- X shut down paid posting schemes, cutting off core InfoFi products overnight.

- Incentivized engagement distorted social data and polluted sentiment signals.

- Token sell-offs suggest markets are repricing credibility, not just features.

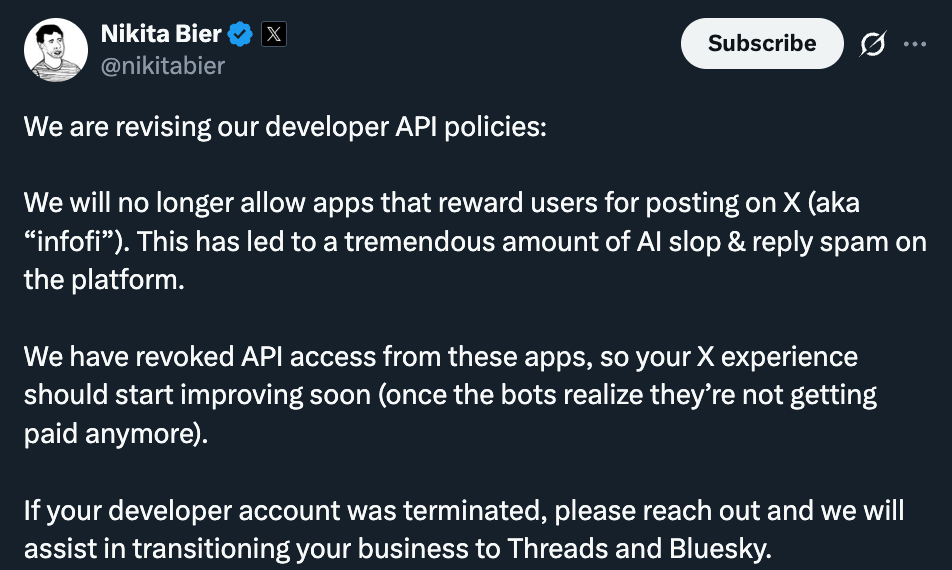

When X abruptly shut down apps that pay users to post, the official explanation was straightforward. Less spam. Less AI sludge. A cleaner timeline. According to X’s Head of Product Nikita Bier, platforms rewarding posts with tokens or points were driving low-quality engagement, so API access was cut and the behavior stopped overnight. InfoFi apps lost their core functionality. Products went dark. Tokens sold off fast.

On the surface, it looks like a quality-of-life upgrade for users. Fewer forced opinions. Fewer recycled replies chasing impressions. But the deeper story isn’t about moderation — it’s about what that engagement was ever worth in the first place.

When “Information” Was Really Just Incentives

InfoFi projects like Kaito and Cookie DAO promised something powerful. Turn attention into data. Measure influence. Extract signal from social chatter. The flaw was structural. Once people were paid to post, behavior changed. Content stopped reflecting genuine belief and started reflecting whatever earned the highest reward.

Reply counts surged. Opinions clustered. Hot takes gravitated toward whatever topic triggered payouts. To an outside observer, engagement looked explosive. To anyone relying on that data for sentiment analysis or market timing, it was quietly corrupted. What looked like signal was often just noise dressed up with metrics.

Markets Repriced the Illusion Quickly

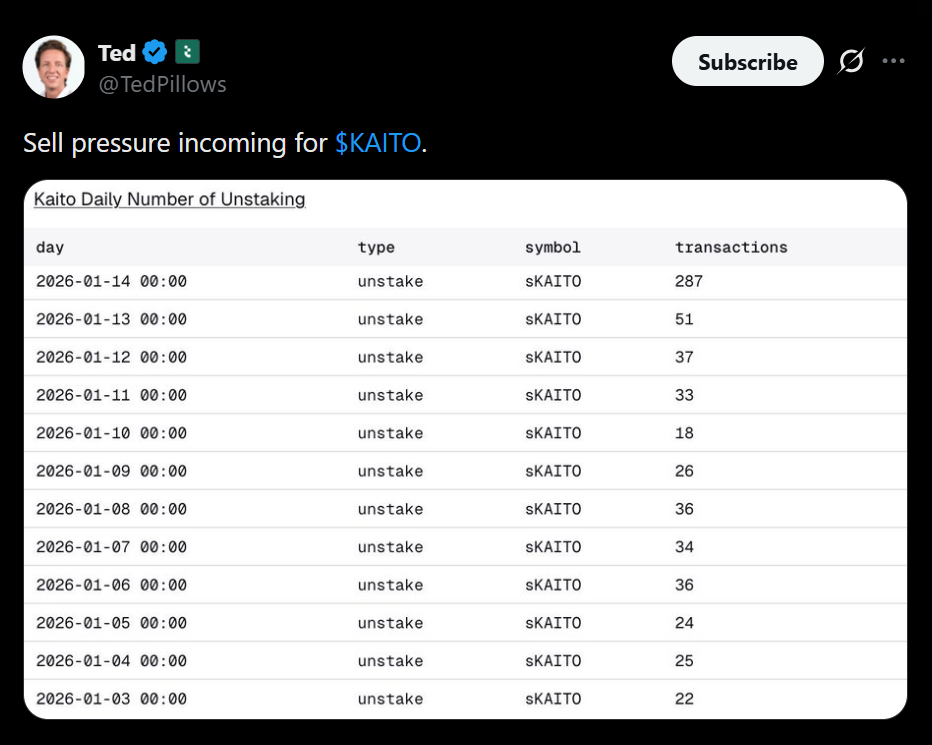

The speed of the sell-off says a lot. KAITO and COOKIE didn’t slide because of roadmap delays or short-term uncertainty. They dropped because the market reassessed the credibility of the underlying data. If engagement is synthetic, then the product built on it loses its foundation. Once trust in the signal disappears, the token tied to that signal loses its narrative just as fast.

This wasn’t fear. It was repricing.

A Turning Point for InfoFi

X’s move may mark the end of the reply-guy economy, but it also forces an uncomfortable industry-wide question. How much so-called crypto research was built on paid behavior masquerading as organic insight? Cleaning up the feed helps users. For InfoFi, it’s a moment of truth. Either rebuild around genuine signal, or admit the data was compromised from the start.

Incentives don’t just shape outcomes. They shape reality. And when they’re misaligned, even the cleanest dashboards can lie.