- SUI remains down over 60% and faces added pressure from an $80M token unlock.

- Spot outflows and weak volume suggest rising caution despite a short-term price bounce.

- Growing TVL and bullish derivatives positioning show some optimism ahead of the unlock.

Layer-1 blockchain Sui has struggled to regain footing, remaining firmly on the bearish side of the market. During this phase, the asset is down roughly 63.9%, a drawdown that continues to weigh heavily on sentiment. As the year winds down, that pressure may not ease, especially with bears still controlling structure and fresh supply looming noteably close.

The broader setup feels fragile. Capital inflows tied to unlocks often arrive at the worst possible time, and in SUI’s case, the timing doesn’t look forgiving. With momentum already weak, any added stress could tip balance further against bulls.

Token Unlock Could Add to the Selling Weight

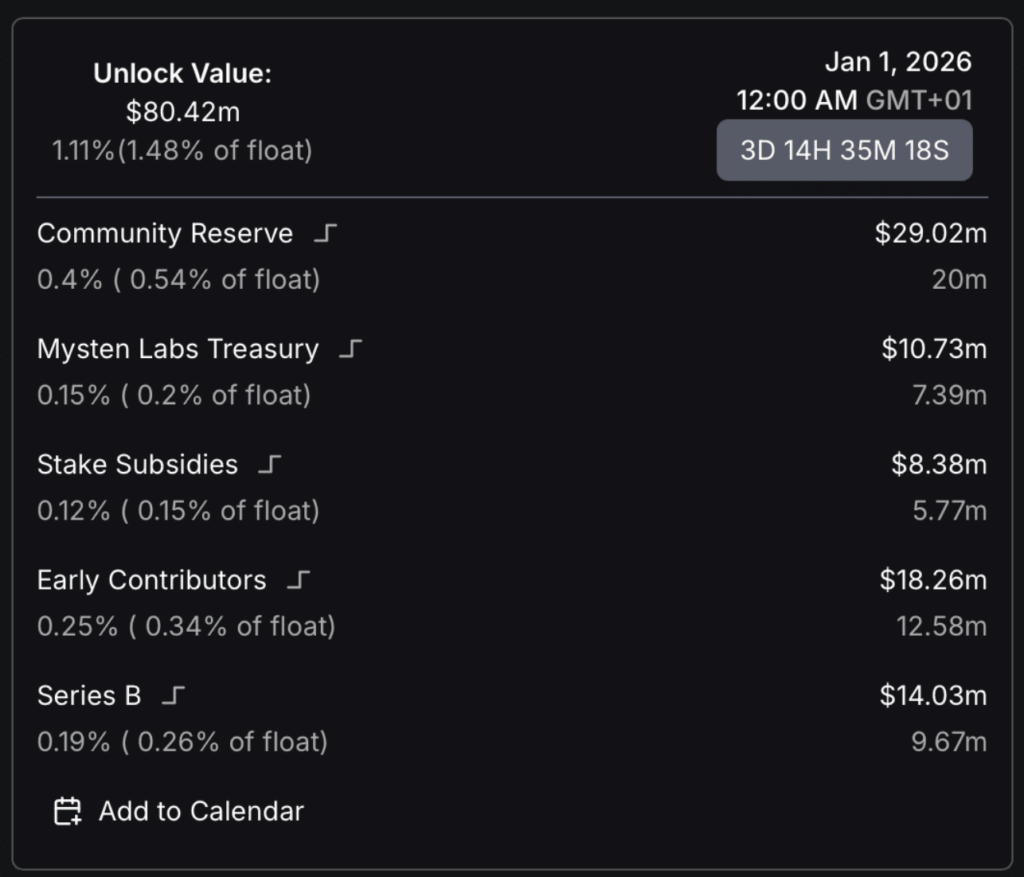

According to recent data, more SUI tokens are about to enter circulation. DeFiLlama shows a total unlock value of around $80.41 million, equivalent to 1.11% of total supply and roughly 1.48% of the circulating float. That’s not insignificant, especially at current prices near $1.41.

What stands out is the allocation to early contributors, who are set to receive about 0.25% of that supply, valued near $12.58 million. Historically, early participants tend to sell into unlocks, particularly when sentiment is already leaning bearish. If exits line up across multiple wallets, downside pressure could build fast, maybe faster than price has shown so far.

Price Rises, but Conviction Looks Thin

At first glance, SUI hasn’t reacted aggressively to the looming supply increase. The token gained about 3.45% over the past day, which might look encouraging on the surface. However, that move came alongside declining volume, which fell nearly 9% to $291.41 million.

Rising price on falling volume usually hints at weak follow-through. It suggests buyers are hesitant, not confident, and that the move could fade quickly if sellers step back in. For now, the bounce feels more like a pause than a shift.

Spot Investors Quietly Step Aside

Spot data adds another layer of caution. CoinGlass shows net outflows of roughly $5 million over the past 48 hours, with selling activity peaking on December 27. This marks the first notable outflow in over a week, breaking a relatively calm stretch.

That sudden change suggests investors are reassessing risk, especially with the unlock approaching. On the charts, SUI is trading into a key resistance zone, one that has repeatedly rejected price in the past. Failure here could send the asset back toward lower levels, reinforcing the bearish narrative.

Bulls Still Linger Beneath the Surface

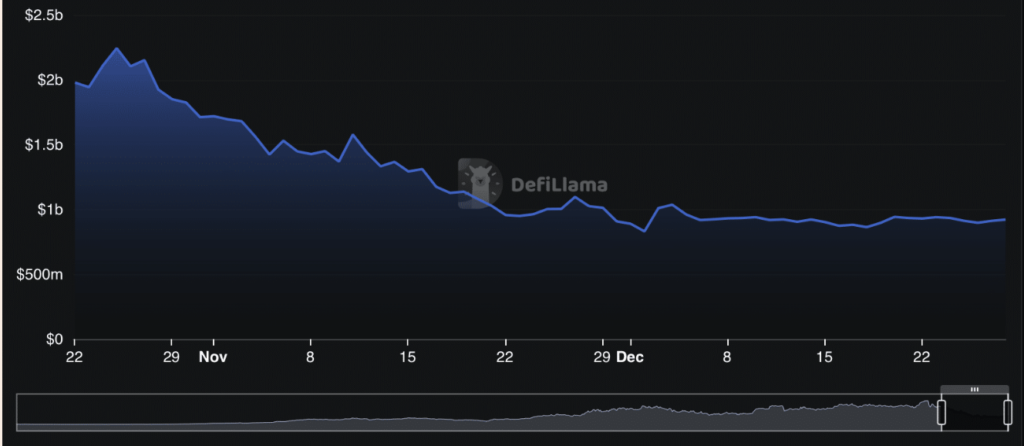

Despite the heavy tone, not everything points lower. On-chain data shows total value locked rising to about $922.25 million, with daily inflows near $24.8 million. That increase hints that some participants still see value, at least in the short term, and are willing to deploy capital.

Derivatives markets echo that cautious optimism. CoinGlass data shows growing long positions in SUI/USDT perpetuals, paired with a positive and rising funding rate. Long traders appear to be leaning in, betting that price can hold or bounce before the unlock hits. Whether that conviction holds is the big question now.

In the near term, SUI’s direction likely hinges on how traders position ahead of the unlock event. If resistance breaks, a move back toward $3.1 becomes possible, though ambitious. If sellers take control, a sweep toward the $1 zone remains very much on the table.