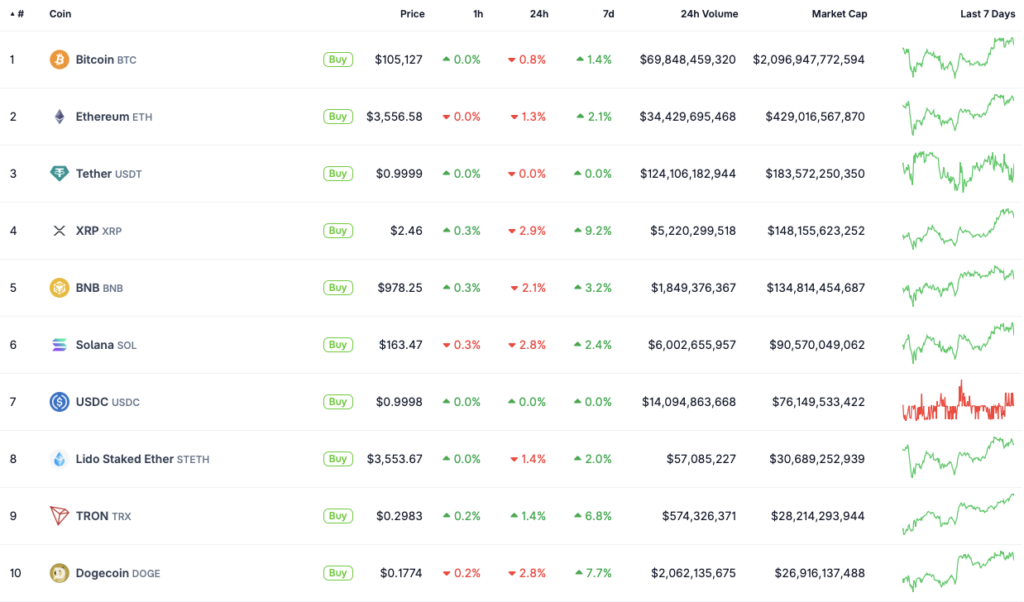

- TRON (TRX) is the only top-10 crypto in the green today, up 1.4% on the day and 81% since November 2024, even as the broader market consolidates.

- Strong network activity, increased burns, and around $37.4 million in ecosystem revenue, plus growing stablecoin usage, are likely supporting TRX’s outperformance.

- While the rally is promising, TRX may still face pressure if the wider market turns risk-off again, especially with fragile global conditions and Fed warnings on growth and inflation.

TRON (TRX) is quietly doing what the rest of the top 10 can’t manage today: trading in the green. While the broader crypto market is mostly stuck in consolidation, TRX is logging gains across almost every major time frame. According to CoinGecko data, TRON is up about 1.4% in the last 24 hours, 6.8% on the weekly, 0.2% over 14 days, and a hefty 81% since November 2024. The only blemish on the chart is a 5.2% decline over the past month, which puts today’s resilience into better context.

This comes on a day when plenty of traders expected a stronger bounce across the board. The U.S. Senate passed a bill to reopen the government, ending a painful shutdown that had weighed on sentiment. But instead of a broad relief rally, Bitcoin (BTC) and most majors chose to chop sideways. TRON, however, is still climbing, and for now it’s the only top-10 asset showing a clean green profile on the daily chart.

Network Activity, Burns, and Revenue Support the Move

So what’s driving TRX while everything else just grinds? A big part of the story seems to be onchain activity and token economics rather than headlines alone.

TRON’s latest price strength appears to be backed by increased network usage, which in turn has likely boosted token burns. More transactions and higher throughput generally translate to more fees, and on TRON that can mean more TRX being removed from circulation over time.

On top of that, the TRX ecosystem reportedly generated around $37.4 million in revenue for token holders, reinforcing the idea that this isn’t just an idle chain with speculative flows, but an active network with recurring onchain demand. The continued surge in stablecoin adoption on TRON has also been a major tailwind. As more users move USDT and other stable assets through the network, onchain volume rises, and the burn mechanics get more room to work.

The combination of steady usage, revenue, and supply pressures gives TRX a bit more fundamental backing than a typical short-lived pump, which helps explain why it’s outperforming while other large caps tread water.

Can TRON’s Rally Really Last?

The key question now is whether this outperformance can actually stick. In the short term, TRON can absolutely continue to decouple if network metrics stay strong and traders keep rewarding that activity. But there are limits.

Crypto still tends to move as an asset class, especially during big macro or liquidity shocks. If Bitcoin remains range-bound or rolls over, and majors like ETH fail to build a trend, TRX may eventually “rejoin the pack” and feel the weight of broader market sentiment. Outliers don’t stay outliers forever, especially in risk-off conditions.

Macro doesn’t help much either. The global economy remains fragile, and Federal Reserve Chair Jerome Powell has already warned about slow growth and sticky inflation in his October remarks. That mix usually makes investors more cautious on risk assets, including crypto, no matter how strong an individual network looks on paper.

In other words, TRON’s current rally is backed by decent fundamentals and onchain data, but it’s still swimming in the same ocean as everyone else. If the tide goes out again, even the strongest swimmer can get dragged back a bit.