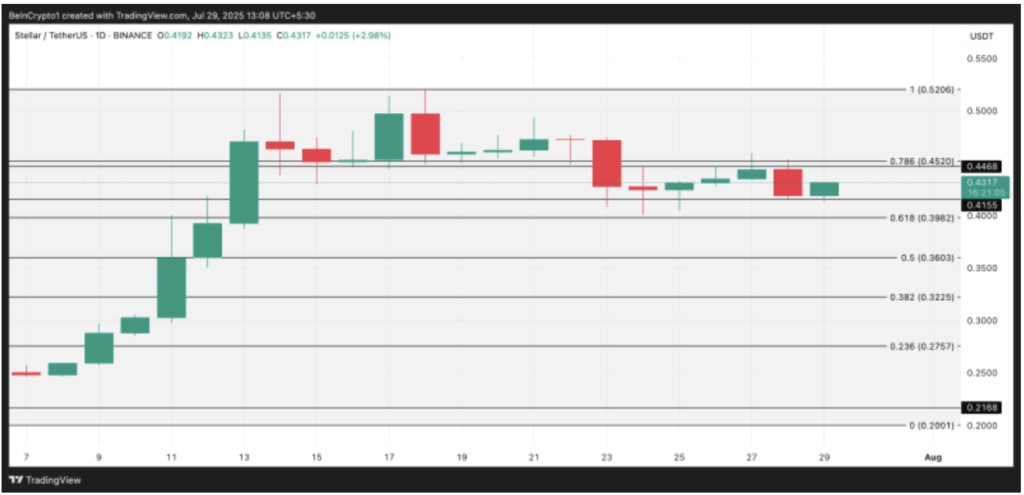

- XLM is flashing bearish signs after a weak week, with a MACD crossover showing fading momentum and price stuck between $0.41 support and $0.44 resistance.

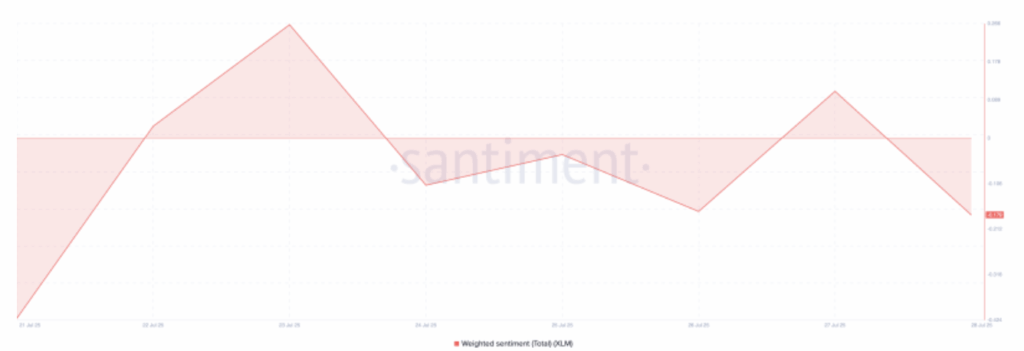

- Market sentiment has turned negative, with Santiment data showing weighted sentiment at -0.179, hinting at growing skepticism among traders.

- Currently trading at $0.43, XLM risks dipping to $0.39 if support cracks, though a rebound above $0.44 could open room for a short-term rally toward $0.45.

Stellar’s XLM hasn’t been having the best week. The charts look heavy, sentiment is turning sour, and the token is starting to wobble near its support levels. After a brief attempt at stability, sellers seem to be stepping back in, hinting at possible trouble ahead.

MACD Flips Bearish on XLM

On July 24, the daily chart flashed a warning when the MACD line crossed beneath the signal line. That’s what traders call a bearish crossover — a sign that short-term momentum is starting to slip against the longer trend. Since then, XLM has been stuck between $0.41 support and $0.44 resistance, with neither side showing much conviction.

This sideways chop isn’t great news. If $0.40 gives way, it could open the door to deeper downside. Bulls need to defend that level or risk losing ground fast.

Sentiment Turns Negative

It’s not just the indicators flashing red. Market mood around Stellar has also dipped. Santiment data shows weighted sentiment down at -0.179 — meaning investors are leaning pessimistic. When sentiment drifts negative like this, it often snowballs into lower activity, lighter trading, and sometimes, sharper sell-offs.

Confidence is fading, and unless fresh buying interest shows up soon, that could make it harder for XLM to bounce.

What’s Next for Stellar?

Right now, XLM trades at $0.43, down about 2% as broader crypto markets stumble. If the bears stay in control, the next move could be a break toward $0.39. But crypto has a way of flipping fast — a spark of renewed demand could help push XLM back above $0.44, with $0.45 as the next small target.

So the battle lines are drawn: $0.40 on the downside, $0.44 on the upside. Which side breaks first may decide where Stellar heads next.