- Solana rebounded above $207 after defending key support near $180, signaling renewed strength.

- VanEck’s updated Solana Staking ETF filing boosted investor confidence and institutional interest.

- On-chain inflows of $5.49M show accumulation, hinting at a potential breakout toward $230–$260.

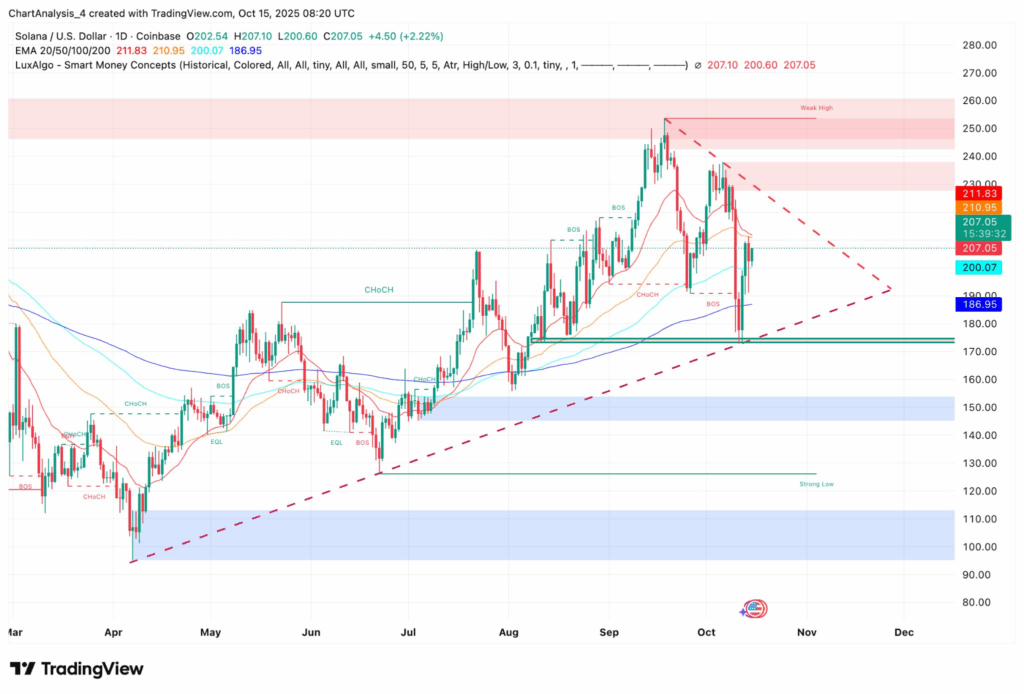

Solana’s back on the rise after a rocky week, climbing past $207 and holding steady above key support around $180. The bounce came right as VanEck dropped an updated filing for its Solana Staking ETF, adding fuel to the bullish sentiment. Combined with fresh on-chain inflows of $5.49 million, investors are starting to circle back with cautious optimism — and maybe a little excitement too.

Technical Strength and Market Setup

Technically, Solana’s chart looks like it’s tightening up for something big. The token’s recovery from $180 — which aligned neatly with the 200-day EMA — signaled strong demand right where it needed it. Since then, SOL’s climbed over the 100-day EMA and now faces resistance near $211. If it can close above $212, that might open the door to a run toward $230, and even back to the $250–$260 range where sellers usually show up.

Still, traders are watching that $180 zone carefully. Losing that level could mean a deeper pullback, maybe toward $150. For now though, the bias stays bullish as long as Solana keeps dancing above its long-term moving average.

ETF Buzz and Institutional Flows

The ETF news definitely gave SOL a spark. VanEck’s proposal for a Solana Staking ETF — with a modest 0.30% fee — could be a big deal. It’d be the first ETF to offer regulated exposure to Solana’s staking rewards, giving traditional investors a safer route into the network’s ecosystem. That’s the kind of thing that’s helped Bitcoin and Ethereum attract huge institutional inflows earlier this year.

And then there’s the on-chain data. Coinglass reported $5.49 million in net inflows on October 15, right as prices began to climb again. That’s typically a bullish signal — it means accumulation, not distribution. The calmer outflow patterns lately also suggest traders aren’t panicking anymore, which is always a good sign.

Outlook Moving Forward

Solana now sits in a key range between $180 and $212, and whichever side breaks first could define the next few weeks. A clean breakout over $212 could carry it up to $230 or even test $260 again if momentum builds. If things turn south though, the 200-day EMA will be the first line of defense.

For now, the fundamentals — strong network activity, steady inflows, and the ETF catalyst — all point to a healthy setup heading into Q4. Solana might just be gearing up for another leg higher if the market keeps the energy going.