- SUI surged over 10% in 24 hours as volume and momentum returned across the market

- A fresh TD Sequential buy signal echoes setups that preceded major rallies in the past

- Strong on-chain metrics and smooth token unlocks are supporting confidence, though risks remain

The latest bounce across crypto markets didn’t leave Sui Network behind. SUI jumped more than 10% in just 24 hours, with trading volume rising right alongside price. It was one of those moves that felt coordinated, not random, and traders definitely noticed.

Sui is often labeled a “Solana killer,” a bold tag, but not entirely baseless if the network can keep scaling at pace. On-chain activity and recent price behavior have started to resemble early Solana phases, though SUI is still far from matching SOL’s historic highs. Even so, the structure forming on the charts has sparked talk that Sui might be setting up for something familiar.

A Technical Signal That’s Hard to Ignore

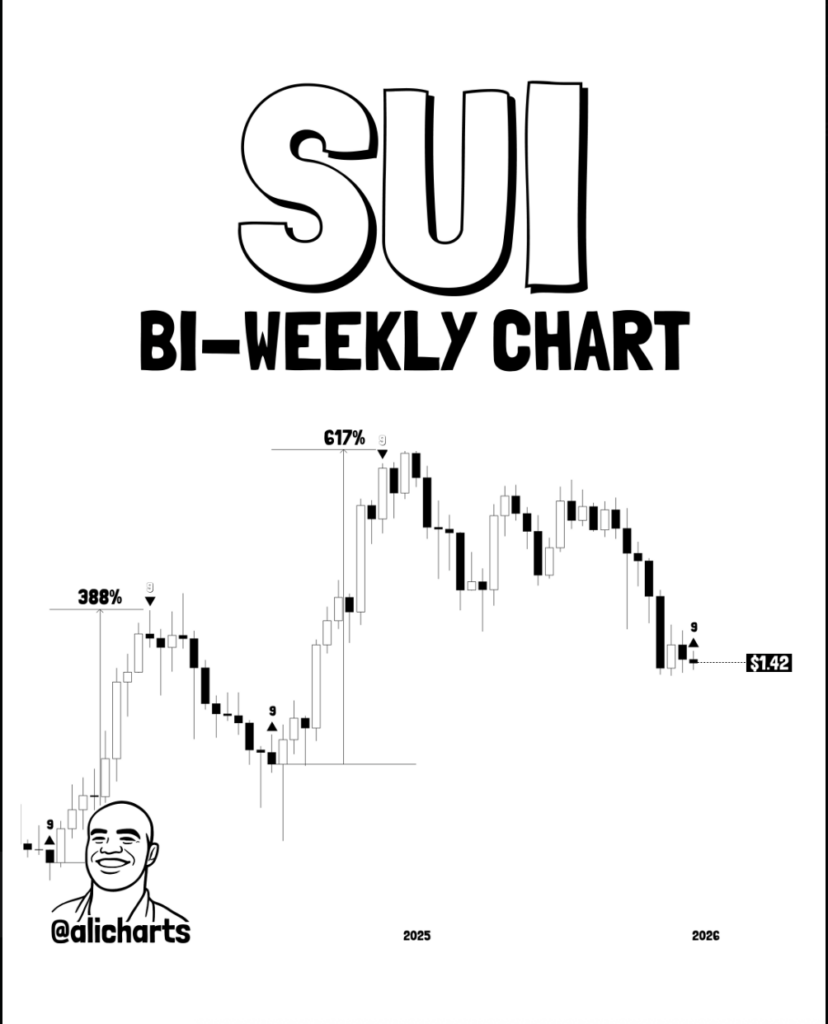

SUI grabbed extra attention after its bi-weekly chart flashed a fresh TD Sequential buy signal. Historically, that pattern has preceded some very aggressive rallies for the token. In early 2024, a similar signal was followed by a 388% move from local lows. Another instance led to a 617% surge that pushed price to new peaks.

The latest signal appeared near the $1.42 level, after a long slide from 2025 highs into early 2026 lows. That downtrend looked less like panic selling and more like a sector-wide correction. After the signal triggered, SUI responded quickly, climbing to around $1.70 by January 4, a gain of over 20% in a short window.

Ali Charts suggested that, in theory, SUI could repeat its historical pattern and push toward the $7 area. That said, not everyone is convinced the past will repeat so cleanly. Market conditions have shifted, liquidity is different, and macro factors matter more now than they did in earlier runs. The setup looks promising, but it’s not a guarantee.

Short-Term Price Action Heats Up

Zooming into the 4-hour chart, SUI rebounded sharply from support around $1.32 and began pressing toward the $1.73 resistance zone. This move followed an extended period of consolidation, often a sign that buyers were quietly building positions before making a push.

Momentum indicators show strength, maybe a bit too much. The RSI climbed close to 78, which puts SUI firmly in overbought territory. That doesn’t kill a rally, but it does raise the odds of a pause or short-term pullback.

Volume is backing the move, though. On-balance volume rose toward $900 million, suggesting real participation rather than thin liquidity spikes. If SUI can hold above $1.60, a clean break past $1.73 becomes more likely. Failure there could send price back toward $1.50, or in a deeper reset, back to the $1.32 range.

On-Chain Growth Keeps the Story Alive

Away from the charts, Sui’s on-chain data continues to look solid. The network recently absorbed a $60 million token unlock without any noticeable disruption, a sign that supply pressure was handled smoothly. That alone boosted confidence among holders.

The Mysticeti v2 upgrade also made a difference, significantly reducing latency while keeping transactions per second near 866. Total value locked sits above $1 billion, helped by a 30% jump in DEX trading volume and growing BTCfi integrations. Daily transactions have climbed past 13 million, showing steady usage.

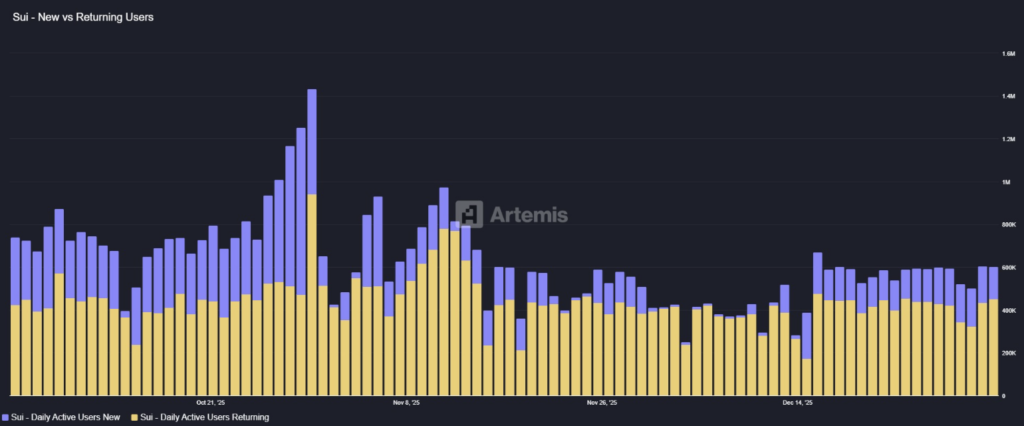

New active users reached around 1.3 million, roughly half the number of returning users. That mix suggests both retention and fresh interest, a healthy combo for a growing network.

What Comes Next for SUI?

Speculation around potential spot SUI ETFs from firms like Bitwise and Canary adds another layer of intrigue. Approval isn’t guaranteed, but even the possibility has helped support sentiment. The fact that SUI remained relatively stable after the token unlock suggests holders aren’t rushing for exits.

Sui is increasingly viewed as a scalable execution layer, but its long-term success will still depend on adoption and regulatory clarity. Broader market pullbacks or macro delays could easily slow momentum. For now though, SUI looks like a network traders are watching closely, with history whispering one thing and reality reminding everyone to stay cautious.