- TON funding rates flipped positive, hinting at early bullish positioning despite low participation.

- Technical support near $1.59 reinforces a slow, steady recovery trend after weeks of pressure.

- Telegram’s tokenized stock trading went live, expanding TON’s ecosystem utility.

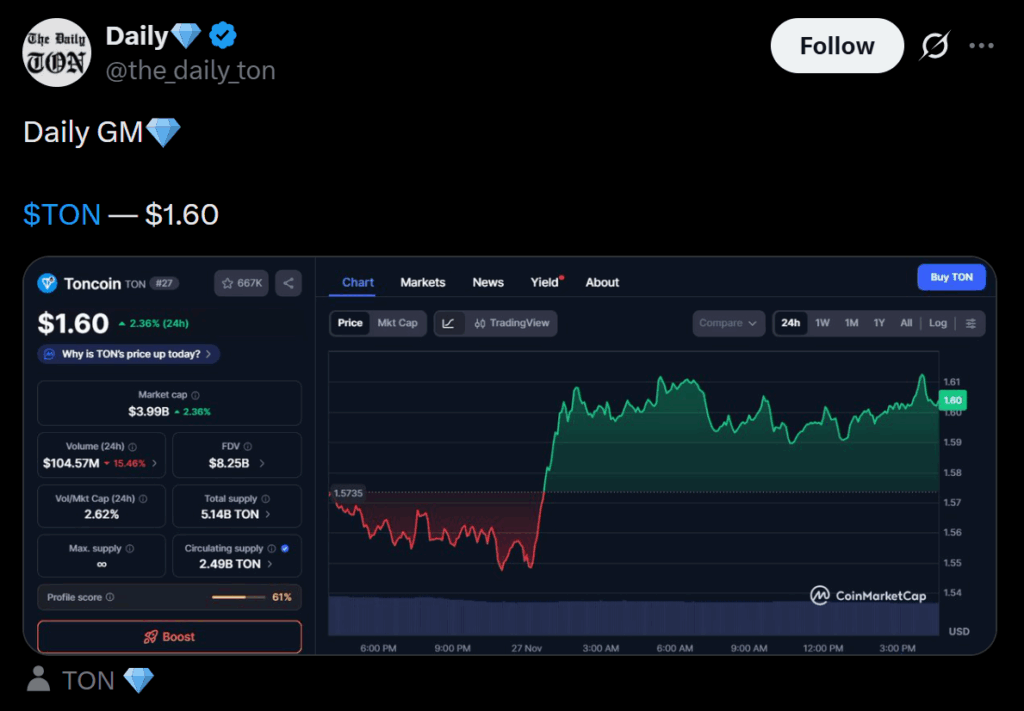

TON is holding near the $1.60 mark after a stretch of pressure, with traders now reacting to fresh derivatives signals that suggest the wider crypto market is slowly stabilizing. A new report from Bybit and Block Scholes points to a “slow-but-steady” recovery led by Bitcoin and Ethereum, both of which reclaimed key levels above $91,000 and $3,000. Meanwhile, the broader CD20 index climbed 6.8% over the last week, though TON lagged behind with a quieter 1.2% move.

Funding Rates Flip as Traders Show Cautious Optimism

What really stood out in the report was the shift in altcoin funding rates. After a weekend of heavy shorting, perpetual swap markets flipped positive across several large-cap assets, including TON. Positive funding means longs are now paying shorts — a sign that traders are slowly rotating back into bullish positioning. Even so, the overall market hasn’t fully returned. Derivatives open interest and volume remain well below pre-crash levels, and volatility data shows traders aren’t pricing in extreme downside anymore, but they’re not rushing back in either.

TON Finds Support but Still Trails Major Assets

For TON specifically, the recent flip in funding rates suggests that some traders see a potential bottom forming after weeks of selling pressure. CoinDesk Research’s technical model highlights support near $1.59, with a slight upward drift that fits the broader “slow recovery” theme. Still, altcoins as a group underperformed BTC and ETH during the crash, and their rebound has been much weaker. With whales still holding large portions of TON’s supply and market participation remaining muted, the asset’s outlook depends heavily on broader risk appetite returning.

Telegram’s Stock Trading Integration Goes Live

Despite the slow pace of price action, TON received a notable ecosystem boost as Telegram officially launched tokenized stock trading inside TON wallets. Users can now trade U.S. equities like Apple and Tesla directly through the app, adding another layer of utility to the network. Whether this development translates into immediate price strength remains uncertain, but it does reinforce TON’s growing presence in real-world financial integrations.