- U.S. markets plunged deeper into bear territory as Trump threatened more tariffs on China.

- Margin calls and panic selling triggered widespread losses across stocks, crypto, and commodities.

- China, Canada, and the EU are preparing retaliatory moves, heightening fears of a global trade war.

U.S. stocks took another hit Monday as trade tensions intensified, with President Donald Trump’s White House standing firm behind its aggressive new tariff strategy. Investors, already rattled by previous losses, found little comfort as threats of even higher tariffs on China rolled in.

Trump Doubles Down on China Tariffs

In a post on Truth Social, Trump warned that unless China backs off its newly announced 34% tariffs by April 8, the U.S. will slap a 50% tariff on Chinese goods the next day. Talks with China would also be halted immediately, he added, escalating fears of an all-out trade war.

Stocks Slide Further Into Bear Territory

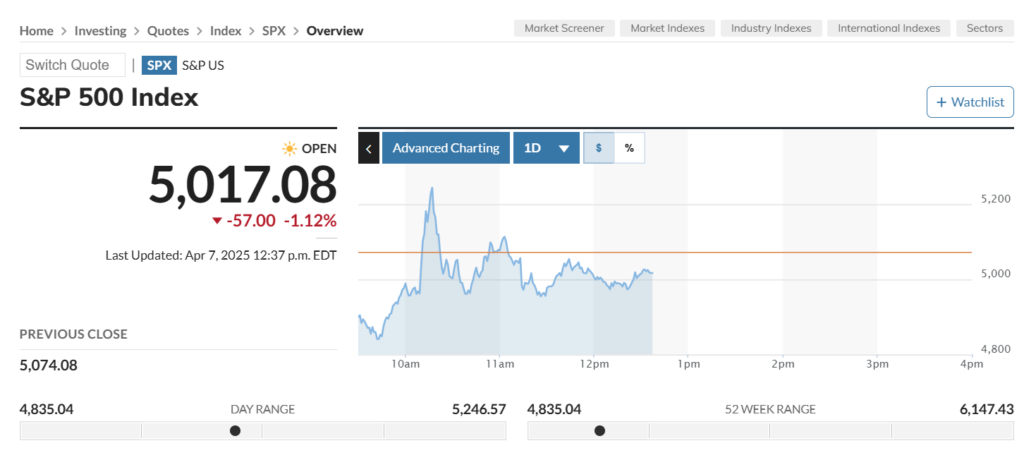

The S&P 500 dropped 2%, pushing its losses near 20% from its February peak—a key threshold for what’s considered a bear market. The Dow shed another 962 points after suffering back-to-back record losses last week. The Nasdaq, heavy on tech names, lost 1.7%, dragging it down 24% from its high.

Brief Rally Fizzles After Tariff Pause Rumors

Markets briefly bounced on rumors of a 90-day pause to the tariffs, with the Dow even turning positive. But the White House swiftly shot down the speculation, calling it “fake news,” and the rally evaporated just as fast.

Uncertainty Rocks Investors

Trump’s initial 10% tariffs took effect Saturday, and instead of calming markets with possible exemptions or negotiations, administration officials stood their ground. Commerce Secretary Howard Lutnick told CBS News the tariffs “are definitely going to stay in place for days and weeks.”

Retaliation From China and Global Fallout

China responded Friday with a 34% tariff on all U.S. goods. Now, with the U.S. threatening to double down, the trade standoff appears locked in. Business leaders like billionaire investor Bill Ackman are raising alarms: “We are heading for a self-induced, economic nuclear winter.”

Allies Line Up for Response

At least 50 countries have contacted the U.S. about trade talks, but key allies like Canada and the EU are reportedly preparing retaliatory tariffs of their own. Vietnam has offered to drop its tariffs entirely, but White House trade advisor Peter Navarro brushed it off, saying the real issue is “non-tariff cheating.”

Margin Calls and Panic Selling

As losses piled up, fears of a broader financial crunch emerged. With hedge funds facing margin calls, some were forced to dump risky assets. The CBOE Volatility Index—the market’s fear gauge—spiked to 50, a level typically seen in full-blown bear markets.

“Margin calls are going out as we speak,” said Chris Rupkey of FWDBONDS. “These tariffs have rocked Wall Street.”

Bitcoin, Oil, Global Stocks Join the Slide

The selloff didn’t stop at stocks. Bitcoin fell below $77,000. Oil prices dropped under $60 a barrel, hitting multi-year lows. Hong Kong’s Hang Seng plunged 13%—its biggest drop since 1997—while Germany’s DAX slipped as much as 10%.

Apple Takes a Hit

Apple shares dropped 5% after Trump floated the idea of increasing tariffs on Chinese imports even further—casting doubt on the company’s already fragile supply chain.

As global uncertainty swells and tariffs take center stage, the markets continue to spiral, with no clear end to the turbulence in sight.