- Strategy, led by Michael Saylor, bought $584M worth of Bitcoin, pushing its holdings past 500,000 BTC.

- The firm now owns 2.4% of Bitcoin’s total supply, valued at over $44 billion.

- Saylor’s move comes as Trump’s pro-crypto stance fuels optimism and regulatory support in the U.S.

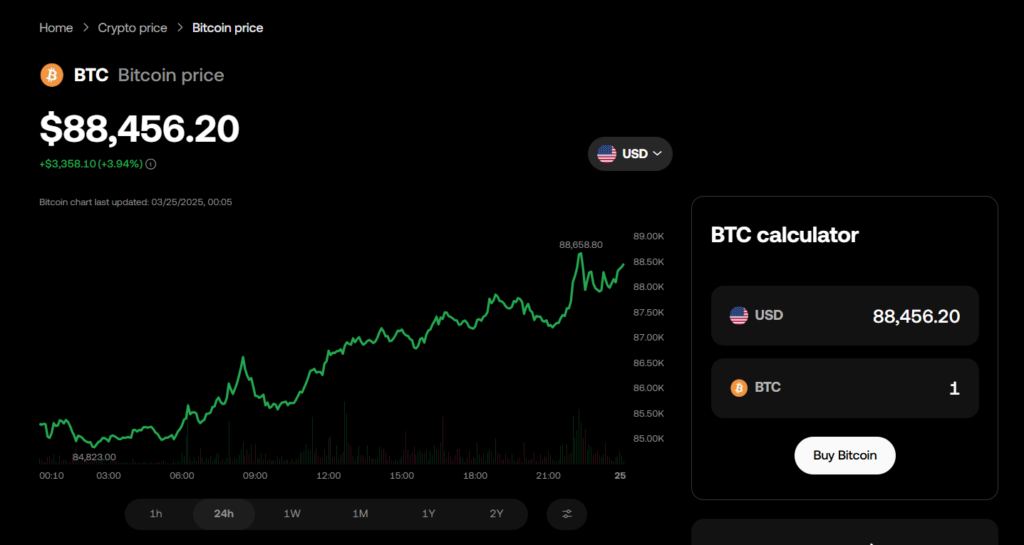

Crypto’s had a monster year so far—and one of its loudest believers isn’t slowing down. Michael Saylor, the longtime Bitcoin evangelist, just pushed his firm Strategy (yep, formerly MicroStrategy) to buy another $584 million worth of BTC. That latest haul? 6,911 Bitcoins.

Strategy’s BTC Stash Hits Insane Milestone

With this move, Strategy now holds 506,137 BTC, crossing a massive milestone. That’s 2.4% of the entire Bitcoin supply, which is wild when you think about it. The total stash is now worth around $44.2 billion, purchased at an average price of $66,607 per coin, according to a new SEC filing.

Saylor teased the move just a day earlier, taking to X (formerly Twitter) to say the firm “needs more orange.” And, well, they got it. The purchase was made possible thanks to capital raised through a preferred stock sale, part of Strategy’s ongoing plan to stack sats—aggressively.

Trump’s Win, SEC Shift Fueling the Fire

Let’s not ignore the bigger backdrop here. With Trump back in office, the U.S. now has its first openly pro-crypto president. And within just a few months, the SEC has pivoted from crypto enforcer to something much more welcoming.

That shift has only emboldened crypto bulls like Saylor. He’s been preaching Bitcoin since before it was cool, and now, with regulators loosening their grip, he’s doubling down.

Is $200 Trillion the Target?

Saylor’s not just buying big—he’s thinking big, too. He’s already said he believes Bitcoin’s market cap could eventually reach $200 trillion. That may sound outrageous, but the man’s been right before. And if Strategy keeps buying at this pace, they’ll be at a million BTC before long.

For now, though, the message is loud and clear: Saylor’s firm isn’t just in the Bitcoin game—it’s rewriting the playbook.