- Bitcoin’s price could reach $100,000 by January’s inauguration, backed by ETF investments.

- Institutional interest and Bitcoin ETFs have brought $2.6 billion in new funds.

- Trump’s pro-crypto policies may create favorable conditions for regulatory support and market growth.

Following former President Donald Trump’s recent election victory, some analysts believe Bitcoin could reach the $100,000 milestone by January’s inauguration. Fadi Aboualfa, head of research at Copper.co, shared with Cointelegraph that Bitcoin, currently at $93,051, may see a boost from pro-crypto policies expected under the new administration.

Aboualfa noted that while a strong U.S. dollar has historically posed challenges for cryptocurrencies, the clarity of the election results has provided markets with a sense of near-term stability. Increased interest from institutional investors, specifically through Bitcoin exchange-traded funds (ETFs), has already funneled $2.6 billion into Bitcoin investments since early November, contributing to the projected price surge.

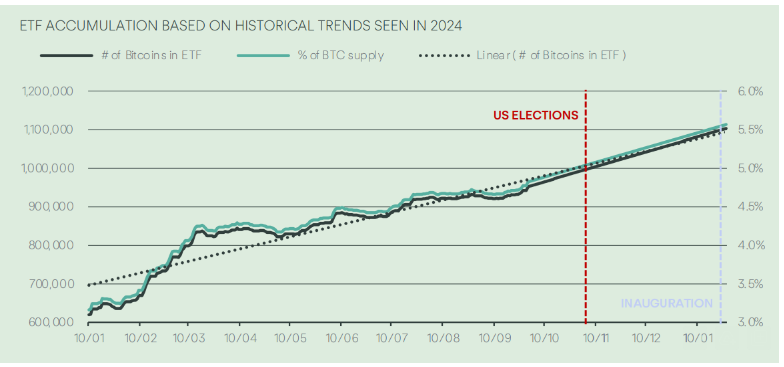

Source: Copper

Institutional Demand and ETF Growth

Copper.co’s research highlights that Bitcoin ETFs could significantly drive up Bitcoin’s value, with analysts suggesting that ETF holdings may grow to nearly 1 million BTC by early 2025. Aboualfa’s forecast, based on back-tested data of ETF accumulation, aligns with Trump’s stated intentions to manage U.S. dollar strength while maintaining its reserve currency status. Analysts expect this approach could help attract further institutional participation in the cryptocurrency market.

Pro-Crypto Policy Expectations Under Trump Administration

Aboualfa anticipates that Trump’s return to office will encourage pro-crypto advocates in various government sectors, which may create a favorable environment for launching, listing, and trading digital assets. However, he suggested that certain regulatory aspects would remain unchanged, particularly for cryptocurrencies classified as securities.

Popular crypto trader Van de Poppe also commented on Bitcoin’s future, predicting a longer market cycle extending into 2026. He cautioned that rising debt levels could eventually lead to a financial crisis similar to 2008, which could have implications for both traditional and digital asset markets.