- Polymarket’s US Election 2024 market will be resolved based on calls from the Associated Press, Fox News, and NBC, or by who is officially inaugurated as President if they disagree.

- Concerns have been raised about potential manipulation of betting odds on Polymarket due to a limited number of accounts placing significant wagers.

- If the election result is contested and neither candidate is qualified by Inauguration Day, the Speaker of the House could potentially take office as President, leading to disgruntled Polymarket traders.

Polymarket, a decentralized prediction market platform, has clear outlines for resolving bets on the 2024 US Presidential Election in the event of contested results.

Resolution Based on Media Calls and Inauguration Events

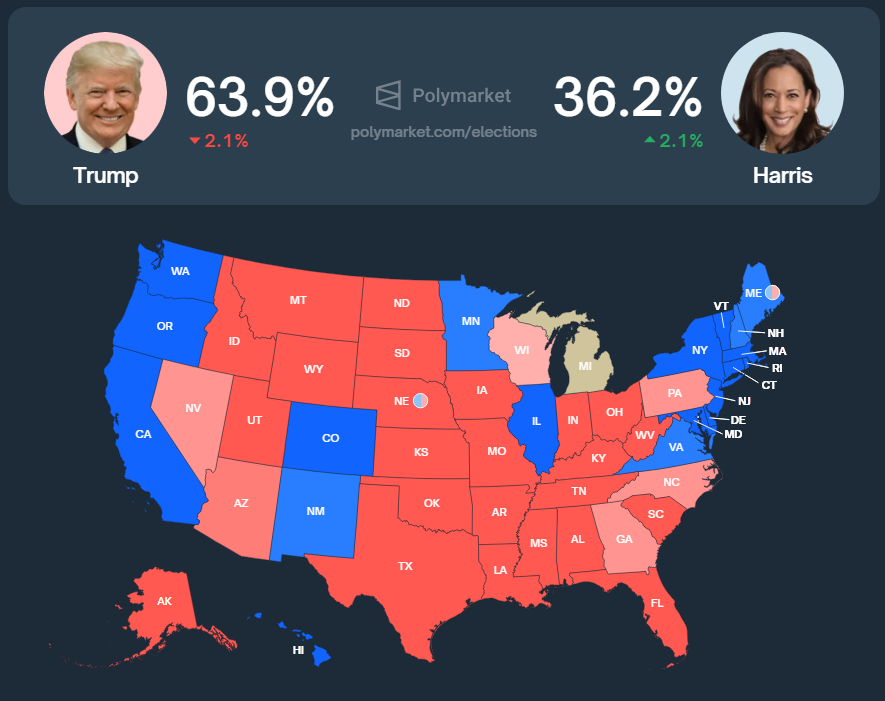

The platform’s market focusing on whether Donald Trump or Kamala Harris will win the presidency will be resolved based on calls from three major news organizations – the Associated Press, Fox News, and NBC.

If all three do not unanimously declare the same candidate as the winner by the inauguration on Jan 20, 2025, the market will settle according to who is officially inaugurated as President. This mechanism addresses potential scenarios where election outcomes are disputed or delayed. Traders’ positions will remain unsettled until a definitive result is established.

Market Vulnerabilities Amid High Trading Volumes

However, as Bitget reported, the governance token for Polymarket’s UMA oracle system has a market cap of just $244 million, potentially making markets vulnerable given the $23 billion in volume the election market has acquired.

Concerns Over Betting Manipulation

Further concerns have emerged regarding the possible manipulation of betting odds on the platform. A limited number of accounts have placed significant wagers favoring Trump, Newsweek highlighted this, raising questions about how substantial bets might influence public perception and the integrity of the market during a contested election.

However, Jim Bianco has also pointed to large bets in favor of Harris over recent days which momentarily moved the market by up to 4%. Additionally, CryptoSlate has reported on the persistent betting in favor of Trump from a handful of Polymarket whales over the past few weeks.

The analysis assessed that less than $6 million would be required to move the market by large percentages due to low order book liquidity.

Ultimately, Polymarket is a free and open market and claims of manipulation are confusing given that the rules upon which the market is built do not appear to be abused. Whether high conviction or coordinated betting, the odds of the next US President on Polymarket are simply based on the nature of trading on the platform. It is a far stretch to claim manipulation in an open market where no technical mechanisms are exploited to alter the odds.

Delays Possible With Contested Results

As the election approaches, Polymarket’s reliance on media outlets for market resolution does prompt discussions about objectivity and potential biases. Media organizations may differ in their projections, especially in tight races, leading to prolonged uncertainty for traders. As The New York Times noted, this could impact the platform’s ability to provide timely resolutions.

Ultimately, the final step in the resolution relies on who is inaugurated. If listed media outlets do not agree by inauguration day, the market winner is determined by who ultimately takes up the White House.

Should the dispute over the election continue through the courts, stopping a President from being inaugurated by Jan 20, the Polymarket result could be delayed further.

Interestingly, the 20th Amendment to the US Constitution provides a framework for what happens if there is no president-elect by Inauguration Day. If the president-elect fails to qualify, the vice president-elect acts as President until a new president is qualified. If neither is qualified, Congress has the authority to determine the next steps, with the Speaker of the House being next in line according to the presidential line of succession.

If a contested election leads to Speaker of the House Mike Johnson taking office, there could be many disgruntled Polymarket traders.

While this is merely a hypothetical scenario, given the history of the 2020 election, the chances of a contested result in 2024 have increased. Although it is unlikely neither candidate will be elected on inauguration day, the market for whether the election will be certified on Jan 6 has fallen from 94 to 84 since August.