- Teucrium CEO Sal Gilbertie called XRP a stronger utility asset than Bitcoin, following the launch of the first U.S.-based 2x Long Daily XRP ETF (XXRP), which already pulled in $40 million despite a sluggish market.

- Analysts are bullish: Standard Chartered projects XRP could reach $12.50, while Sistine Research predicts $33–$50 by 2027, citing similarities to XRP’s 2014–2017 breakout pattern.

- Despite price momentum, XRP Ledger activity has slowed in 2025, suggesting network traction must improvefor long-term price targets to play out—though bulls may push for short-term gains if key support at $2.10 holds.

XRP is back in the spotlight, and this time it’s not just the XRP Army hyping it up.

Sal Gilbertie, CEO of Teucrium (a $345M asset manager), just went on Bloomberg and threw some serious praise at Ripple’s token—saying flat-out that XRP might have more utility than Bitcoin.

“We believe XRP will have the most utility out there. Bitcoin is a store of value, but I think XRP has a true use case—and Ripple will make this work.”

That’s… kind of a big statement.

And he didn’t just talk. Days earlier, Teucrium launched the first-ever 2x Long Daily XRP ETF in the U.S., dubbed XXRP. So yeah, there’s capital behind the confidence.

XRP ETF Already Pulling In Big Numbers

According to Bloomberg ETF analyst Eric Balchunas, XXRP posted massive inflows despite the market being kinda meh right now. It’s already sitting on $40 million in net assets—not bad at all for a leveraged ETF that just launched.

So the question is—why now?

XRP: The Cross-Border King?

Gilbertie’s comments actually echo what Standard Chartered’s Geoff Kendricks said earlier this month. His prediction? XRP could surge 600% to $12.50 in the next three years.

Why? Because XRP is uniquely positioned to dominate cross-border payments. Simple as that.

And Ripple’s latest acquisition kind of confirms they’re pushing in that direction. They just picked up Hidden Road, a prime broker, with plans to use both XRP and Ripple’s stablecoin RLUSD to handle settlements in global trade and payments.

But get this—some folks think even $12.50 is playing it safe.

How High Could XRP Actually Go?

Sistine Research is throwing around much bigger numbers. Their model suggests XRP could hit $33–$50 by 2027. That’s a potential 1500% to 2500% rally—if, and it’s a big if, the setup plays out.

Their logic? XRP’s current price behavior looks eerily similar to the 2014–2017 breakout, right before it went parabolic. If that pattern finishes forming? Yeah… $30+ might be on the table.

But There’s a Catch—Network Activity Is Lagging

Even with all this optimism, XRP Ledger address activity has been sluggish in 2025. And without stronger network usage, that massive price explosion might take a little longer to kick off.

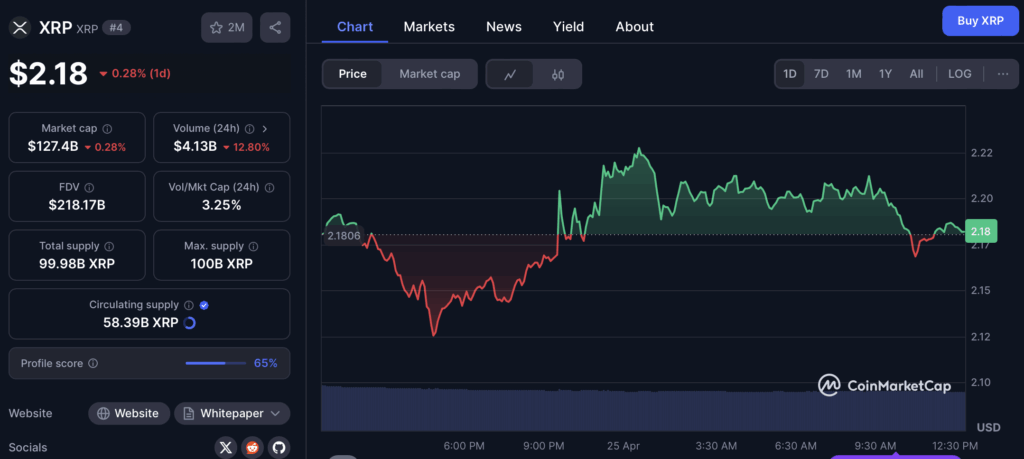

Still, on the daily chart, things aren’t looking bad. XRP hit a local high of $2.30 earlier in April, before sliding back to a bullish order block around $2.10. If bulls can hold that zone and the RSI stays above 50, we could see another short-term push higher.

If not? We might dip back below $2. Not ideal—but not the end of the world either.