.

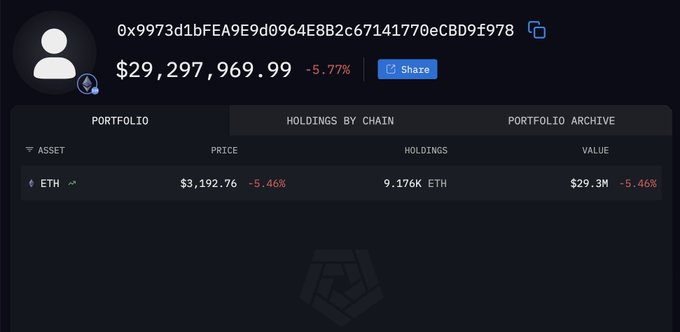

- Tom Lee’s Bitmine bought $29M worth of ETH, reinforcing bullish sentiment as the firm continues accumulating toward its goal of holding 5% of the total supply.

- Ethereum is battling to stay above the critical $3,450 support, with the upcoming Fusaka upgrade (Dec 2025) expected to be a major catalyst for scalability and renewed demand.

- Analysts say ETH could still reach $10,000 in the long term if Fusaka succeeds and institutional accumulation—like Bitmine’s—continues to accelerate.

Ethereum’s been wobbling through a rough stretch lately, testing key support levels while traders wait to see which direction the market wants to move. But right in the middle of all that uncertainty, Tom Lee’s Bitmine pulled the trigger on a massive $29 million ETH purchase, adding a spark of optimism right when sentiment was starting to thin out.

Bitmine loads up with $29M in ETH as consolidation drags on

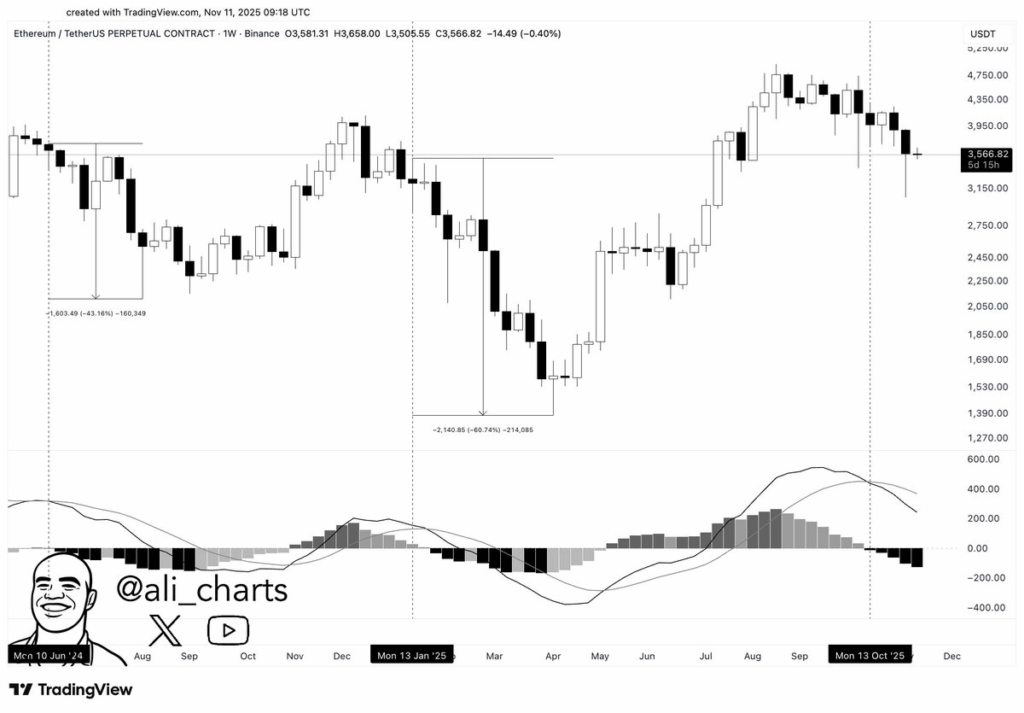

ETH has been struggling to stay above its critical $3,450 support zone, slipping into the $3,175 range at the time of writing. The market feels stuck — not quite bearish, but definitely not convincingly bullish either. That’s the nature of consolidation: sideways, choppy, and frustrating.

Bitmine’s big purchase cut through that noise. Tom Lee has never been quiet about his long-term bullish stance on Ethereum, and scooping up $29M worth of ETH while the market dips sends a loud signal. The move also aligns with Bitmine’s ongoing push to capture 5% of the entire ETH supply, something they’ve been aggressively pursuing since July.

The company has now built a massive treasury of over 3.5 million ETH, putting Bitmine in a league few institutions occupy. Their strategy seems clear: accumulate when the market stalls, hold through the volatility, and position early for the next cycle.

Ethereum clings to $3,450 support as Fusaka upgrade approaches

Right now, all eyes are on that $3,450 support level. It’s been tested repeatedly in recent weeks, and losing it could trigger a deeper correction — possibly dragging ETH into lower support zones before bulls return.

But hovering above the chart is the real wildcard: the Fusaka upgrade scheduled for December 3, 2025. Fusaka is expected to supercharge Ethereum’s scalability by increasing the block-gas limit and improving Layer 2 efficiency. Faster throughput, cheaper transactions, smoother dApp performance — all things that tend to bring in waves of new users and liquidity.

Analysts say if ETH can manage to hold support through the current turbulence, it could rebound toward the $3,715 resistance zone. A clean bounce there would set the stage for a more convincing rally into the upgrade window.

Is Ethereum really on the road to $10,000?

This is where predictions get bold. Some analysts — including well-known market strategist Ali Martinez, who highlighted this setup in a recent post — are calling for ETH to reach $10,000 by December 2025, tying the target directly to Fusaka’s success, rising institutional accumulation, and the possibility of a full-blown bull cycle.

Is it guaranteed? Not at all. But is it unrealistic? Honestly — no.

Ethereum is one of the few digital assets with massive developer activity, real institutional interest, and a clear roadmap of upgrades that actually matter. Bitmine’s accumulation is part of a bigger shift: whales and institutional players continue buying ETH quietly while retail stays hesitant. Historically, that combo has fueled Ethereum’s biggest breakouts.

If Fusaka delivers the performance boost people expect and macro conditions lean risk-on, the door to $10K ETH doesn’t look nearly as far away as it did a year ago.

The momentum building beneath the surface

Despite recent volatility, ETH’s long-term structure looks surprisingly healthy:

- Institutions like Bitmine continue scooping up large amounts of ETH.

- Upgrades like Fusaka promise major improvements to Ethereum’s scalability.

- Market consolidation is setting the stage for the next expansion phase.

Right now, Ethereum’s in waiting mode — stuck between support and resistance — but whales are already making their bet. And historically, they tend to be early… but very rarely wrong.