- Venezuela has a documented history of having sovereign assets seized or frozen abroad, especially gold and bank reserves.

- This history fuels speculation that any alternative reserves, including rumored Bitcoin holdings, would be handled very differently.

- Even unconfirmed, the discussion highlights how sanctions reshape sovereign behavior and global asset flows.

Over the past decade, Venezuela has repeatedly watched its wealth disappear once it crossed foreign borders. Gold stored in overseas vaults was frozen or seized, bank accounts were locked, and access to dollars slowly evaporated under sanctions. Reuters reporting confirms that tens of tons of Venezuelan gold were sold or immobilized abroad during the late 2010s, permanently altering how the country — and others like it — think about reserve security.

That history matters. It taught a harsh lesson: if your reserves depend on foreign custodians, they are not really yours.

Why Bitcoin Keeps Coming Up

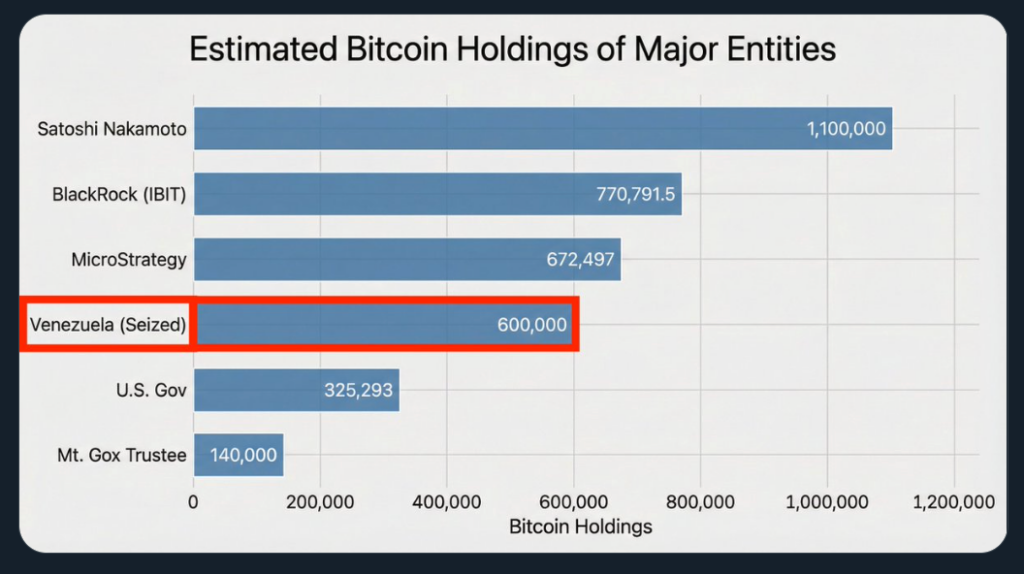

Against that backdrop, speculation about Venezuelan Bitcoin reserves has picked up. There is no public on-chain proof of large state-controlled wallets, and that point matters. But so does the incentive logic.

Bitcoin cannot be frozen by a foreign bank, seized from a vault, or invalidated by correspondent banking rules. For governments operating under sanctions, it represents a reserve asset that sits entirely outside traditional choke points. That does not confirm Venezuela holds Bitcoin at scale, but it explains why the idea refuses to go away.

The Market Angle Most People Miss

If sovereign-held Bitcoin ever became entangled in legal disputes, it likely would not hit the market quickly. Those assets would be locked in courts, not dumped on exchanges. From a market perspective, that removes supply rather than adding sell pressure.

Zooming out, this highlights a broader pattern. Sanctions do not erase wealth. They reshape it. When traditional assets become liabilities, alternatives that resist seizure start to look less speculative and more strategic.

The Bigger Takeaway

Whether or not Venezuela holds Bitcoin today is almost beside the point. The documented gold seizures are real, and they explain why sanctioned states look for assets that cannot be frozen, censored, or quietly confiscated. Bitcoin’s role here is not about hype. It is about incentives forged by experience.