- SUI broke toward the top of its triangle after gaining 9%—now flirting with the $3.5 breakout line.

- Futures data shows strong buyer aggression, and Open Interest is rising fast.

- Shorts are getting liquidated hard, which may add fuel to a larger breakout if bulls keep pressure on.

Sui (SUI) has been stuck in a symmetrical triangle for what feels like forever—just grinding sideways, teasing both bulls and bears. But now? It’s getting interesting. The chart’s tightening hard, and the latest price push is bumping right up against resistance.

The SUI network just passed 225 million total accounts, which, let’s be honest, is no small feat. Users are clearly showing up. Price-wise, it tapped $3.53 recently—up over 9% in a single day. That’s a clean pop toward the triangle’s upper edge. If it breaks above this level and holds, things could move quickly.

But like always in crypto… nothing’s guaranteed. Momentum’s gotta show up.

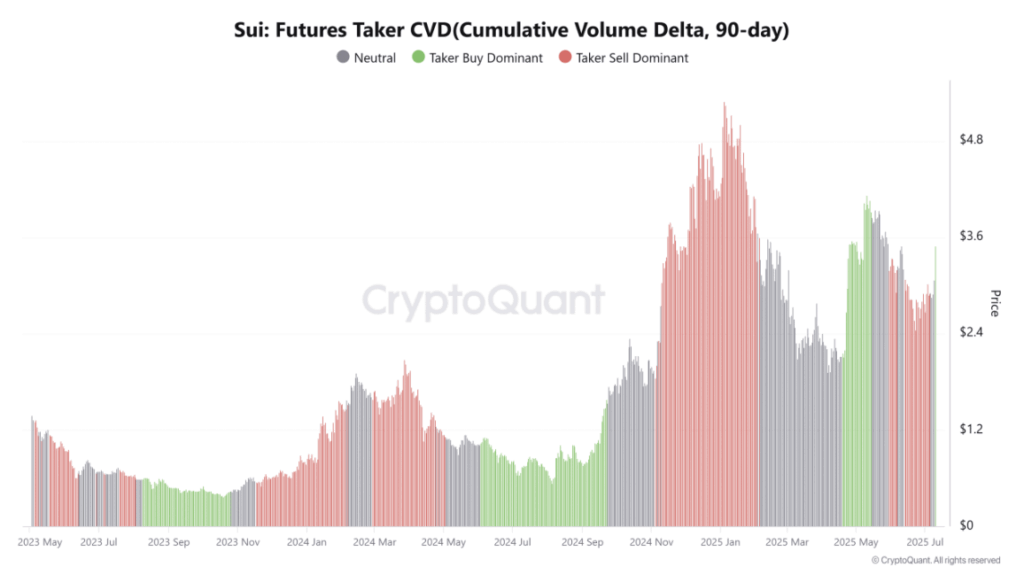

Futures Traders Are Getting Aggressive

Zooming out a bit, the Futures Taker CVD is flashing some solid signals. For the past three months, it’s been leaning bullish—buyers outnumbering sellers, and not just by a little. Takers have been loading up on buy-side orders with steady confidence.

That kind of persistent pressure is usually no accident. It lines up pretty clean with the recent price action too. If this pace keeps up, a breakout from the triangle could come sooner rather than later. But the market needs follow-through. Otherwise, it’s just noise.

Open Interest Is Heating Up

Derivatives traders are also stepping into the ring. Open Interest jumped over 12%, now sitting around $1.59 billion. That’s a decent-sized pile of capital betting on a move, one way or another.

Generally, rising OI plus solid buy pressure hints at volatility ahead—most likely to the upside if buyers keep control. But hey, no pressure, right? If bulls drop the ball, the market could whip back fast and shake out the overleveraged folks.

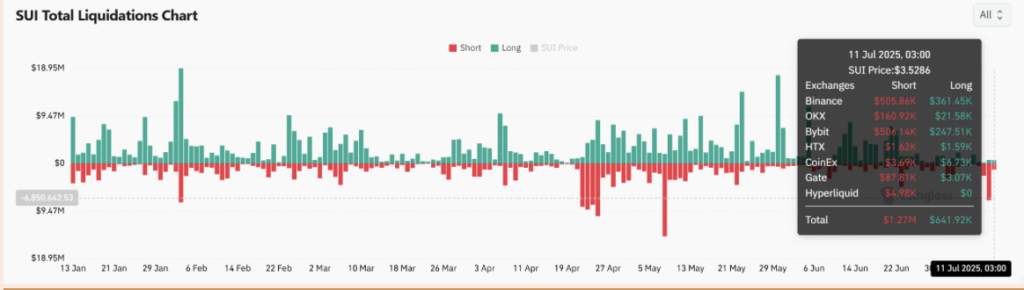

Shorts Are Starting to Sweat

Speaking of leverage, shorts are already feeling the squeeze. Liquidations on bearish bets hit $1.27 million, double the long side. That’s a clear sign that some sellers got caught flat-footed during this latest push.

And when shorts get liquidated in clusters, prices usually spike quickly. That creates what traders call a feedback loop—more liquidations lead to more buying, which leads to even more short pain.

In short (no pun), bears are on the back foot. One wrong move and they’re toast.

Final Thoughts: Can SUI Hold the Line?

SUI’s technical setup is getting harder to ignore. Tight pattern, buyer dominance, open interest climbing, shorts getting blown out—it’s all there. But now comes the hard part.

It has to break—and stay—above $3.5. That’s the key. Without a daily close above that level, this could just be another fakeout in a long list of fakeouts.

But if the bulls hold the wheel and sentiment stays positive, SUI might be ready to finally rip.