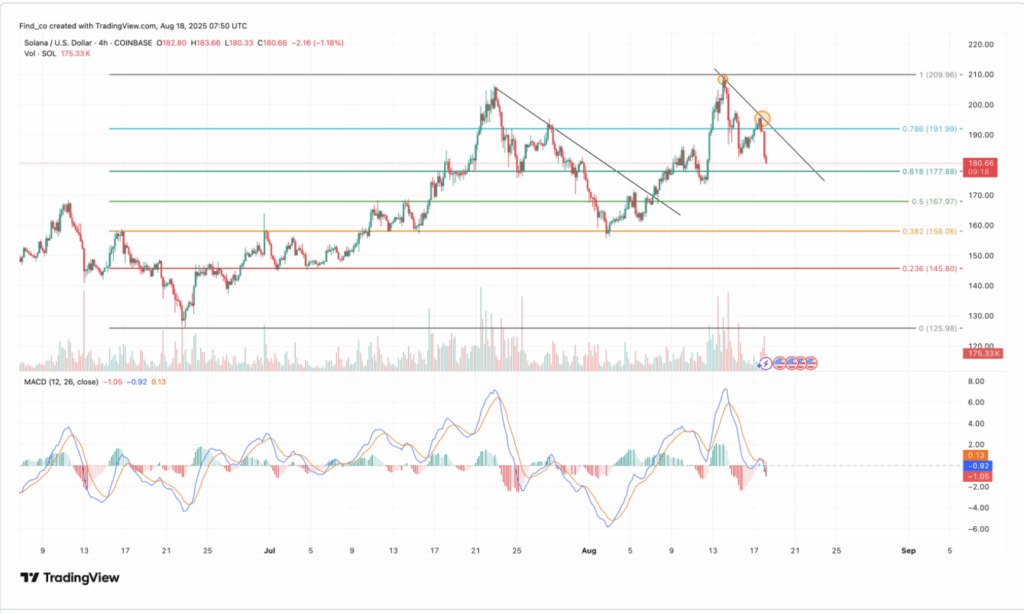

- Solana (SOL) dropped 5.4% in 24 hours, failing to hold above $200 and slipping under key support at $182.89, exposing it to deeper downside risks.

- On-chain data shows exchange inflows spiked to nearly 472k SOL, suggesting holders are preparing to sell, adding bearish pressure.

- If SOL breaks below $158, price could slide toward $145, but reclaiming $191 resistance might reopen the path to $209.

After weeks of printing higher highs, Solana’s momentum just hit a brick wall. In the past 24 hours, SOL dropped about 5.4%, slipping under the $200 psychological mark and leaving bulls scrambling to hold the line. The excitement that pushed it through summer highs has cooled, and for now the charts aren’t exactly screaming “instant recovery.”

The Rally Breaks Down

Just last week, traders were buzzing over an inverse head-and-shoulders pattern, usually a bullish setup hinting at new highs. Instead, Solana broke below its neckline support at $182.89, a level that had been propping up the rally. With that gone, the token looks exposed to deeper losses. Momentum flipped too—the Awesome Oscillator switched from green to red, showing sellers gaining control. If pressure holds, SOL could break under $157, maybe even test $150 or worse, with $131 as a lurking downside target.

Exchange Flows Hint at More Selling

On-chain data paints an equally shaky picture. Glassnode tracked a sharp rise in SOL moving back onto exchanges. On Friday, things looked fine with 237k SOL flowing out—usually bullish since coins head to cold wallets. But sentiment flipped fast. By Sunday, inflows had spiked to nearly half a million SOL, signaling holders may be preparing to sell. More supply hitting exchanges generally means more pressure on price, and right now that’s stacking against bulls.

What’s Next for SOL?

Looking at shorter timeframes, the setup feels eerily similar to July’s failed breakout attempt. Two rejections since Aug. 14 show heavy resistance still holding. Meanwhile, the MACD has crossed bearish, confirming momentum isn’t on buyers’ side. If things don’t shift, price could break the $158 Fibonacci level and head lower toward $145. On the flip side, if buyers suddenly step in, reclaiming $191 resistance could flip the script and send SOL to $209—but at the moment, the market’s leaning toward more downside before any fresh push higher.