- VeChain (VET) rose 7.2% in 24 hours despite broader market weakness

- Enterprise transaction growth and digital passport updates boosted sentiment

- Macro pressure and Bitcoin’s softness could limit upside momentum

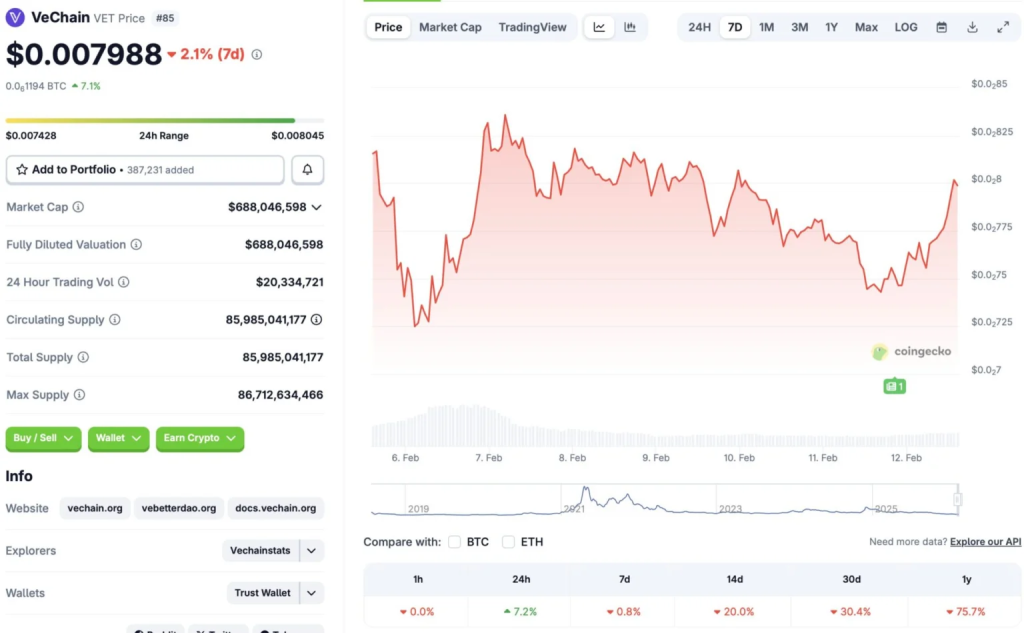

VeChain (VET) is currently one of the better-performing assets in the top 100 cryptocurrencies, posting a 7.2% gain in the last 24 hours, according to CoinGecko. On the surface, that kind of move stands out, especially in a market that has been largely risk-off. But zoom out and the broader picture looks less impressive.

VET remains down roughly 20% over the past 14 days, more than 30% in the last month, and over 75% since February 2025. So while the daily candle looks strong, the higher time frames are still deeply negative. That context matters when discussing whether this is a reversal or just a relief bounce.

Enterprise Activity Is Driving the Narrative

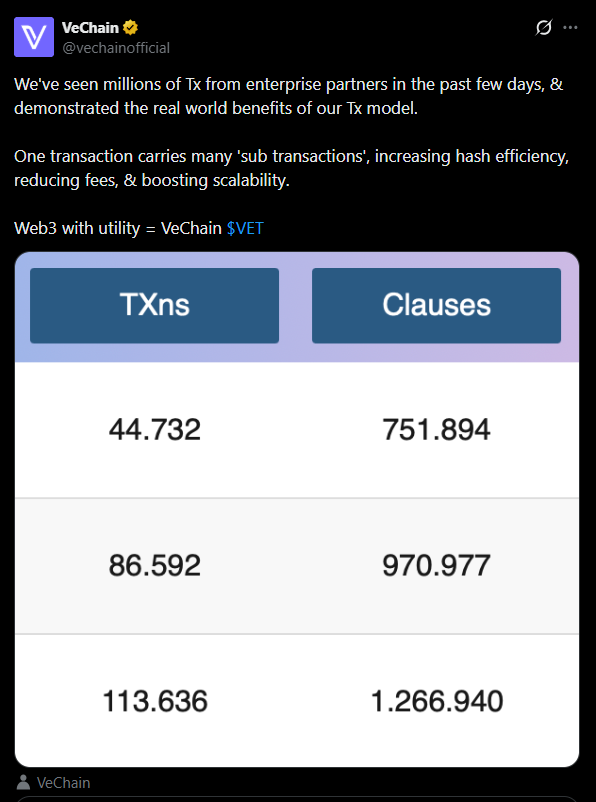

One of the likely catalysts behind VeChain’s rally is renewed focus on its enterprise transaction model. An official update highlighted that the network processed millions of transactions from enterprise partners in recent days. VeChain’s structure allows one primary transaction to include multiple sub-transactions, which improves hash efficiency while keeping fees low.

That’s the type of real-world usage narrative VET holders have leaned on for years. Scalability, enterprise partnerships, and measurable network activity differentiate VeChain from purely speculative tokens. When that data resurfaces during market weakness, it can reignite interest, at least temporarily.

Digital Passport Momentum Adds Fuel

Another driver appears to be VeChain’s advancement in digital passport infrastructure. The project is working alongside Rekord and the University of Sheffield’s Advanced Manufacturing Research Centre (AMRC) to support industrial-grade digital product passport (DPP) systems. The European Union’s Ecodesign for Sustainable Products Regulation (ESPR) is now in motion, and VeChain is positioning itself as a technical layer within that framework.

For investors, regulatory-aligned use cases tend to carry more weight than abstract promises. If VeChain can anchor itself to compliance-driven supply chain tracking and sustainability reporting, it gains relevance beyond crypto-native hype cycles. That shift in perception likely boosted short-term sentiment.

Macro Reality Still Looms Large

Despite these developments, the broader crypto market remains fragile. Bitcoin is hovering near $67,000, and overall sentiment continues to lean defensive. Investors have been rotating into gold, silver, and other traditional safe-haven assets amid macroeconomic uncertainty.

In that kind of environment, altcoin rallies often struggle to sustain momentum. Short-term traders may take profits quickly, especially after a sudden spike. Without broader liquidity returning to the market, isolated strength in a single asset can fade just as fast as it appeared.

Conclusion

VeChain’s 7% daily rally reflects renewed attention on enterprise transactions and digital passport adoption. Those fundamentals strengthen the long-term case for VET. However, given the larger bearish environment and Bitcoin’s continued weakness, this move may represent a short-term bounce rather than a confirmed trend reversal.

For a sustained recovery, VET will likely need both continued real-world traction and a more supportive macro backdrop. Until then, volatility remains the default setting.