- Ethereum staking ETFs are gaining traction in the U.S. as exchanges like Cboe BZX and NYSE Arca submit proposals to the SEC, potentially allowing traditional investors to earn ETH staking rewards through regulated ETF structures.

- Key concerns for SEC approval include slashing risks, staking-related liquidity delays, and whether staking constitutes an “investment contract” under securities law — all of which could impact investor protections.

- Global pressure and evolving sentiment (especially from Hong Kong’s staking-friendly stance) are pushing U.S. regulators to adapt. Industry experts say the odds of approval by the end of 2025 are growing, though caution remains.

Since early 2025, exchanges like Cboe BZX and NYSE Arca have been pushing for Ethereum ETFs that include staking features. If approved, these could make it easier for traditional investors to earn passive income from ETH.

Brian Fabian Crain, CEO of Chorus One, is “cautiously optimistic” about these proposals gaining approval before the end of President Trump’s first term. However, he notes that the SEC will likely prioritize investor protections before moving forward.

The Push for Staked Ethereum ETFs in the US

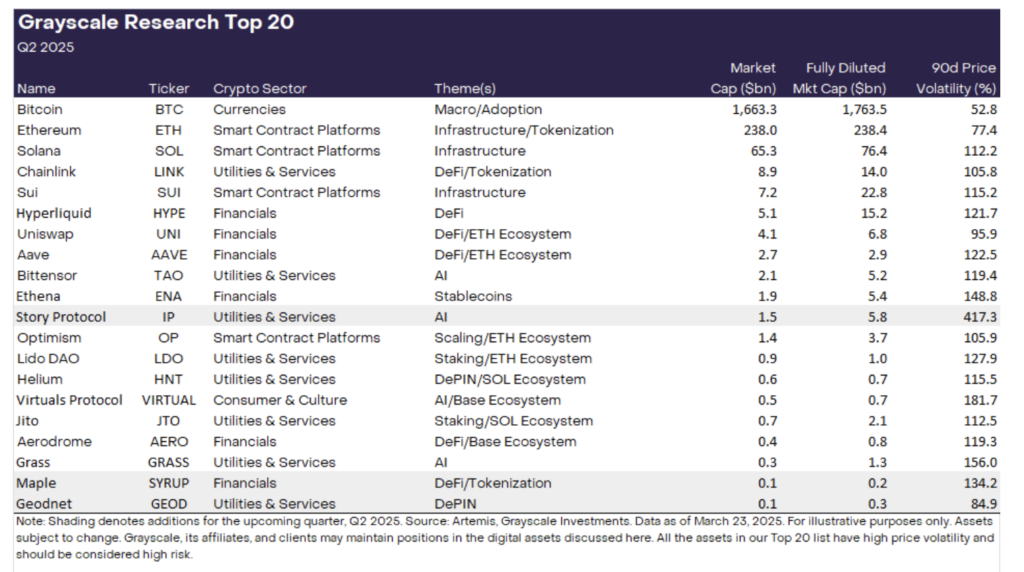

In February, both Cboe BZX and NYSE Arca filed proposals to add staking to existing Ethereum ETFs. Cboe BZX aimed to amend the 21Shares ETF, while NYSE Arca targeted Grayscale’s offerings.

Staking, a key part of Proof-of-Stake blockchains, allows participants to validate transactions based on the amount of cryptocurrency they have locked up. If these ETFs are approved, investors could gain exposure to ETH and earn staking rewards, all within a familiar ETF structure.

“The approval of an Ethereum staking ETF would mark a watershed for institutional adoption,” Crain told BeInCrypto.”It provides regulated, easy-to-access exposure to ETH that includes its native yield.”

Can Staking Yield Revitalize Ethereum’s Market Position?

Throughout 2024 and into 2025, Ethereum’s price growth lagged behind Bitcoin’s. The ETH/BTC ratio hit a record low in April 2025, indicating Bitcoin’s outperformance.

Market fluctuations further complicated Ethereum’s position. Earlier this month, ETH reached its lowest price in two years, shaking investor confidence.

Crain believes that incorporating staking into ETFs could make Ethereum more attractive to investors. “Ethereum’s ~3% annual staking yield is a major draw,” he explained. “Even if ETH’s price growth trails Bitcoin’s, staked ETH can deliver higher total returns thanks to the yield.”

How Hong Kong’s Staking Approval Impacts the US SEC

Recently, Hong Kong’s Securities and Futures Commission (SFC) announced new guidance allowing licensed crypto exchanges and funds to offer staking services. Platforms must meet strict conditions before providing these services.

“Hong Kong’s adoption of regulated staking sends a message: it’s possible to allow staking in a compliant manner,” Crain said. “US regulators often watch regimes like Hong Kong as bellwethers for emerging best practices.”

If the US doesn’t eventually allow staking in ETFs, global investors might turn to international markets to access these products.

The “Investment Contract” Conundrum

One major consideration for the SEC is whether staking programs constitute investment contracts. Previously, the SEC targeted centralized exchanges like Kraken and Coinbase for operating staking services considered unregistered profit schemes.

However, staking within an ETF differs from exchange-based staking. “An ETF staking its own assets isn’t ‘selling’ a staking service to others; it’s directly participating in network consensus,” Crain explained. This nuance is contributing to the SEC’s willingness to reconsider its stance.

Slashing Risks: A Unique Challenge for Ethereum Staking ETFs

Unlike traditional commodity funds, a staking ETF must actively participate in network consensus, exposing it to slashing risks. Slashing is a penalty where a portion of the staked ETH can be destroyed if a validator acts improperly.

“The SEC will assess how significant this risk is and whether it’s been mitigated,” Crain noted. Filings indicate that the sponsor will not cover slashing losses on behalf of the trust, meaning investors bear that risk.

Custodians typically have insurance for asset loss due to theft or cyberattacks, but slashing is a protocol-enforced penalty, not traditional theft. Therefore, the SEC will likely inquire about safeguards should a slashing event occur.

Further SEC Considerations

Staked ETH lacks instant liquidity. Even after the Shanghai upgrade enabled withdrawals in 2023, the Ethereum protocol still incorporates delays that prevent staked ETH from being instantly liquid.

“The SEC will examine how the fund handles redemption requests if a large portion of assets are locked in staking,” Crain said. Exiting a validator position can take days to weeks if there’s a backlog.

During heavy outflows, the fund might not immediately access all its ETH to meet redemptions, posing a structural complexity that could harm investors if not planned for.

The “Point-and-Click” Model

Securing custody for Ethereum in an ETF is crucial, and adding staking increases the SEC’s scrutiny. “The SEC will examine how the ETF’s custodian secures the ETH private keys, especially since those keys will be used to stake,” Crain explained.

Some exchanges have proposed that the ETH for staking remain within the custodian’s control at all times, referred to as a “point-and-click” mechanism. This model aims to stake without altering fundamental custody or introducing extra complexities for investors.

When Will the SEC Approve Staking in Ethereum ETFs?

Despite the complexities, the prevailing political climate in the US could lead to a more favorable environment for the eventual approval of Ethereum staking ETFs. “On balance, it now seems more likely than not that the SEC will approve a staking feature for Ethereum ETFs in the relatively near future,” Crain told BeInCrypto.

However, he cautioned that the SEC will not approve such an ETF until it’s fully satisfied with the investor protections in place. Even so, the overall outlook remains positive.

“Considering all the factors discussed, the outlook for an Ethereum staking ETF approval appears cautiously optimistic,” Crain concluded. “The likelihood of eventual approval is growing, though the timing remains a subject of debate.”