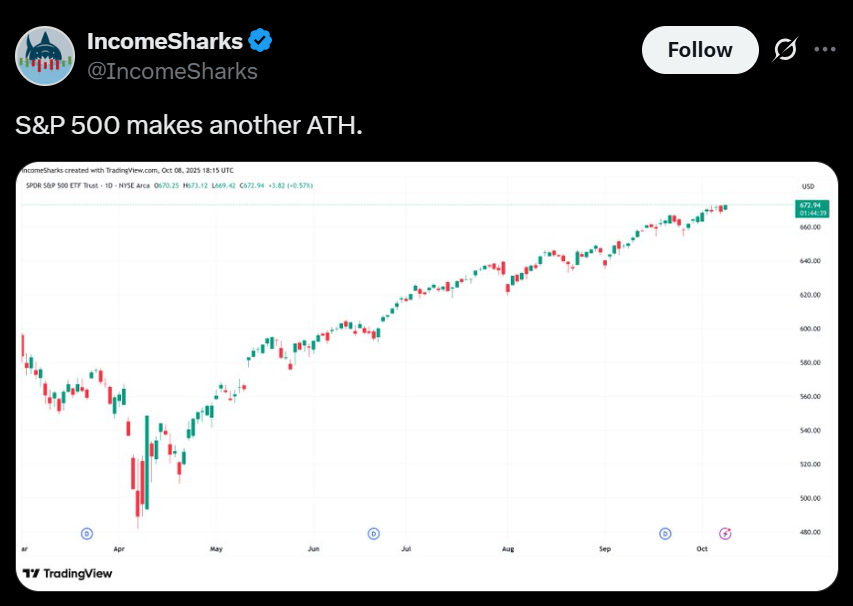

- S&P 500 and Nasdaq hit new all-time highs as markets rebounded.

- Gold surged past $4,000, while Bitcoin rose 2% to $123,800.

- AI-driven tech stocks like AMD, Nvidia, and Dell led equity gains.

U.S. stocks bounced back on Wednesday, ending the short-lived dip from the previous session. The S&P 500 climbed 0.5% to set a new all-time high, while the Nasdaq jumped 0.9% to also reach record territory. The Dow Jones Industrial Average inched up 0.1%, extending the market’s bullish streak despite ongoing concerns around the government shutdown.

Investor focus shifted to the Federal Reserve’s September meeting minutes, which confirmed the central bank’s first rate cut since late 2024. Roughly half of surveyed economists expect at least two additional cuts this year, a signal that has reinforced bullish sentiment across equities.

Gold and Bitcoin Push Higher

Gold extended its historic rally, climbing 1.6% to $4,070 per ounce after crossing $4,000 for the first time on Tuesday. The flight to safety reflects investor concern over political gridlock in Washington and global macro uncertainty.

Bitcoin also steadied after a sharp drop earlier this week. The world’s largest cryptocurrency rose nearly 2% to trade around $123,800, bouncing back from Tuesday’s 3% decline. Analysts suggest digital assets are increasingly being treated as an alternative hedge alongside gold in the current risk environment.

Tech Giants Lead the Charge

Tech stocks once again fueled market momentum. Nvidia rose 2% after CEO Jensen Huang told CNBC that demand for computing has surged significantly in the past six months. Dell Technologies jumped 7.5% following strong AI-driven growth forecasts, extending its rally from Tuesday.

Advanced Micro Devices led gains across major indexes, soaring 10% after announcing a major AI chip deal with OpenAI. This follows a remarkable 24% rally on Monday and another 3.8% rise yesterday. Meanwhile, Tesla gained 1.4% after recent losses, and Amazon rose 2% after unveiling new prescription vending kiosks at One Medical clinics.

Corporate Movers and Market Highlights

Other notable moves included:

- AppLovin (APP): down slightly after surging 7.6% yesterday.

- Confluent (CFLT): up 10% on reports it may pursue a sale.

- AST SpaceMobile (ASTS): spiked 10% after inking a Verizon partnership.

- Equifax (EFX): gained 2% after cutting credit score prices.

- Fair Isaac (FICO): slid 8% following industry shifts.

In commodities and currency, the U.S. dollar index strengthened 0.4% to 98.95, WTI crude rose 1.5% to $62.65 per barrel, and the 10-year Treasury yield held steady at 4.13%.

Final Thoughts

Markets continue to display resilience despite political uncertainty and macro risks. Record-breaking gold prices and surging AI-driven equities underscore investor appetite for both safe havens and growth plays. With rate cuts on the horizon, momentum across stocks, crypto, and commodities suggests volatility will remain high — but so will opportunity.