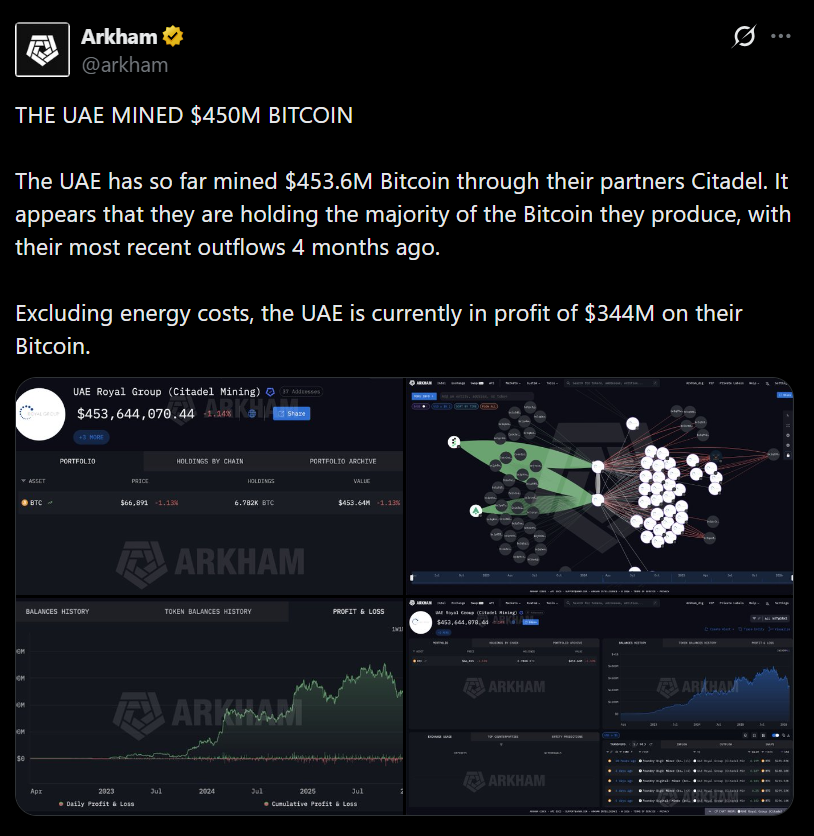

- Arkham data claims the UAE mined roughly $453.6M in Bitcoin through Citadel

- Most of the BTC appears to be held, with limited outflows in recent months

- Governments are increasingly building BTC exposure through mining, not just seizures

The UAE’s Bitcoin mining sector is getting fresh global attention after Arkham published a major update claiming the country has mined around $453.6 million worth of Bitcoin through its partner, Citadel. According to the dataset, most of that mined BTC is still being held, with the last major outflow reportedly occurring about four months ago.

Excluding energy costs, the UAE is estimated to be sitting on roughly $344 million in unrealized profits. That detail matters because it frames this as more than a mining operation. It starts looking like a strategic reserve play built through infrastructure, not just market buying.

The UAE’s Mining Buildout Has Been Quiet but Aggressive

The UAE began expanding its mining footprint in 2022, with reports pointing to large facilities established by Citadel Mining, an entity described as being affiliated with the Abu Dhabi royal family. The facilities were built on Al Reem Island, marking one of the clearest examples of sovereign-level industrial mining outside of the usual suspects.

In 2023, the sector expanded again through a joint venture between Marathon Digital and Zero Two. The partnership deployed 250 megawatts of immersion-cooled mining capacity, which at the time was one of the largest disclosed mining deployments in the region. The signal was clear: the UAE wasn’t experimenting, it was scaling.

Updated Estimates Lower the UAE’s Prior Mining Figures

Arkham’s new dataset also revised its previous estimate from August 2025. Earlier estimates suggested the UAE had mined close to $700 million worth of Bitcoin, though BTC was trading at a higher price during that period. Arkham also referenced figures of around 9,300 BTC mined and roughly 6,300 BTC held.

The latest update suggests the UAE Royal Group now holds about 6,782 BTC. That sounds huge in dollar terms, but in Bitcoin supply terms it’s still small, roughly 0.03% of circulating BTC. The important takeaway is behavior: the state appears to be holding, not selling.

Sovereign Bitcoin Strategies Are Splitting Into Two Models

The UAE’s approach fits one of the two emerging sovereign Bitcoin playbooks. The first is mining-backed accumulation, where a country converts energy into BTC reserves over time. Bhutan is the clearest example here, starting mining in 2019 through Druk Holding & Investments and eventually seeing reserves exceed $1 billion at peak market value. Arkham revealed Bhutan’s government-linked addresses in September 2024, confirming holdings above 13,000 BTC.

The second model is seizure-based accumulation, where governments build reserves through confiscation. The United States is the largest example, holding around 328,000 BTC valued near $22 billion, about 1.64% of circulating supply. Those reserves came from high-profile cases like Silk Road, the Bitfinex hack, and other major seizures.

The Bigger Story Is Bitcoin Becoming a Strategic Asset

What the UAE mining update really shows is that Bitcoin is evolving into a strategic reserve phenomenon, not just a speculative trade. Countries are now building exposure through infrastructure, energy, and long-term holding behavior, rather than simply buying on the open market.

That shift matters because sovereign behavior tends to be slower, quieter, and more patient than retail cycles. If the UAE continues holding mined BTC with minimal outflows, it reinforces a growing trend: Bitcoin is being treated less like a trade and more like an asset class governments want optionality on.