- The Supreme Court may rule Wednesday, January 14, on the legality of Trump’s tariffs.

- The case centers on executive authority and potential tariff refunds.

- The decision could materially impact costs, inflation, and market sentiment.

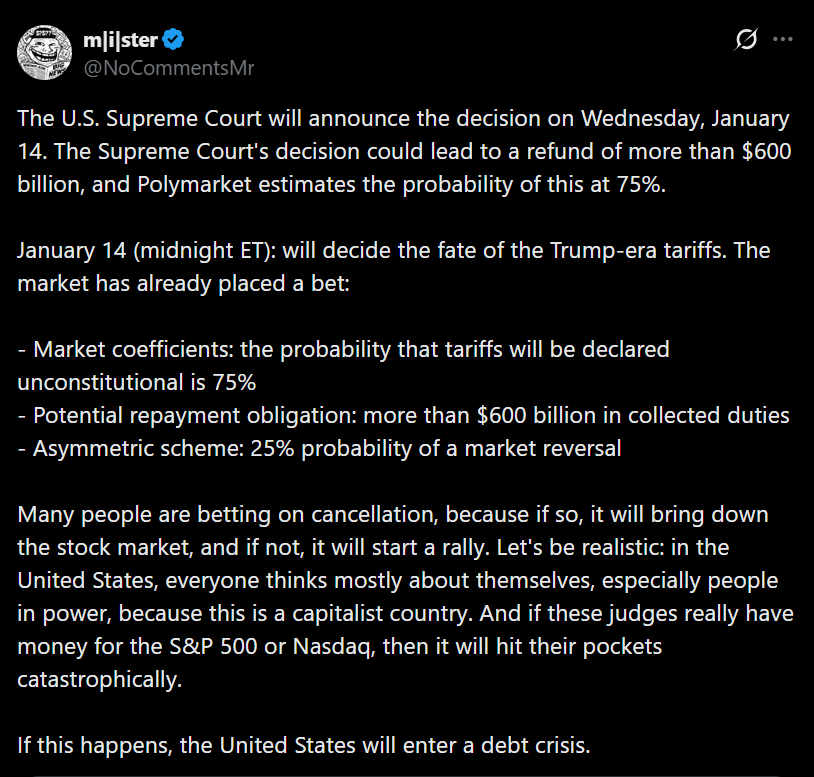

The fate of President Donald Trump’s sweeping tariff regime may be decided Wednesday, January 14, as the U.S. Supreme Court prepares to issue rulings on several high-profile cases. Among them sits the challenge to tariffs imposed on nearly all major U.S. trading partners last year, a policy Trump has repeatedly called his favorite economic weapon. If the court rules, the outcome won’t just clarify trade law. It could quietly reshape costs across the global economy.

Tariffs as Policy, Pressure, and Punishment

Since beginning his second term, Trump has leaned heavily on tariffs as a negotiating tool. They’ve been used to extract concessions, signal dominance, and punish countries that defy U.S. preferences. Last August’s additional 25 percent tariff on Indian imports over Russian oil purchases is a clear example. This wasn’t trade theory. It was leverage, applied bluntly and publicly.

What the Supreme Court Is Deciding

The legal challenge hinges on two core questions. First, whether the administration had the authority to impose such broad tariffs under the International Emergency Economic Powers Act. Second, if that authority is found lacking, whether the U.S. government must reimburse importers who already paid billions under the tariff regime. That second point is where markets start paying closer attention, because refunds would act like an unexpected release of capital back into the system.

Why This Isn’t Just a Legal Story

Tariffs have functioned as a hidden tax on supply chains, margins, and consumers. Businesses adapted, but adaptation isn’t the same as relief. A ruling against the tariffs would instantly change expectations around pricing, inventory costs, and inflation pressure. A ruling in favor keeps the status quo intact, reinforcing the idea that trade friction is now a permanent feature of policy.

Conclusion

Wednesday’s decision isn’t about whether tariffs are good or bad politics. It’s about whether a massive layer of cost remains embedded in the economy or gets peeled back. Either outcome sends a clear signal, and markets are unlikely to ignore it. This is one of those moments where legal clarity translates directly into financial consequences.