- TRON’s daily transactions fell 60%+, yet TRX price barely moved

- Whales are buying heavily while retail remains mostly passive

- Despite rising social buzz, funding rates remain negative, showing market caution

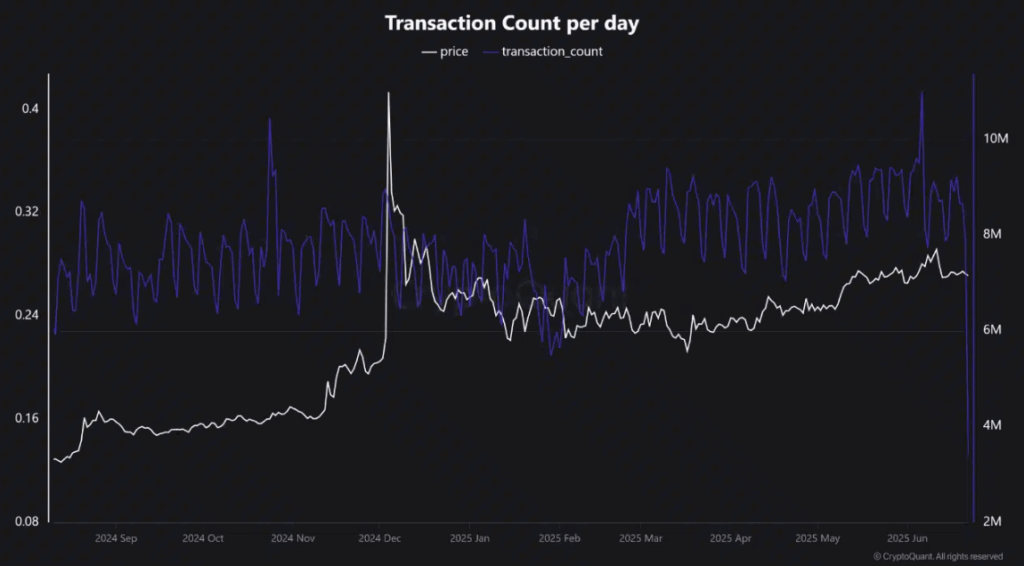

So, something’s… off. TRON’s network just took a nosedive in June 2025, with daily transactions free-falling from 9 million to just 3.5 million. That’s like losing two-thirds of the action—gone in a blink. You’d expect TRX to crash, right? But nope. It’s still hovering around $0.2676, down only 1.9% on the day. Weird.

This isn’t just some farm-bot traffic drying up either. It feels structural. Like something under the hood changed—maybe new bandwidth limits, or projects quietly jumping ship to chains like Base or BSC. Whatever it is, the silence from TRON’s end doesn’t feel random. It feels… planned.

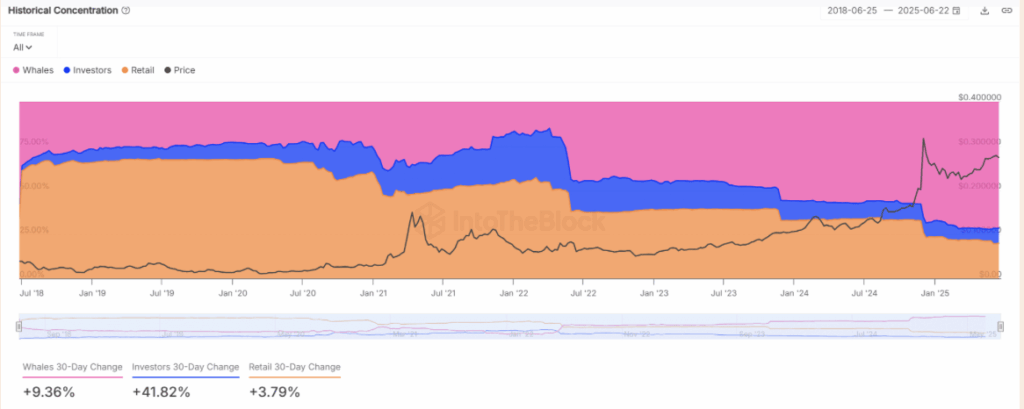

Whales Are Scooping Up TRX—Retail’s Just Watching

Despite all this chaos (or maybe because of it?), whales are making moves. Big ones. In the past month, TRX whale wallets grew by 9.36%, and investor-tier holders jumped over 41%. Meanwhile, retail? Up just 3.79%.

That’s a major gap. Could mean big players see something coming—something the average holder’s missing. Historically, when smart money consolidates during quiet periods like this, it usually sets the stage for a big directional shift. Up or down? TBD. But if retail waits too long, they might end up chasing the move after it’s already halfway done.

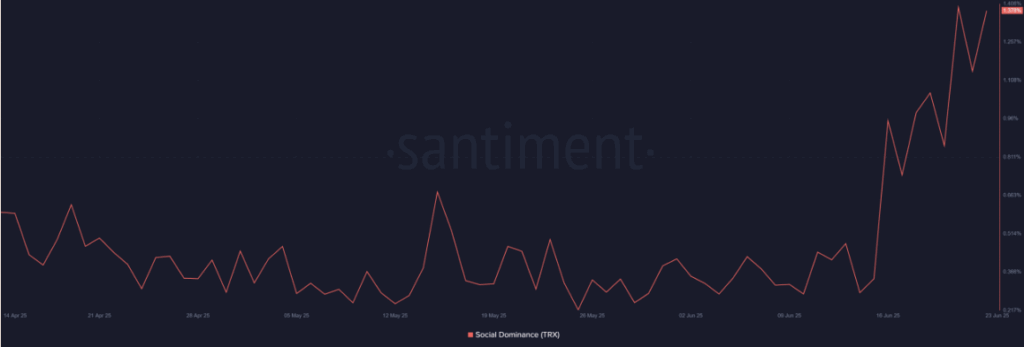

Social Buzz Is Rising—But Is It Just Noise?

On the flip side, TRON’s getting louder online. TRX’s Social Dominance shot up from 0.3% to 1.37% in just a few days. So yeah, people are talking. A lot. Some are wondering if this divergence—where price holds, usage drops, but sentiment spikes—means something’s brewing.

Social chatter isn’t everything, obviously. But when it aligns with quiet whale accumulation, it can stir up short-term rallies. Doesn’t mean a full recovery is locked in, but it sure adds fuel if any real momentum kicks in.

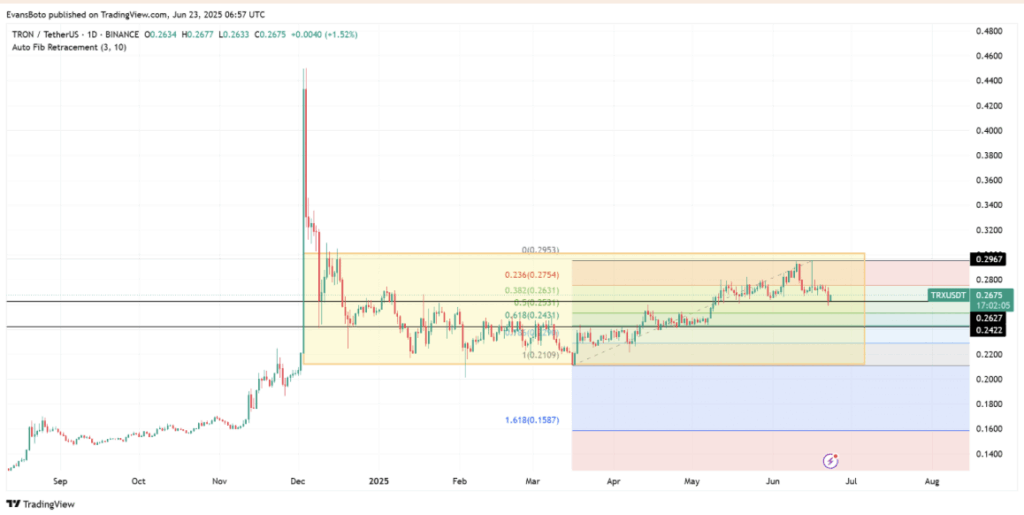

Bears Still Lurking—Funding Rates Show Caution

TRX might look calm on spot markets, but derivatives are telling a more anxious story. Binance’s funding rate dropped to -0.022%—traders are literally paying to stay short. And this isn’t new, it’s been like this for most of June.

Negative funding like this usually means folks are bracing for a dip. Doesn’t guarantee it’ll happen, but it puts a damper on any sudden breakout unless something flips sentiment fast. So even with price holding its ground, there’s hesitation under the surface.

TRX Still Stuck Between the Lines

Price-wise, TRX hasn’t moved much. It’s been trapped in a tight band between $0.2422 and $0.2967, barely nudging past key resistance at $0.2754. Right now, it’s dancing around the 0.382 Fib level—$0.2631—still indecisive.

Unless bulls bring serious volume, this sideways grind could continue. If it breaks below $0.2422? Trouble. If it finally clears $0.2967? Different story. Until then, it’s just drifting.

So… What Happens Next?

TRON’s caught in a weird moment. The chain’s actual usage is tanking, but TRX’s price is kinda just chillin’. That disconnect won’t last forever. One of two things will happen: usage bounces back and justifies the valuation—or the market finally adjusts and the price drops to match the fundamentals.

Either way, the window for easy accumulation (or exit) might be closing soon.