- Solana broke out from a cup-and-handle, now pushing toward $218 resistance.

- Technical momentum is strong, with price holding above major EMAs and VWAP in focus.

- $218 remains the key breakout level, while $193–$195 is immediate support.

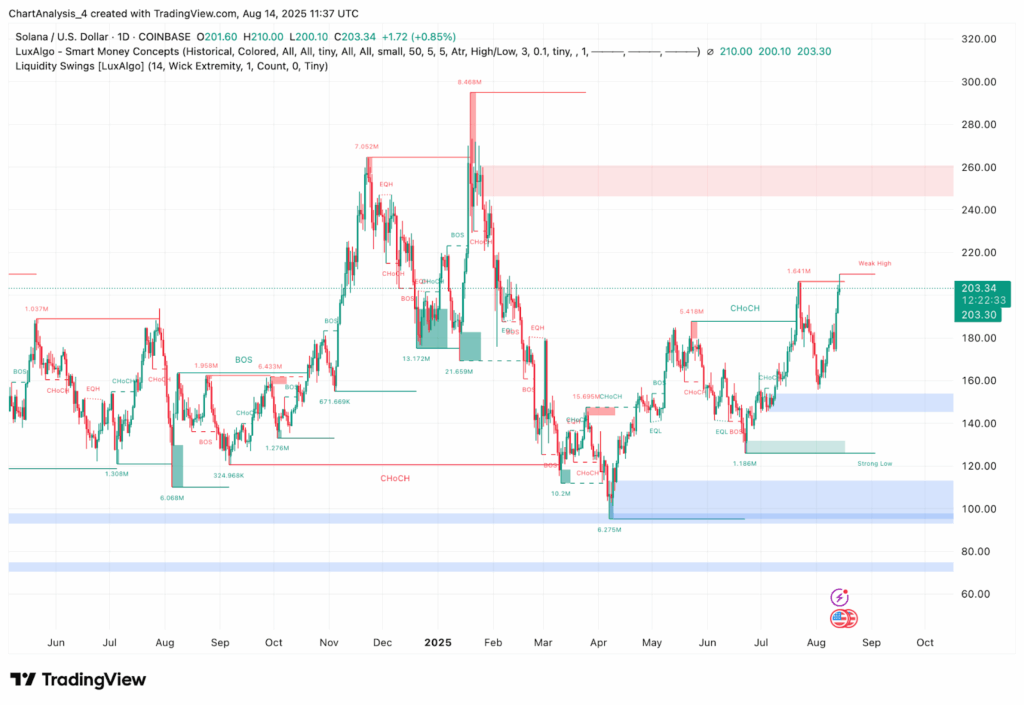

Solana is still riding its bullish wave, pushing to $203.34 today after briefly testing $210. This run comes off a strong rebound from the $140–$150 demand zone and a clean breakout from a major cup-and-handle setup on the daily chart. Now, traders have their sights set on $218 — the next big wall to clear.

A Technical Picture Turning More Convincing

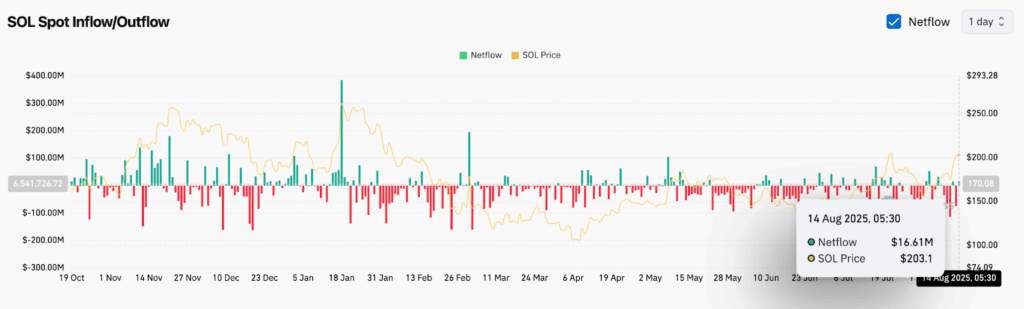

Since early August, SOL’s been grinding higher, punching through the $190 barrier and clearing liquidity sitting at $203. The daily structure now shows multiple Break of Structure (BOS) signals — a sign buyers are firmly steering. Smart Money Concepts put major support down at $115, with that $140–$150 pocket acting like a launchpad for the latest move.

The neckline breakout at $190 confirmed the cup-and-handle pattern, with projections pointing to $218–$220 as the first realistic upside target. Those levels also line up with historical liquidity zones, adding weight to the setup.

Resistance in Sight — But Room to Run

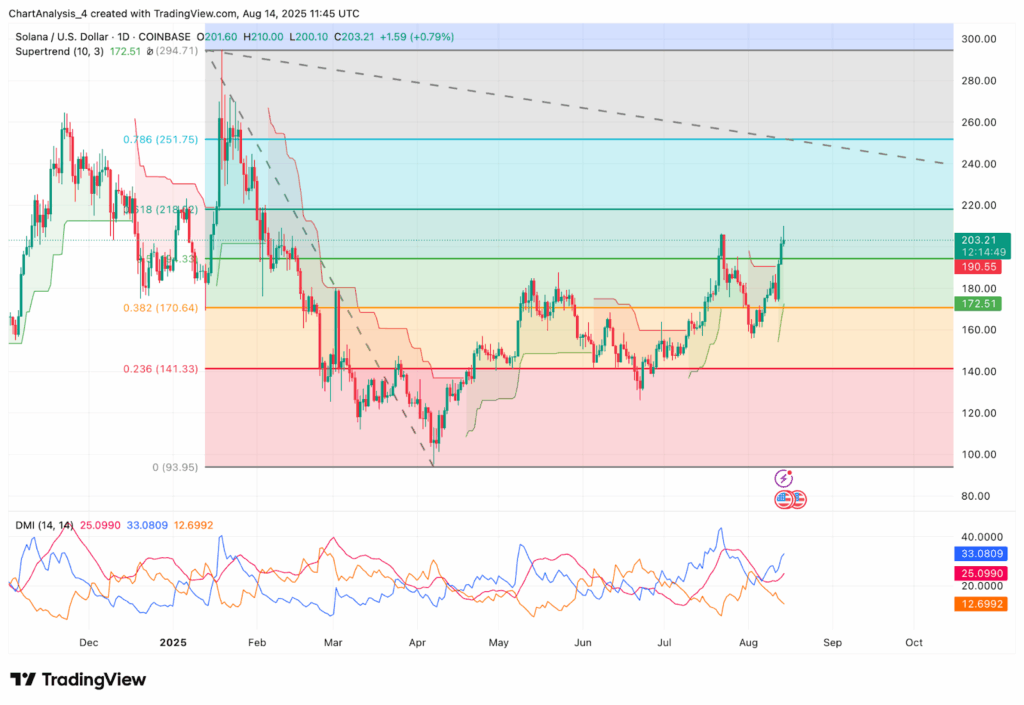

Fibonacci retracement from Nov. 2024’s high to Mar. 2025’s low shows SOL reclaiming the 0.5 level at $190.55 and pressing against the 0.618 at $218.12. A daily close above there could open the path toward $251.75. Immediate pullback support sits at $193–$195, then $172.51, with a deeper dip possibly testing $160 — though current structure makes that less likely for now.

In the short term, if SOL holds above $200 and clears VWAP with strong volume, $218 is back in play fast. But that level could also trigger quick profit-taking before the next leg higher.