- Solana’s trading performance is beating ETH lately, and the SOL/ETH ratio just hit a record close.

- Some traders think a $300 breakout could be next, pointing to chart patterns from Ethereum’s 2021 run.

- But falling network fees and DEX volumes suggest Solana’s facing a tough uphill battle unless user activity picks up big time.

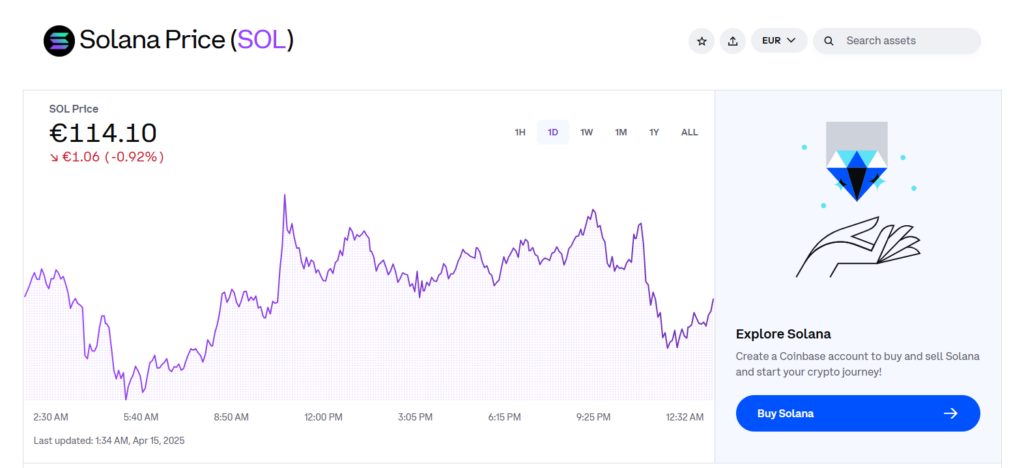

Solana‘s been on a bit of a tear lately — up over 20% against Ethereum in just the past week. Some traders are even whispering about a potential breakout that could launch SOL to $300, a fresh all-time high… if the stars align.

SOL/ETH Ratio Hits Record Weekly Close

On April 13, Solana hit a new milestone. The SOL/ETH ratio — basically how much Solana is worth in terms of Ether — climbed to 0.080, its highest-ever weekly close, according to data from Cointelegraph Markets Pro and Binance.

Since April 4, the ratio’s been consistently making higher highs on the daily chart, a classic sign that momentum’s building.

“Solana has closed its highest weekly close against Ethereum in history,” said pseudonymous trader Bitcoinsensus. “We could see continued outperformance of the Solana ecosystem.”

This kind of movement echoes back to January, when the SOL/ETH ratio briefly hit 0.093 during a post-inauguration crypto surge after Trump took office again. That rally saw Solana push close to $295.

Eyeing $300 — But Is It Realistic?

A trader known as BitBull dropped a futures chart that got folks buzzing. He pointed out that SOL is now showing a similar pattern to what Ethereum did right before it blasted off to record highs back in 2021.

“Just like Ethereum’s run in 2021, Solana is setting up for a massive move in 2025,” he claimed.

So yeah, in theory, the $300 mark isn’t off the table. But—and it’s a big but—technical charts don’t paint the full picture.

Onchain Data Says: Not So Fast

Despite the flashy price action, the real-world usage of Solana’s network is showing cracks. On April 14, network fees tanked by more than 97%, dropping to under $900K from over $35 million back in January. Yikes.

Same goes for decentralized exchanges (DEXs) on the network. Platforms like Raydium and Pump.fun have seen huge slowdowns. DEX volumes on Solana slid down to $2.17 billion on April 14 — a massive 93% drop from their January peak.

So, even if the price charts are glowing green, Solana’s fundamentals need some serious fuel to back another big move.