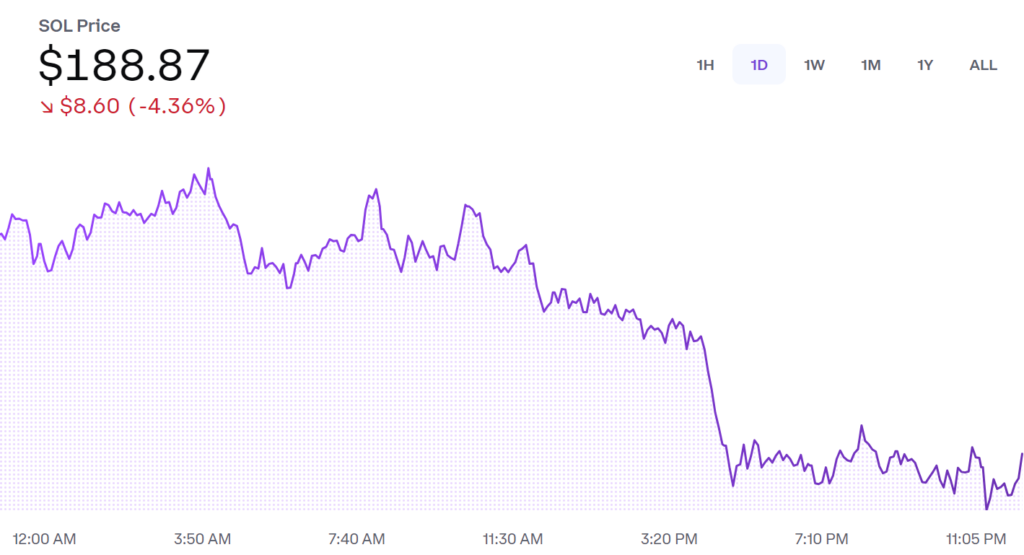

- SOL drops 4.36 percent in the past 24 hours, trading at $188.87.

- Market support observed at $180, with resistance near $200.

- Volatile trading conditions influence short-term sentiment and momentum.

Solana’s market has seen a challenging day, with the token’s price sliding 4.36 percent to $188.87. This decline follows recent market-wide volatility, reflecting shifts in investor sentiment and broader cryptocurrency trends. After a rally that pushed SOL to notable highs, the current downturn signals a period of consolidation, testing the strength of near-term support levels.

The Coinbase chart illustrates consistent selling pressure throughout the trading session, with recovery attempts failing to gain traction above the $190 mark. Market participants appear cautious, with trading volumes suggesting measured activity as buyers and sellers await further clarity on the token’s trajectory.

Price Consolidation Near Critical Support

Support at $180 is emerging as a significant level for Solana, with the market looking to this area for stability. A break below this threshold could lead to extended losses, targeting the $170 level as the next potential floor. On the upside, resistance around $200 remains a critical barrier for any recovery effort.

The chart highlights a downward trend, with lower highs forming over recent sessions. Momentum indicators show weakened bullish momentum, with sellers exerting greater control over short-term price movements. Market volatility, a hallmark of SOL’s trading activity, underscores the importance of clear directional signals for traders navigating the current landscape.

Broader Implications for Solana

Solana’s recent price performance aligns with broader market behavior, where external economic and regulatory factors influence digital asset trends. The token’s ecosystem remains a vital component of the blockchain space, fostering innovations across decentralized finance, gaming, and other sectors. However, its price action highlights the challenges faced by growth-focused projects during periods of uncertainty.

Holding above $180 will be critical for Solana to maintain investor confidence and avoid deeper pullbacks. Sustained consolidation within this range could provide a foundation for a rebound toward $200 and beyond. Conversely, a breach of key support levels would amplify bearish sentiment, prompting further selling pressure.

The coming days will be pivotal in determining whether Solana’s price can stabilize and regain its upward momentum or if it will continue to face headwinds in the evolving cryptocurrency market.