- Solana could dip 40% to $95 if resistance holds and the harmonic pattern plays out.

- This drop might be part of a bullish setup that could send the price back above $200 later.

- Watch for either a rejection at $163 or a breakout—volume will tell the story.

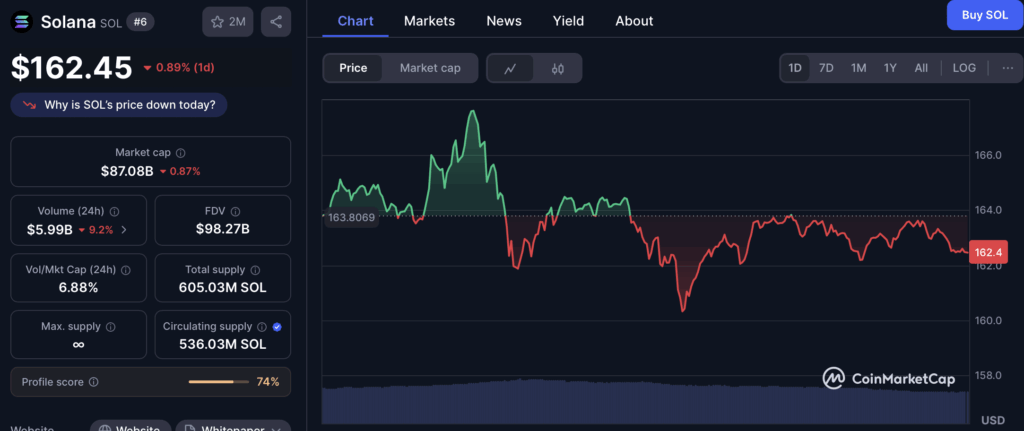

Solana’s been on a rocky ride lately. After hitting nearly $300 back in January 2025, the token’s taken a steep tumble—and even with a bit of a market bounce, it’s still hanging around 45% below those highs. Oof. And now, some folks think the pain isn’t over just yet.

In fact, one crypto analyst, who goes by The Alchemist Trader, thinks Solana could take another hard fall—like, a 40% crash kind of fall. But weirdly enough, that might not be as awful as it sounds. Let’s break it down.

So… Why the Crash Talk?

Alright, here’s the setup: the analyst spotted what’s called a “bullish harmonic pattern” forming on the charts. Sounds nice, right? It is, technically. But this specific pattern tends to start with some downside. Think of it like a slingshot—it pulls back before it shoots up.

Right now, Solana’s floating around $150+, but the pattern suggests we might see a drop to $95 first. That’s the previous low and also the expected end of the “C-leg” of the move, which—if you’re into chart lingo—signals a liquidity sweep. In plain speak: the market might need to shake out weak hands before moving up.

And there’s more fuel for the bearish fire. Solana’s stuck battling resistance right at the Point of Control (POC)—a key level traders obsess over. Momentum’s weak. Plus, that stubborn 0.618 Fibonacci resistance sitting just above $163? Yeah, it’s putting a lid on things. If SOL can’t bust through that wall, $95 could come into view real fast.

But Hold Up—It’s Not All Doom and Gloom

Here’s the part that gives bulls a reason to breathe. Even if Solana does take that hit and drops to $95, it doesn’t mean the whole project’s in trouble. In fact, that might just be the setup for something much bigger.

According to the analyst, that fall could mark the end of the “D-leg” in the harmonic structure. After that? Boom—Solana could snap back and rally toward $200 or more. That’s a 100% move, give or take.

But—and there’s always a but—none of this is confirmed yet. The chart is sitting in no man’s land, range-bound between major high timeframe levels. Until we either see a hard rejection at current resistance or a solid breakout backed by strong volume, it’s all just theory.

Final Word?

Keep your eyes peeled. If Solana breaks above the $163 zone with real conviction, that bearish setup might get tossed. But if it stumbles here? Don’t be shocked if we revisit $95 before the next leg up.