- Stellar trades at $0.4041, up 9% over the week with $310M in daily volume.

- A close above $0.41 could push price toward $0.45 and $0.50.

- Indicators show moderate bullish pressure, with RSI strong and MACD flashing caution.

Stellar (XLM) is keeping its upward rhythm, with price action showing stability after a solid week of gains. The token has managed a 9% climb over the past seven days, signaling fresh buying interest from traders and long-term holders alike. At the moment, XLM is changing hands around $0.4041, with daily trading volume rising more than 12% to $310.42 million. Market cap sits near $12.92 billion, a slight dip despite the strong activity, hinting at some rotation but not enough to derail momentum.

XLM Technical Setup Targets $0.41 Breakout and $0.50 Upside

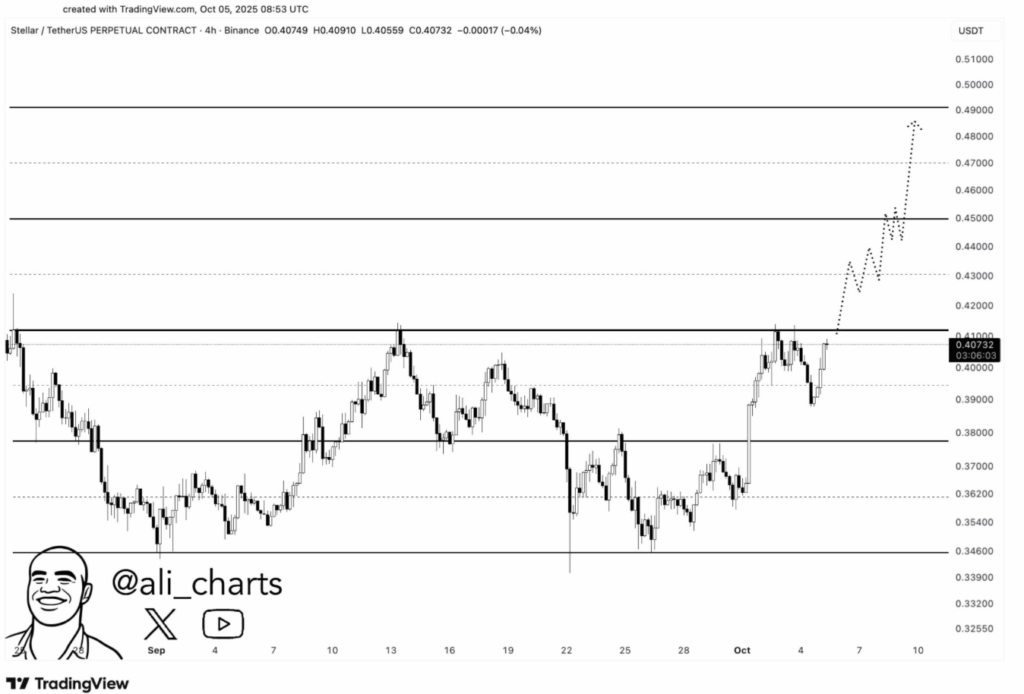

Crypto analyst Ali highlighted that Stellar’s price structure is flashing strength. After bouncing hard from the $0.38–$0.39 zone, the token is now knocking on the door of the $0.41 resistance. Buyers have been stepping in with conviction, pushing the chart into a steady pattern of higher highs and higher lows. If bulls manage to close above $0.41, it could confirm a short-term reversal and set up a push toward $0.45. A clean breakout above the $0.42–$0.45 band could accelerate gains, opening the road toward the $0.50 mark—a move that would represent a 20–25% lift from current levels.

RSI and MACD Indicators Show Mixed but Bullish Bias for XLM

Technical indicators are giving a mixed but mostly positive read. The RSI sits at 57.6, above its moving average at 54, suggesting moderate bullish pressure without tipping into the overbought zone. That leaves some space for further upside if demand keeps flowing. On the other hand, the MACD paints a slightly cautious picture, with the MACD line at 0.00319 crossing under the signal line at 0.00380. The histogram slipped into the red at -0.00061, hinting at a brief slowdown in bullish strength. Even so, accumulation around support levels continues to back the short-term bullish case.

Stellar Price Prediction: Can XLM Rally Toward $0.50 Next?

For now, XLM sits in a healthy consolidation range, balancing out after its week-long rally. Traders are watching the $0.41 level closely, since a breakout there could ignite momentum toward $0.45 and potentially $0.50. Support around $0.38–$0.39 remains key to holding the bullish structure intact. Despite short-term caution from the MACD, overall sentiment still leans positive, and Stellar’s setup suggests buyers are quietly preparing for the next leg higher.