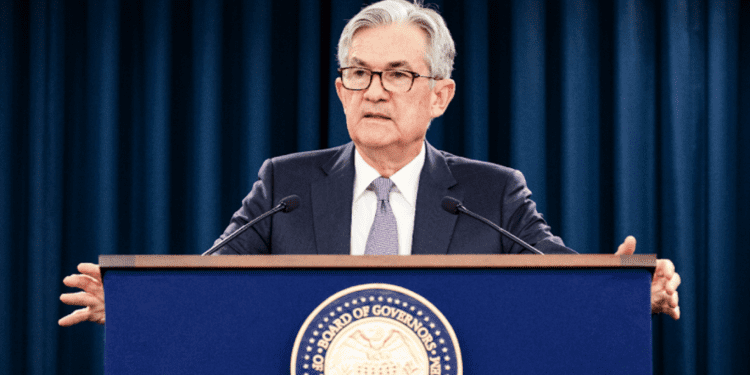

The Federal Reserve has held its first meeting of the year today, with investors and traders eagerly awaiting the outcome. The central bank has decided to raise its short-term interest rate by a quarter of a percentage, marking this the eighth increase since the Fed began its tightening cycle in March 2022. Despite this, the focus was more on Fed’s Chair, Jerome Powell’s post-meeting press conference for clues on the Fed’s long-term stance on policy change.

The market was expecting the Federal Reserve to be very predictable in its decisions, which it was. The Federal Reserve has released its Federal Open Market Committee’s (FOMC’s) statement, outlining its current stance on monetary policy. The report highlights the recent data showing modest spending and production growth. However, the central bank notes that inflation remains elevated, and the ongoing conflict in Ukraine contributes to uncertainty in the global market.

The Balance Between Inflation and Recession

To support its goals of maximum employment and an inflation rate of 2 percent over the long term, the Federal Reserve raised its benchmark interest rate by 25 base points (bps), bringing it to a target range of 4.5%-4.75%, the highest rate since 2007. With this, the Fed aims to reduce inflation which remains elevated despite recent signs of slowing down.

This action should not be a shock, as the Fed has repeatedly warned over the last year about the rates remaining “higher for longer.” The economists who once questioned the Fed’s delay in raising interest rates now wonder when the Fed will stop as it balances between lowering inflation to its 2% target and avoiding pushing the economy into recession. However, this move represents a slowing down of last year’s aggressive pace of hikes.

FOMC and General Crypto Sentiment

The crypto market was also paying close attention to the outcome of the Fed meeting. Bitcoin and Ethereum prices have been relatively steady, with the global crypto market cap at $1.05 trillion. Even with a solid start to 2023, with bitcoin up 40%, traders appeared reluctant to make any significant moves once the Fed policy meeting had concluded.

Up until the anticipation of the FOMC, Bitcoin (BTC) and Ethereum (ETH) continued to maintain stability, with their prices staying above $23,000 and $1,500, respectively, contributing to a 0.91% overall growth of the global crypto market cap in the last 24 hours.

The sentiment before the meeting was leaning towards a hawkish stance of the Fed, pointing at a temporary price pullback in the crypto market. The general crypto market is maintaining above crucial resistance levels while major cryptocurrencies are gaining some percentage increase since Powell’s post-meeting address.

Clues on the Fed’s Long-Term Stance

Considering the current market scenario, Powell stated in the post-meeting press conference that inflation has eased somewhat but remains elevated. He insisted on not expecting a rate cut in 2023 by saying,

“Given our outlook, I don’t see us cutting rates this year if our outlook comes true.”

He went on further to state that they will determine the extent of future rate increases based on factors such as:

- the effects of previous hikes,

- the impact of lags in policy, and

- Developments in the economy and financial conditions.

Powell pointed out that “our focus is not on short-term moves but on sustained changes to broader financial conditions.” He continued, “And we judge that we’re not yet at a sufficiently restrictive policy stance, which is why we expect ongoing hikes.”

Powell iterated on the need for further rate hikes and pointed out that the Committee will closely monitor incoming information and be prepared to adjust monetary policy as needed to achieve its goals.

In conclusion, the outcome of today’s FOMC meeting and Chair Powell’s post-meeting conference have provided valuable insight into the central bank’s stance on inflation and its plan for future rate hikes. FOMC’s statement indicated that inflation has eased somewhat but remains elevated and that the Committee sees the need for ongoing rate increases.