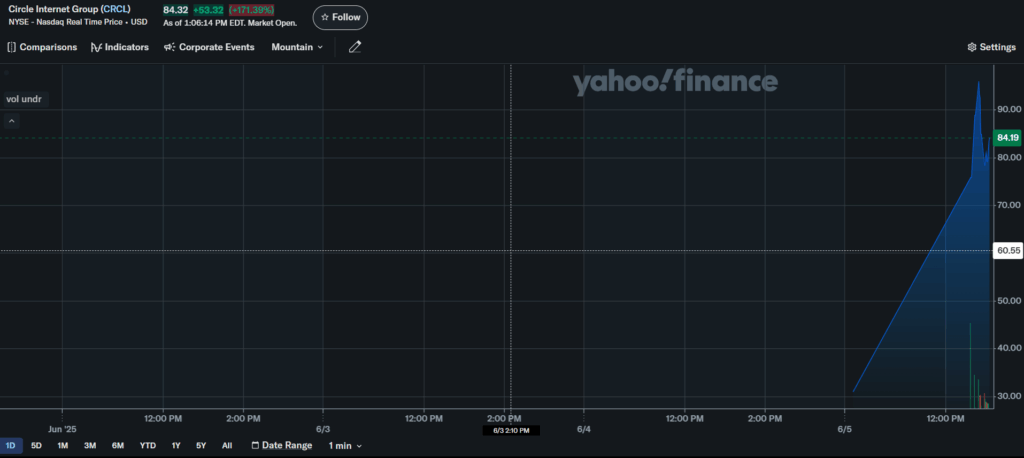

- Circle’s IPO raised nearly $1.1B as its shares surged 173% on day one, hitting a peak of $103.

- CEO Jeremy Allaire credits tight compliance and transparency for Circle’s successful public debut.

- With stablecoin regulation on the horizon, USDC’s growing role may help preserve U.S. dollar dominance.

Circle Internet Group just made a thunderous entrance on Wall Street—shares exploded 173% after the company and its early investors raised nearly $1.1 billion in an IPO that seriously outpaced expectations. Priced at $31 per share, Circle’s stock hit the New York Stock Exchange at $69.50 and even touched $103 during trading, giving the company a pre-market valuation of $6.8 billion. This wasn’t their first go at going public either; a 2022 SPAC merger failed due to regulatory hurdles, but this time, they made it stick.

Now, Circle joins the small club of U.S.-listed crypto-native firms alongside Coinbase and Riot Platforms. CEO Jeremy Allaire credited their tight compliance playbook and transparency for the successful debut, telling CNBC, “If you want crypto to work in the mainstream, it’s gotta play by mainstream rules.” And it seems that strategy’s paying off—with Circle now positioned at the heart of a sector that might 10x within five years.

USDC’s Rise, Regulation Tailwinds, and a Trillion-Dollar Dream

Back in 2018, Circle co-created the USDC stablecoin with Coinbase to set a new digital money standard. Fast forward to now: Centre—the original joint venture behind it—is gone, but USDC lives on under Circle’s control, with Coinbase still hanging on via a minority stake. The two companies even share the coin’s revenue, and Coinbase CEO Brian Armstrong recently said their “stretch goal” is to push USDC past Tether as the world’s top stablecoin.

USDC is already number two, trailing only USDT, but it’s gaining traction fast. As crypto gains legitimacy in Washington and legislation for stablecoins inches closer to the finish line, analysts say the whole space could soon be worth over a trillion bucks. That kind of growth isn’t just good news for Circle—it’s a rising tide moment for the entire stablecoin ecosystem.

Stablecoins Are Going Mainstream, and Circle’s Right There

While stablecoins used to be mostly a tool for crypto traders looking to hop between tokens, they’re now catching the eye of traditional finance. Banks, payment processors, even e-commerce companies are looking at them for their speed and lower costs in cross-border payments and B2B transactions. And then there’s the political piece: with President Trump’s administration actively reversing crypto-hostile policies from the Biden era, the door’s wide open for adoption.

There’s also a bigger narrative forming—one where stablecoins like USDC are seen as reinforcing U.S. financial power globally. Because they’re backed largely by U.S. Treasurys, they indirectly help fuel demand for government debt. In other words, for policymakers and investors alike, this isn’t just a tech play—it might be a geopolitical one too.