- SOL trades at $201.87, up slightly but still down 9% weekly, as volume cools before another potential move.

- VanEck’s updated Solana ETF proposal could draw fresh institutional money and boost long-term demand.

- Solana’s next key breakout level sits at $250, with short-term support forming near $200.

Solana (SOL) is quietly bouncing back after a shaky week, finding its footing again as investor interest returns across the broader crypto space. The token’s price rose 1.18% in the last 24 hours, though it still sits down about 9.2% on the week, reflecting mixed sentiment after days of volatility.

At press time, SOL trades around $201.87, giving it a market cap of roughly $110.3 billion. Daily trading volume dipped more than 21% to $10.7 billion, a sign that traders might be pausing before making their next move — kind of a calm before the next wave.

VanEck’s Solana ETF Update Sparks Institutional Excitement

Crypto analyst Coin Bureau revealed that VanEck has revised its Solana Staking ETF proposal, adding a 0.30% management fee that would make it one of the most cost-effective products of its kind. The ETF — set to trade under the ticker VSOL — would blend Solana’s price exposure with staking rewards, meaning investors could earn passive yield directly through validator participation.

The filing also outlines risk protections like regulated custody and liquidity buffers, addressing some of the main concerns that have kept institutions on the sidelines. Although the SEC hasn’t approved it yet, the move signals clear institutional appetite for Solana exposure. If greenlit, this ETF could funnel serious capital into the Solana ecosystem, pushing both liquidity and adoption to new highs.

Solana Breaks Free — $250 Could Be the Next Target

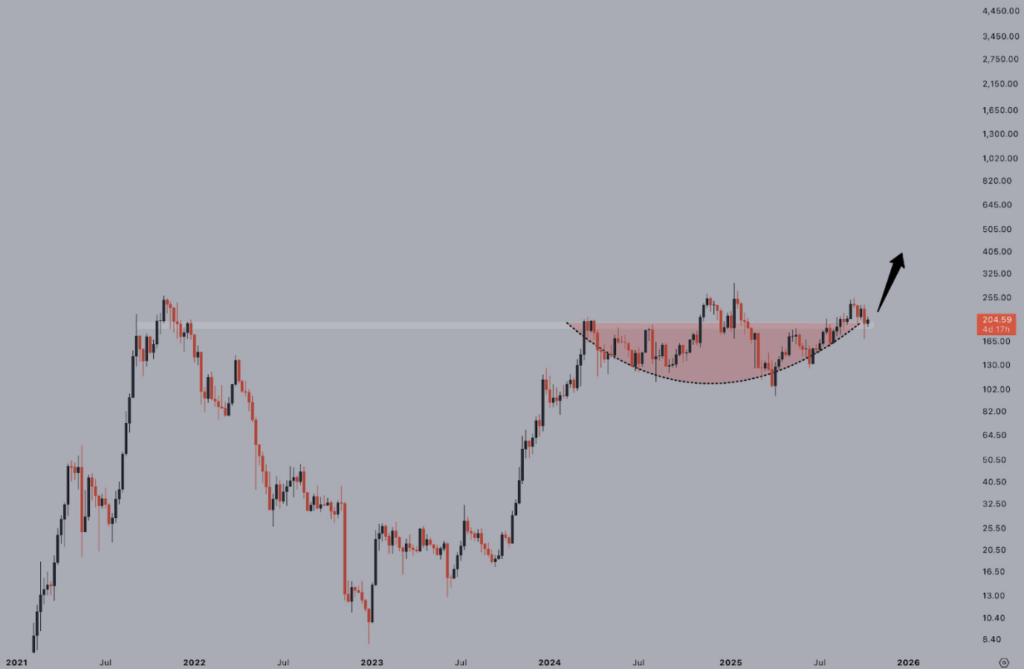

Analyst Jelle pointed out that Solana recently broke out of an 18-month reaccumulation range, signaling a shift from stagnation to growth. The token’s clean retest above $200 confirms renewed bullish strength after months of sideways action.

With momentum returning, $250 stands out as the next key resistance. If SOL breaks that level decisively, it could kick off a fresh rally — possibly entering price discovery territory. Analysts believe this setup mirrors Solana’s 2021 breakout pattern, where similar accumulation zones led to explosive gains. As on-chain activity keeps rising and market sentiment stabilizes, Solana’s next leg could come sooner than most expect.

Solana’s Technical Setup Points to Short-Term Caution

Despite its renewed strength, Solana’s short-term chart hints at consolidation. The price currently sits below both the 20-day ($210.70) and 50-day ($211.22) EMAs, which means bulls still have work to do before reclaiming momentum. On the other hand, the 100-day ($199.93) and 200-day ($186.88) EMAs serve as strong support zones — the safety net for any pullback.

The RSI sits at 44.8, showing weak buying momentum, while the MACD remains bearish but is beginning to flatten out — a possible hint that selling pressure is fading. A break above $211 could reignite an upward push, while dropping under $199 might pull prices back toward $186.