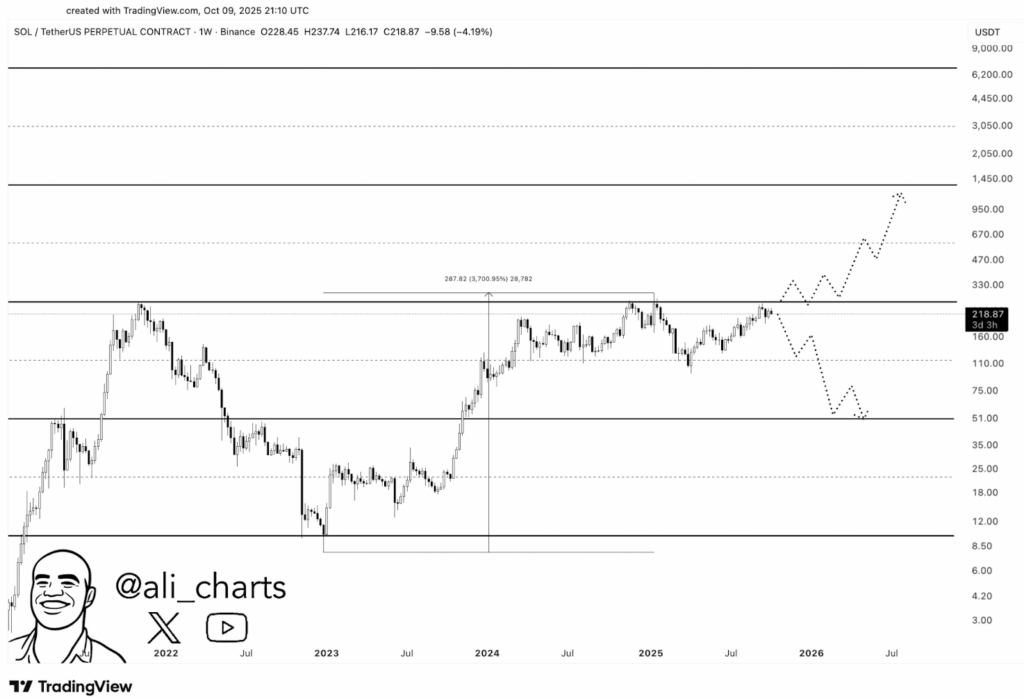

- Solana trades near $218, up 3,700% from 2022 lows.

- Breaking $330 could fuel a move toward $1,300.

- Losing $160 may trigger a steep correction toward $50.

Solana’s been one of crypto’s wildest comeback stories — no doubt about it. Since its brutal 2022 low, SOL has rocketed over 3,700%, a run that’s turned heads across the market. But now, hovering near $218, the big question looms: is this rally gearing up for one last explosive leg… or about to hit a wall?

A Defining Moment for Solana

Crypto analyst Ali dropped a chart that’s been making rounds lately — one that shows Solana sitting right on the edge of something major. The token’s down about 4% this week, but it’s not the dip itself that has traders nervous. It’s what comes after.

Right now, SOL’s price map looks like this:

- Current Price: $218

- Key Resistance: $330 — this one’s huge. A clean breakout here could send it ripping toward $470, $670, maybe even $1,300.

- Support Zone: Around $160 for now, but if that breaks, it opens doors to $110, $75… and yeah, possibly even $50.

- Volatility History: Every past rally has flipped on a dime. When Solana moves, it really moves.

This setup’s got traders on both sides sharpening their arguments — the bulls pointing to expansion and momentum, the bears warning of exhaustion and overextension.

The Push and Pull Behind the Price

Solana’s fundamentals have been strong — DeFi protocols expanding, NFT markets coming back to life, and gaming projects launching almost weekly. It’s clear the network’s growing, fast. But still, not everyone’s fully convinced. Old ghosts like network reliability and those infamous outages keep surfacing, reminding investors that rapid growth doesn’t come without risk.

Then there’s the macro backdrop. Interest rate policies, global liquidity, and the broader crypto cycle — they’re all playing a part. After such a monster rally, even the most loyal holders are torn between taking profits or staying for what could be another breakout. The market’s feeling… uncertain, like a coin toss that could go either way.

Where Could Solana Go From Here?

If the bulls win out, a break above $330 might light the fuse for the next leg up — $470 first, then maybe $670, and who knows, a wild push toward $1,300. That’s the dream scenario.

But if support at $160 doesn’t hold, things could unwind quickly. The lower zones at $110 and $75 would come into play, erasing months of gains in just weeks. Solana’s price history shows it doesn’t do slow corrections — when it drops, it dives.

For now, Solana’s walking a fine line between glory and correction. It’s the kind of setup that makes or breaks conviction, and whichever side wins — it’ll likely happen fast.