- SUI jumped by double digits and reclaimed ~$1.53 as analysts turned bullish.

- Touching a long-held support trendline could set up another 450–750% style move.

- Oversold RSI readings and strong exchange outflows point toward a potential rally into the $1.90–$2.20 range.

The crypto market finally showed some spark over the past 24 hours, and SUI ended up one of the strongest movers in the entire group. The token jumped by double digits and is now trading around $1.53 — a level it hasn’t held confidently in a while. Some analysts think this might be the opening move of something bigger rather than just a brief relief bounce.

Analysts point to a major trendline that triggered past explosive rallies

One of the first to comment was market watcher Ali Martinez, who noted that SUI has just touched a key support trendline that’s held firm since 2023. The last two times SUI hit this exact trendline, it erupted with massive rallies of roughly 450% and 750%. If the pattern repeats — and crypto loves repeating patterns at the strangest moments — SUI could rocket past $4 in the not-too-distant future.

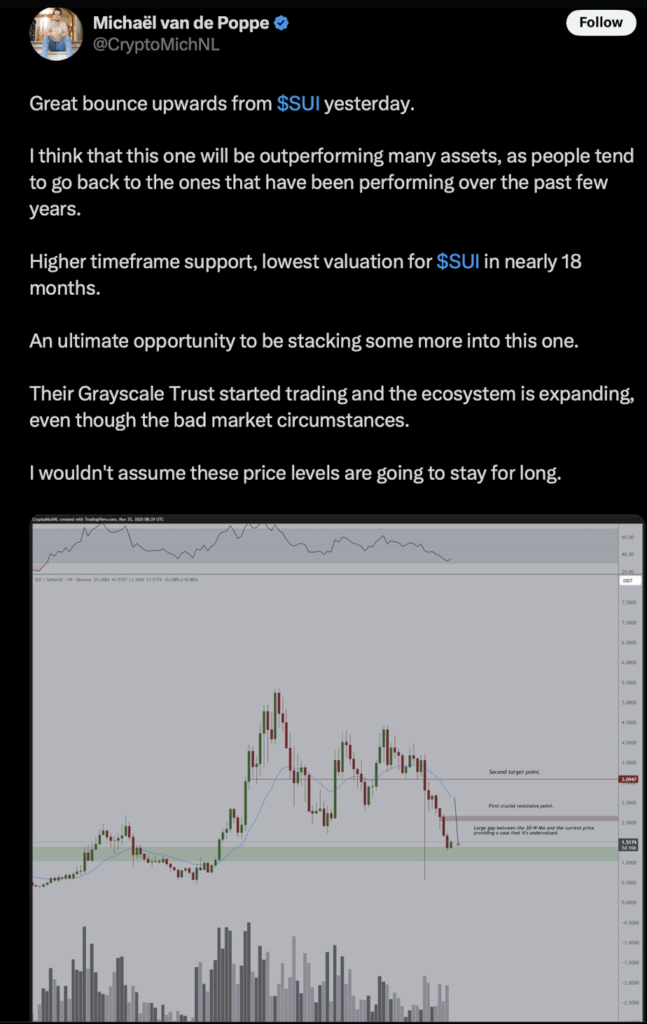

Another analyst, Michael van de Poppe, echoed the bullish outlook. He suggested that SUI could outperform most other altcoins soon because traders often rotate back into the assets that performed well in previous cycles. He also pointed to the recent launch of Grayscale’s Sui Trust, calling this moment “an ultimate opportunity” for investors who want deeper exposure.

Exchange netflows show investors quietly moving coins off platforms

Supporting the bullish argument is SUI’s recent exchange netflow data. Over the past several weeks, outflows have heavily outweighed inflows — meaning holders are sending coins off centralized exchanges into self-custody. This usually signals reduced short-term selling pressure and increased conviction among holders, since assets sitting in cold wallets are far less likely to be dumped immediately.

Oversold signals stack up as traders eye the $2 region

Adding more fuel, analyst CryptoBullet highlighted that SUI just tapped its most oversold level on both the 3-day and 1-day charts since 2023. According to him, that kind of extreme reading often sets the stage for a move toward the $1.90–$2.20 zone. CryptoWaves backed this up, noting that SUI’s daily RSI is hovering right around 30 — the classic oversold boundary. When RSI dips below 30, it often signals exhaustion on the sell side and hints a reversal could be forming. Anything above 70 is where things turn overheated and bearish.

With so many oversold indicators firing at once — plus a major trendline holding for the third time — traders are watching closely to see whether SUI can carry this momentum toward the $2 mark. Here is where the rally either fizzles out or starts building into something much bigger.