- Terraform Labs launched the Terra blockchain and UST stablecoin in 2018-2020, but UST lost its dollar peg in May 2022 leading to a $40 billion collapse.

- The “death spiral” wipeout caused contagion across crypto markets and led to lawsuits and investigations alleging misconduct.

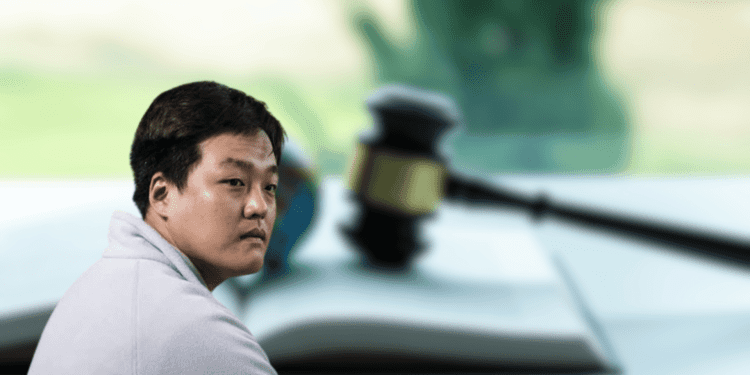

- Terraform Labs tried reviving the network, while founder Do Kwon became a fugitive as prosecutors seek his arrest over the stablecoin failure.

The dramatic collapse of Terra’s algorithmic stablecoin UST and its sister token LUNA in May 2022 sent shockwaves through the crypto industry. Within a few days, over $40 billion in market value was wiped out, leading to contagion across digital asset markets. The implosion also led to multiple legal issues and investigations into Terraform Labs, its co-founder Do Kwon, and related entities. This article provides a timeline of the key events leading up to and following the Terra crisis.

The Creation of Terra and UST

Terraform Labs was founded in 2018 by Do Kwon and Daniel Shin to create Terra, a blockchain payment network that powers algorithmic stablecoins. The project’s main stablecoin, TerraUSD (UST), launched in 2020 and was designed to maintain a 1:1 peg to the US dollar through a complex algorithmic system.

UST Gains Traction

In 2021, UST saw rapid growth in adoption and market cap as investors were drawn to its high yields. Major decentralized finance (DeFi) platforms began integrating UST, and it became the third-largest stablecoin. However, critics warned that UST’s stability mechanisms were untested and fragile.

Cracks Emerge in UST’s Peg

In early May 2022, UST lost its 1:1 dollar peg as sellers exceeded buyers. Terraform Labs’ Luna Foundation Guard attempted to defend the peg by selling Bitcoin reserves, but this only delayed the inevitable.

The Death Spiral

On May 7th, UST fell below $0.70 due to a bank run-like panic. This caused Luna’s price to crash as its minting was increased to restore the UST peg. With both tokens collapsing in value, $40 billion was wiped out in a “death spiral.” UST soon became almost worthless.

The Aftermath

Terraform Labs paused the Terra blockchain on May 12th to stem the crisis. Waves of lawsuits and government investigations into Terraform Labs, TFL subsidiaries, and Kwon soon followed. Prosecutors allege that the collapse amounted to fraud and misconduct.

Attempts to Revive Terra

Kwon launched Terra 2.0 in May 2022 to revive the Terra ecosystem without UST. In December 2022, TFL launched a proposal to fork the original Terra chain, reviving UST in a decentralized manner. Both new chains have seen limited success so far.

Kwon Evades Arrest

Arrest warrants were issued for Kwon in South Korea and the US related to the stablecoin collapse. Kwon became a fugitive as prosecutors sought his extradition from Singapore and other jurisdictions. Despite multiple close calls, he has so far evaded arrest through legal appeals.

Conclusion

The Terra/UST implosion will go down as one of the most spectacular failures in crypto history. The full fallout is still unfolding through legal proceedings and the attempted network relaunches. However, the event highlighted the inherent risks of algorithmic stablecoins and fragility of the loosely regulated crypto ecosystem.