- Solana Traders Bet on $200 by June: Block traders are buying $200 call options for Solana (SOL) set to expire on June 27th, signaling strong bullish sentiment as SOL continues its impressive rally.

- SOL Maintains Momentum Amid Trade Deal Optimism: Despite a slight dip to $171 on Monday, Solana is still up 17% in the past week and 32% over the past month, driven by optimism around the US-China trade talks.

- Path to $200 – Can SOL Break Through? With SOL already up 85% since April 17th, traders are watching for volume spikes and continued momentum as the $200 target comes into focus.

Crypto traders have been riding a rollercoaster this year, but Monday’s market shift might’ve set the stage for some major moves ahead. One token that’s firmly in the spotlight? Solana (SOL). And right now, block traders are betting big that SOL could hit the $200 mark by June.

Block Traders Bet on $200 Call Options

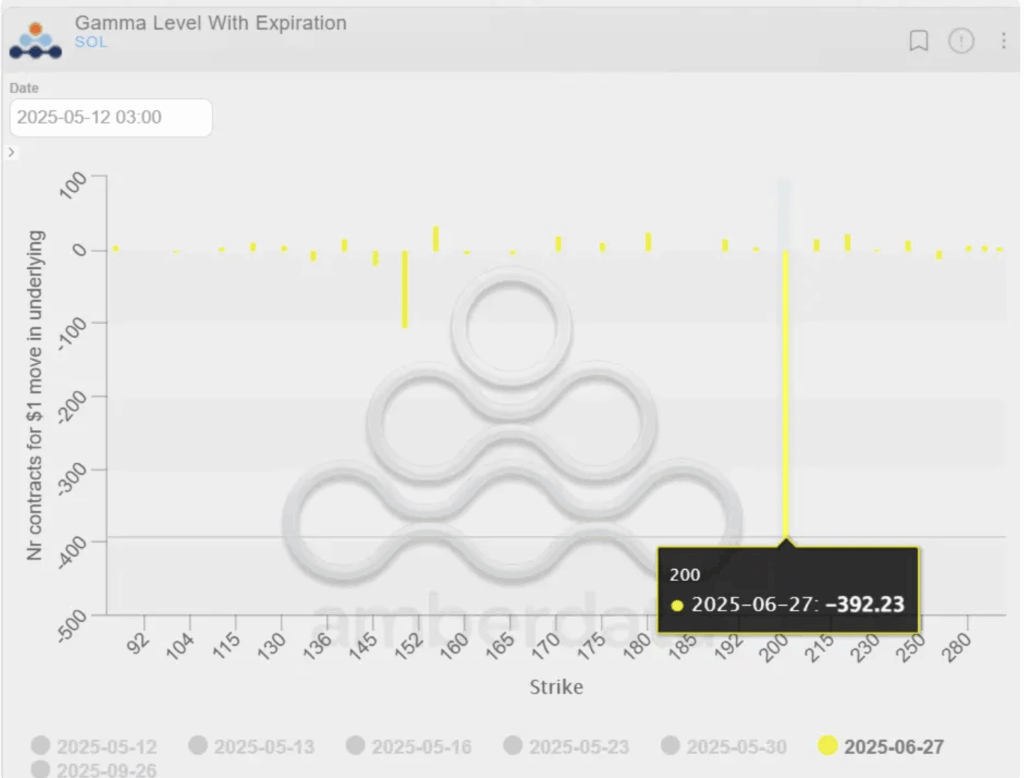

Solana’s been making some serious waves lately, and it seems like big players are banking on more upside. Block traders — the ones who execute massive trades off public order books — have been buying into $200 call options for SOL set to expire on June 27th. That’s a strong signal that they’re expecting the current rally to keep pushing higher.

Why the optimism? Well, Monday’s news that the US and China agreed to pause tariff increases for 90 days has sparked fresh hope for a trade deal. The announcement gave the US stock market a solid boost, with the S&P 500 hitting a two-month high. And in the crypto space, Solana is emerging as one of the main tokens to watch.

SOL Price Action — Bullish Momentum Continues

Despite a slight 0.2% dip on Monday, Solana held firm around the $171 mark, according to CoinMarketCap. That minor pullback barely dented its impressive run — SOL is still up 17% in the past week and a whopping 32% in the last month. And since April 17th, Solana has gained 85%, easily outpacing Bitcoin’s rise above $103,000.

For context, these block traders have scooped up June 27th call options listed on Deribit, betting that SOL will breach $200 by the end of the month. If they’re right, Solana could cement itself as one of the year’s top performers.

The Bigger Picture — Can SOL Hit $200?

Hitting $200 would be a major milestone, and it’s not entirely out of reach. With macro conditions looking a bit more stable, and with block traders putting serious money on the line, Solana’s upward trajectory might still have plenty of room to run.

For now, SOL traders are keeping a close eye on volume and momentum. If the bullish sentiment holds and the $200 call options keep getting snapped up, Solana could be gearing up for a breakout move in the weeks ahead.