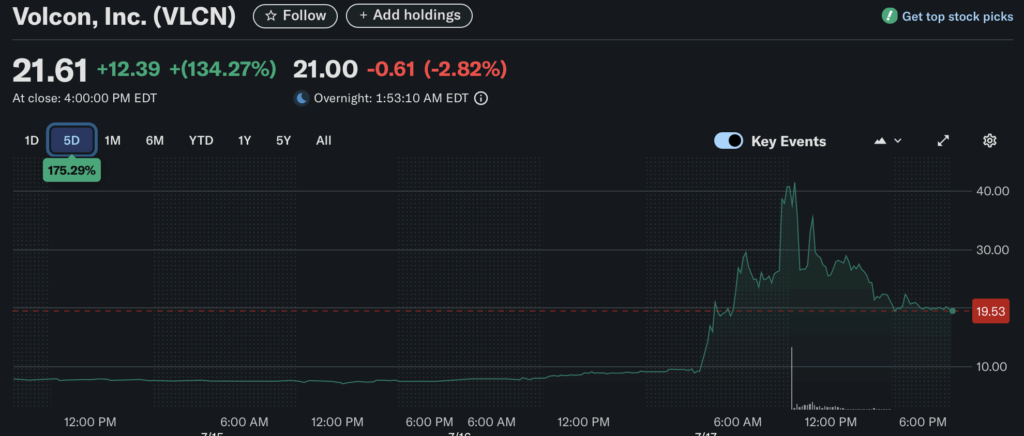

Well, that escalated quickly. Shares of Volcon, the Texas-based electric vehicle company, rocketed nearly 135% on Thursday after it dropped a bombshell: it’s raising $500 million to load up on Bitcoin. Yep—95% of that cash is going straight into BTC, making Volcon the latest in a growing crew of companies flipping their treasuries into crypto mode.

In a private placement deal, Volcon’s selling over 50 million shares at $10 apiece. And if you’re wondering why a powersports firm suddenly wants to go digital hard—Co-CEO John Kim summed it up: “In an era of accelerating monetary debasement, holding Bitcoin on our balance sheet represents a strategic move to safeguard shareholder value and align with a digital future.” Bold words.

Losses, Volatility… and Now BTC?

It’s a bold bet for a firm that reported a whopping $45M net loss in 2024. Shares had already taken a hit this year—down more than 35% before the BTC news lit the rocket. But now? Volcon’s joining the Bitcoin treasury club, chasing the playbook popularized by Michael Saylor’s Strategy Inc., which sits on a $72B BTC stack.

Altogether, over 140 companies now hold a collective $102.2 billion in Bitcoin, according to bitcointreasuries.net. Strategy owns most of that pie. Others like SharpLink and DeFi Dev Corp are leaning into Ethereum and Solana instead, diversifying the “digital vault” trend.

Who’s Bankrolling the Bitcoin Pivot?

Volcon’s big BTC buy-in is backed by some notable names—Empery Asset Management is leading the funding round, with help from FalconX, Pantera Capital, Borderless, RK Capital, and Relayer. The deal is expected to close by July 21, if everything goes smoothly.

To be clear, this isn’t some tech startup pivoting to crypto. Volcon builds rugged off-road electric vehicles. Its lineup? The “Brat,” a chunky city commuter that kinda looks like a motorcycle, and the “Grunt” e-bike, aimed at hunters and outdoor lovers. So yeah, not your typical crypto-native team.

Crypto Heating Up Across the Board

Oh, and while we’re here—Bitcoin is hovering around $120,200, up 3% over the past week. Not bad considering the chop. Meanwhile, BlackRock’s making its own moves, filing to add staking to its Ethereum ETF, ETHA. That means more ETH, more yield, more attention—bullish stuff overall.

So, back to Volcon. Will this Bitcoin treasury gamble pay off? Too soon to say. But judging by the stock’s explosive move and the sudden rush of big names into the deal, the market’s clearly intrigued.