- Solana (SOL) eyes a breakout above $204 as hidden bullish signals form despite volatility.

- Chainlink (LINK) shows quiet accumulation by whales, with recovery targets between $21 and $27.

- Stellar (XLM) risks bearish crossovers but could surprise with a short squeeze if market sentiment flips.

As U.S. markets prepare for a big week — with CPI data on the way, a potential Fed rate cut looming, and Jerome Powell’s comments expected to sway global sentiment — crypto traders are on edge, watching how digital assets will react to changing policy winds. Among them, a few “Made in USA” coins like Solana (SOL), Chainlink (LINK), and Stellar (XLM) are showing mixed but intriguing setups that could define how the next few weeks play out.

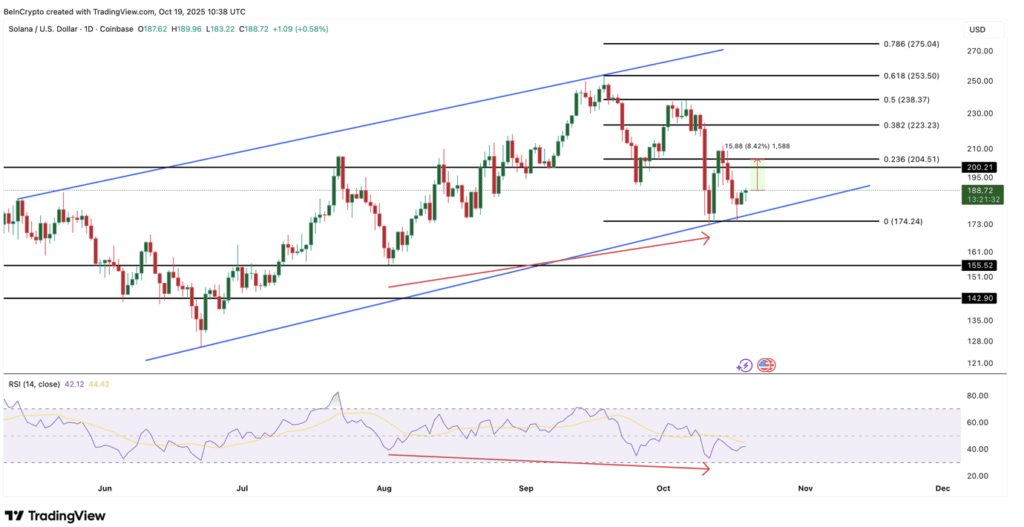

Solana (SOL) Hints at Recovery Amid Volatility

Solana has managed to stay one of the stronger performers despite a rocky month. After losing about 23% since early October’s “Black Friday” crash, the token is slowly regaining ground, up more than 2% this week.

Technically, SOL is still trading within an ascending channel pattern that’s been intact since May — a bullish setup that typically supports continuation trends. Right now, the key level to beat sits at $204. If Solana breaks through cleanly, it could open a move toward $223–$238, and a decisive close above $253 might even set the stage for new highs in the short to mid-term.

The RSI supports this case — between August 7 and October 11, price made higher lows while RSI made lower ones, forming a hidden bullish divergence. That’s usually a signal that the overall uptrend remains alive, even if price looks shaky short term.

Still, traders are cautious. A daily close below $174 could flip the pattern bearish and push the token down toward $155–$142, temporarily breaking structure for one of the strongest altcoins this quarter.

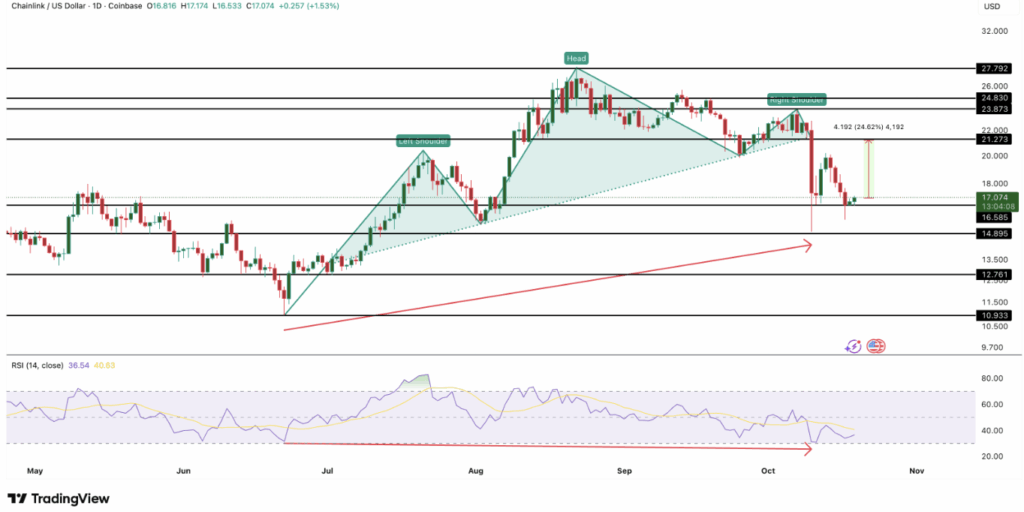

Chainlink (LINK) Holds Its Ground After Correction

Chainlink has also taken a hit recently, down about 30% over the last month, but signs of recovery are emerging. In the past 24 hours, LINK closed in the green, signaling that buyers might be stepping back in.

Data from Whaler Talk shows that roughly 270,000 LINK tokens (worth around $4.6 million) were pulled out of Binance wallets recently — a hint that whales are accumulating again.

From a technical perspective, LINK broke below a head-and-shoulders pattern earlier this month, with the neckline at $21, leading to a sharp correction toward $14. Since then, it’s found support at $16, which now acts as the base for a potential rebound.

Between June and early October, LINK’s price made higher lows while RSI fell — another hidden bullish divergencesuggesting the bigger uptrend is still alive. If LINK manages to close above $21, a move to $24–$27 could follow. But if it slips back under $16, bears could drag it back toward $14 or even $12 before stability returns.

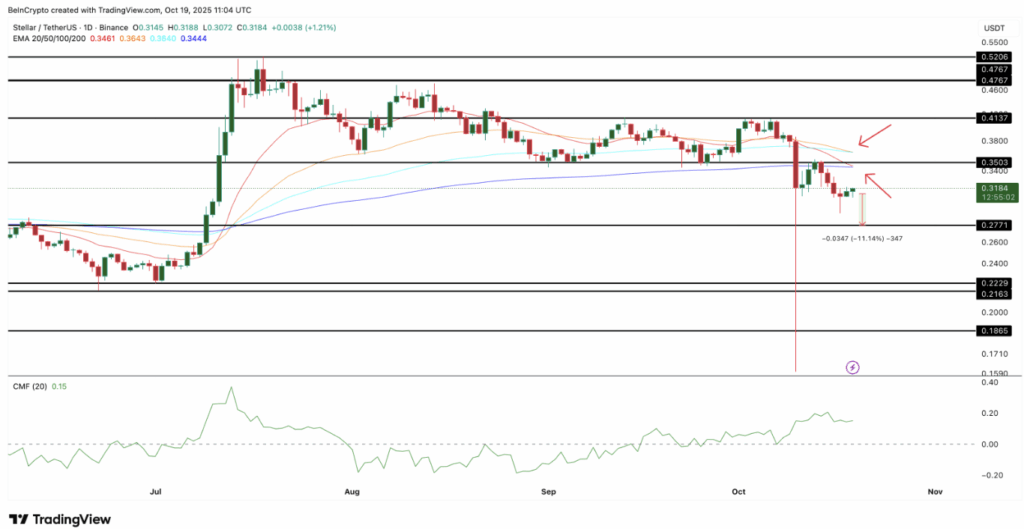

Stellar (XLM) Balances Between Confidence and Collapse

Stellar is proving to be one of the trickier assets to read. The token is trading around $0.31, supported by steady whale inflows. The Chaikin Money Flow (CMF) has stayed above zero since October 7, showing that large investors are still buying dips.

However, technical signals are turning tense. The 20-day EMA is about to cross below the 200-day EMA, and the 50-day EMA is closing in on a cross beneath the 100-day EMA — both known as death crosses, which often point to growing bearish momentum. If those crossovers confirm, XLM could drop toward $0.27, with deeper supports near $0.22–$0.18.

Still, there’s a twist. Derivatives data from Bybit shows about $4.7 million in short leverage on XLM, compared to $2.6 million in longs. If prices dip slightly, those long positions might get liquidated — but if the opposite happens and shorts start closing, a sharp short squeeze could send XLM higher fast.

For now, Stellar remains the wildcard of the “Made in USA” group — walking a fine line between misplaced optimism and a sudden rebound driven by panic liquidations.