- Bitcoin moved in sync with equities and software stocks during the recent risk-off wave

- The “BTC as a safe haven” narrative weakens when correlation rises in stress

- This selloff looks like broader market repricing, not a crypto-specific failure

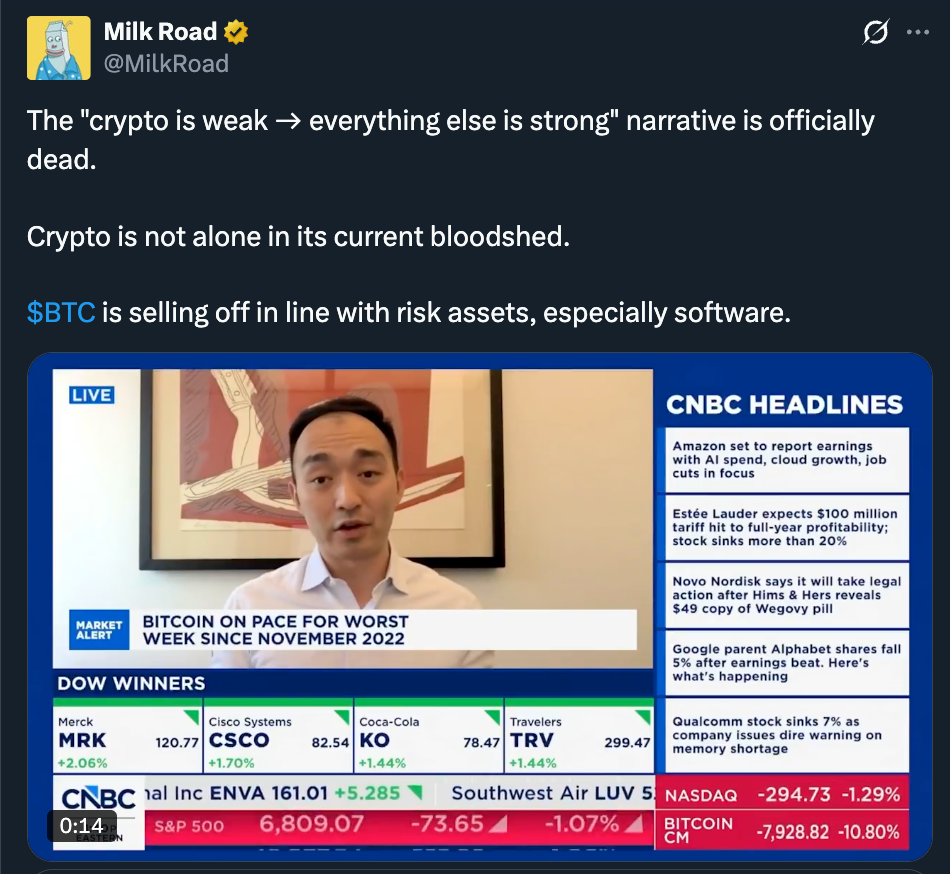

After every sharp crypto pullback, the same explanation tends to show up. Crypto is broken. Crypto is collapsing. Crypto is uniquely weak. But last week’s price action doesn’t support that story. Bitcoin’s decline wasn’t an isolated implosion. BTC moved in step with broader risk assets, including tech and software stocks, and that matters because it changes how the move should be interpreted.

One analysis tied Bitcoin’s slide to its rising correlation with a struggling software sector, with BTC tracking the same risk tone seen in the S&P 500 and tech-heavy indices. In other words, the market wasn’t punishing “crypto.” It was punishing risk.

Correlation Has Been Climbing for Years, and Stress Makes It Worse

This isn’t a one-week phenomenon. Exchange research and market data have shown Bitcoin’s correlation with the Nasdaq and S&P 500 has been trending higher over the past few years. The more institutional capital participates, the more Bitcoin gets treated like a high-beta asset rather than a separate, decoupled alternative.

That correlation doesn’t stay constant either. It tightens during stress, which is exactly when the “safe haven” narrative is supposed to matter most. If BTC trades like tech when markets are falling, it stops functioning as a hedge in the way many investors still describe it.

Risk Sell-Offs Don’t Pick Favorites Anymore

Equity markets cracked at the same time crypto did. Over the past few sessions, global software and services stocks lost close to $1 trillion in value amid concerns about AI disruption, and major chipmaker earnings misses dragged the Nasdaq lower. Bitcoin’s plunge lined up with those moves, not with a single crypto-specific headline that could explain the scale.

A separate report also pointed to broad risk-off rotation hitting equities and even precious metals, not just crypto leverage unwinds. When markets slide into a high-beta skid, the rule is simple. Assets don’t get judged on their narratives. They get judged on their volatility. Bitcoin is now in that bucket.

Bitcoin’s Role Is Shifting in Institutional Portfolios

The bigger picture is uncomfortable but straightforward. Institutional capital increasingly treats crypto as part of the beta complex, not as a hedge. That means BTC is now competing with tech exposure, growth exposure, and other risk allocations. When those buckets get cut, Bitcoin gets cut too.

This also explains why some of the old comparisons feel broken. Gold can rally while Bitcoin drops. Stocks can fall and Bitcoin can fall harder. The relationship isn’t “Bitcoin versus the system” right now. It’s Bitcoin inside the system, moving with it.

Context Matters More Than Panic

The “crypto is weak on its own” narrative is basically obsolete. Bitcoin’s drop makes more sense when viewed alongside the selloff in software stocks and broader equity stress. What looks like a crypto fault line often turns out to be a market-wide repricing that hits every volatile asset at the same time.

Ignore the noise and zoom out. This wasn’t a crypto-specific failure. It was a phase where everything risk-linked sold together, and Bitcoin was simply part of that trade.