- QT has officially ended, and markets now price in 92% odds of a December rate cut.

- Internal divisions at the Fed could produce rare dissents as leadership politics gain influence.

- The combination of QT ending and easing expectations sets the stage for a volatile year-end shift.

The Federal Reserve has reached a critical crossroads. After two 25-basis-point cuts in September and October, the federal funds rate now sits at 3.75%–4.00%, marking a clear shift away from the tight policy stance that kept rates above 5% for most of the past two years. But whether the Fed follows through with a December cut remains contested inside the FOMC, even as markets treat it like a near-certainty.

QT Officially Ends as Reserves Near the “Ample” Threshold

On October 29, the Fed announced it would end quantitative tightening (QT) beginning December 1, freezing the size of its balance sheet at roughly $6.5–$6.6 trillion. Since QT began in 2022, the Fed has shed more than $2.2 trillion in securities — shrinking holdings from 33% of GDP to about 20%. Officials say they stopped QT because reserves were drifting close to the lower edge of the “ample-reserves” framework, with stresses flashing through repo markets and reverse-repo usage. Ending QT removes a major liquidity drain and is widely seen as supportive for risk assets.

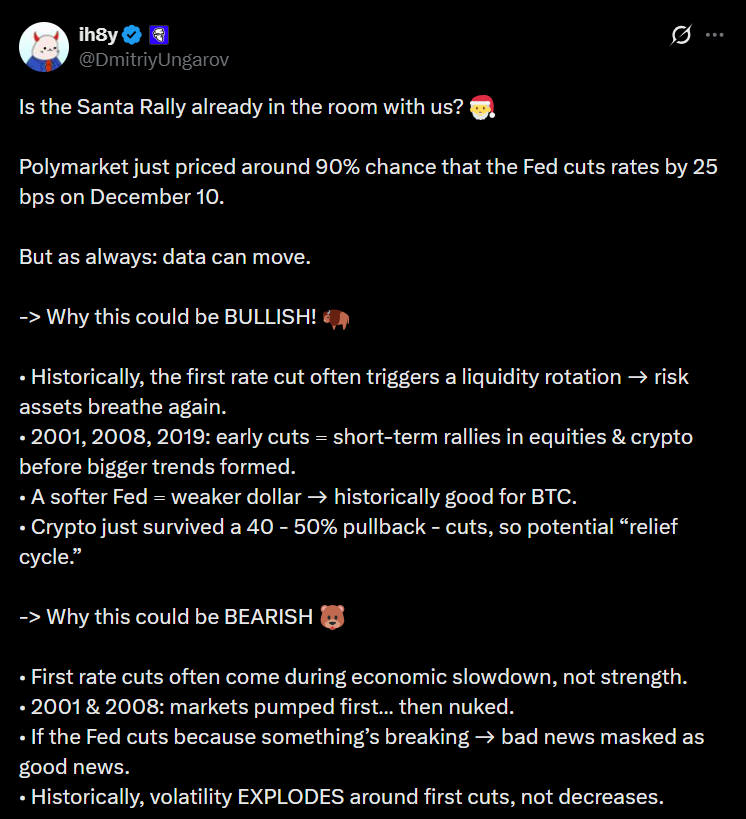

Markets Now See a December Cut as the Base Case

Across futures markets, the message is almost unanimous: traders now price in 92% odds of a 25-basis-point rate cut at the December 9–10 meeting. Bank research has shifted in the same direction. Bank of America expects not only a December cut but additional easing in June and July 2026 — a view tied partly to expected changes in Fed leadership. J.P. Morgan reversed its earlier “no move until January” call and now also expects a December cut. Only a handful of firms remain in the “no change” camp. Politics is also shaping expectations: Kevin Hassett is seen as the frontrunner to replace Powell in 2026, and analysts view him as more dovish, subtly influencing market pricing.

A Deeply Divided FOMC Heads Into a High-Stakes Vote

Despite overwhelming market expectations, the Fed itself is split. Up to five of the 12 voting members are skeptical of another cut, according to Reuters. Governor Christopher Waller has already warned that the upcoming meeting could produce three or more dissents — extremely rare in modern Fed history. With inflation progress stalling, job growth cooling, and crucial data delayed by the government shutdown, policymakers are flying with incomplete information. Meanwhile, Treasury Secretary Scott Bessent criticized the Fed’s operating framework, calling it overly complex and warning that the balance sheet risks distorting the yield curve. With political pressure mounting and a leadership transition ahead, December’s vote is as much about institutional credibility as it is about 25 basis points.

The Regulatory Front: Bowman Pushes Basel III Changes

Vice Chair for Supervision Michelle Bowman appears before Congress today, outlining her priorities for banking regulation. She is expected to stress financial stability and efficiency, while signaling the Fed may revise parts of its Basel III “endgame” capital proposal. That could include lighter capital surcharges for regional banks, new risk-weighting adjustments, and more flexibility in market-making — changes that are drawing increased attention now that QT has ended.

What the End of QT Means for Markets and Households

Ending QT provides liquidity relief but doesn’t guarantee cheaper borrowing. Treasury yields have already climbed again, with the 10-year above 4.0% and the 30-year pushing back toward the upper end of its recent range. Mortgage rates are rising, too, with 30-year fixed loans creeping back into the mid-6% area. For savers, a December cut — now priced at 92% odds — would likely drag high-yield savings and CD rates lower. Meanwhile, gold and silver are pushing toward multi-week highs, and crypto traders are cautiously eyeing the end of QT as a potential tailwind despite thin liquidity and choppy price action.

What to Watch Next

With the Fed now in blackout mode, attention shifts to the final data arriving before the vote:

• Delayed inflation and labor reports (including PCE and job openings).

• Bowman’s testimony on regulatory recalibration.

• The December 9–10 FOMC meeting and the fresh dot plot.

• Any movement in Kevin Hassett’s probability of becoming the next Fed chair.